Annual Premium Tax And Fees Instructions

ADVERTISEMENT

Department of Insurance

State of Arizona

ANNUAL PREMIUM TAX AND FEES

Financial Affairs Division – Tax Unit

INSTRUCTIONS

2910 North 44th Street, Suite 210

Phoenix, AZ 85018-7269

Telephone: (602) 364-3997

Facsimile: (602) 364-3989

All forms are posted on our web site at www.

and Forms E-LD, E-PC

and E-HEALTHORG are available on the NAIC OPTins system for electronic filing.

You may pay annual fees and Installment Taxes via the OPTins system without a form.

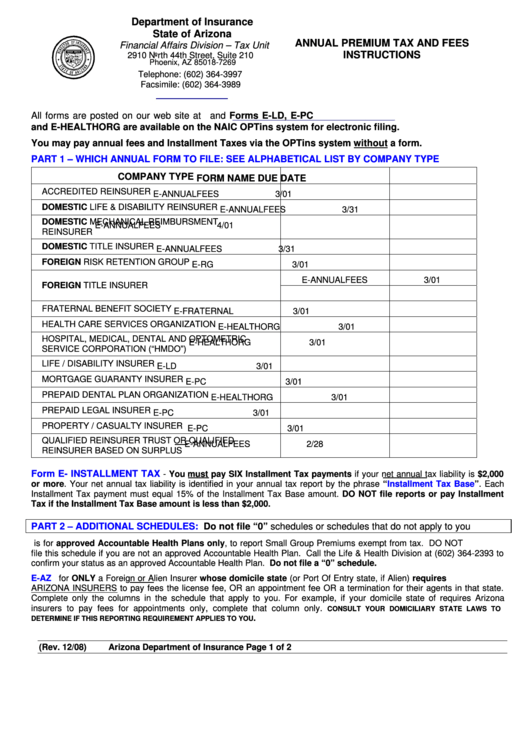

PART 1 – WHICH ANNUAL FORM TO FILE: SEE ALPHABETICAL LIST BY COMPANY TYPE

COMPANY TYPE

FORM NAME

DUE DATE

ACCREDITED REINSURER

E-ANNUALFEES

3/01

DOMESTIC LIFE & DISABILITY REINSURER

E-ANNUALFEES

3/31

DOMESTIC MECHANICAL REIMBURSMENT

E-ANNUALFEES

4/01

REINSURER

DOMESTIC TITLE INSURER

E-ANNUALFEES

3/31

FOREIGN RISK RETENTION GROUP

E-RG

3/01

E-ANNUALFEES

3/01

FOREIGN TITLE INSURER

E-TITLE.RETALIATORY

4/14 OR 10/15

FRATERNAL BENEFIT SOCIETY

E-FRATERNAL

3/01

HEALTH CARE SERVICES ORGANIZATION

E-HEALTHORG

3/01

HOSPITAL, MEDICAL, DENTAL AND OPTOMETRIC

E-HEALTHORG

3/01

SERVICE CORPORATION (“HMDO”)

LIFE / DISABILITY INSURER

E-LD

3/01

MORTGAGE GUARANTY INSURER

E-PC

3/01

PREPAID DENTAL PLAN ORGANIZATION

E-HEALTHORG

3/01

PREPAID LEGAL INSURER

E-PC

3/01

PROPERTY / CASUALTY INSURER

E-PC

3/01

QUALIFIED REINSURER TRUST OR QUALIFIED

E-ANNUALFEES

2/28

REINSURER BASED ON SURPLUS

Form E- INSTALLMENT TAX

- You must pay SIX Installment Tax payments if your net annual tax liability is $2,000

or more. Your net annual tax liability is identified in your annual tax report by the phrase

“Installment Tax

Base”. Each

Installment Tax payment must equal 15% of the Installment Tax Base amount. DO NOT file reports or pay Installment

Tax if the Installment Tax Base amount is less than $2,000.

PART 2 – ADDITIONAL SCHEDULES:

Do not file “0” schedules or schedules that do not apply to you

E-AHP.xls

is for approved Accountable Health Plans only, to report Small Group Premiums exempt from tax. DO NOT

file this schedule if you are not an approved Accountable Health Plan. Call the Life & Health Division at (602) 364-2393 to

confirm your status as an approved Accountable Health Plan. Do not file a “0” schedule.

E-AZ AGENTS.xls is

for ONLY a Foreign or Alien Insurer whose domicile state (or Port Of Entry state, if Alien) requires

ARIZONA INSURERS to pay fees the license fee, OR an appointment fee OR a termination for their agents in that state.

Complete only the columns in the schedule that apply to you. For example, if your domicile state of requires Arizona

insurers to pay fees for appointments only, complete that column only.

CONSULT YOUR DOMICILIARY STATE LAWS TO

.

DETERMINE IF THIS REPORTING REQUIREMENT APPLIES TO YOU

E-ANNUALTAX.INSTRUCTION (Rev. 12/08)

Arizona Department of Insurance

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2