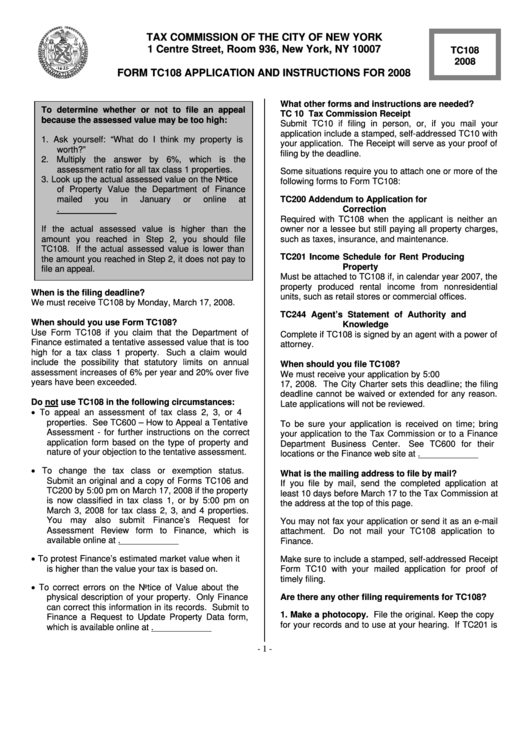

Form Tc108 - Application For Correction Of Assessed Value Of A One, Two Or Three Family House, Class One Condominium, Or Other Tax Class One Property - 2008

ADVERTISEMENT

TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

TC108

2008

FORM TC108 APPLICATION AND INSTRUCTIONS FOR 2008

What other forms and instructions are needed?

To determine whether or not to file an appeal

TC 10

Tax Commission Receipt

because the assessed value may be too high:

Submit TC10 if filing in person, or, if you mail your

application include a stamped, self-addressed TC10 with

1. Ask yourself: “What do I think my property is

your application. The Receipt will serve as your proof of

worth?”

filing by the deadline.

2. Multiply the answer by 6%, which is the

assessment ratio for all tax class 1 properties.

Some situations require you to attach one or more of the

3. Look up the actual assessed value on the Notice

following forms to Form TC108:

of Property Value the Department of Finance

mailed

you

in

January

or

online

at

TC200

Addendum to Application for

Correction

nyc.gov/finance.

Required with TC108 when the applicant is neither an

If the actual assessed value is higher than the

owner nor a lessee but still paying all property charges,

amount you reached in Step 2, you should file

such as taxes, insurance, and maintenance.

TC108. If the actual assessed value is lower than

TC201

Income Schedule for Rent Producing

the amount you reached in Step 2, it does not pay to

Property

file an appeal.

Must be attached to TC108 if, in calendar year 2007, the

property produced rental income from nonresidential

When is the filing deadline?

units, such as retail stores or commercial offices.

We must receive TC108 by Monday, March 17, 2008.

TC244

Agent’s Statement of Authority and

When should you use Form TC108?

Knowledge

Use Form TC108 if you claim that the Department of

Complete if TC108 is signed by an agent with a power of

Finance estimated a tentative assessed value that is too

attorney.

high for a tax class 1 property. Such a claim would

include the possibility that statutory limits on annual

When should you file TC108?

assessment increases of 6% per year and 20% over five

We must receive your application by 5:00 p.m. on March

years have been exceeded.

17, 2008. The City Charter sets this deadline; the filing

deadline cannot be waived or extended for any reason.

Do not use TC108 in the following circumstances:

Late applications will not be reviewed.

•

To appeal an assessment of tax class 2, 3, or 4

properties. See TC600 – How to Appeal a Tentative

To be sure your application is received on time; bring

Assessment - for further instructions on the correct

your application to the Tax Commission or to a Finance

application form based on the type of property and

Department Business Center.

See TC600 for their

nature of your objection to the tentative assessment.

locations or the Finance web site at nyc.gov/finance.

•

To change the tax class or exemption status.

What is the mailing address to file by mail?

Submit an original and a copy of Forms TC106 and

If you file by mail, send the completed application at

TC200 by 5:00 pm on March 17, 2008 if the property

least 10 days before March 17 to the Tax Commission at

is now classified in tax class 1, or by 5:00 pm on

the address at the top of this page.

March 3, 2008 for tax class 2, 3, and 4 properties.

You may also submit Finance’s Request for

You may not fax your application or send it as an e-mail

Assessment Review form to Finance, which is

attachment.

Do not mail your TC108 application to

available online at nyc.gov/finance.

Finance.

•

To protest Finance’s estimated market value when it

Make sure to include a stamped, self-addressed Receipt

is higher than the value your tax is based on.

Form TC10 with your mailed application for proof of

timely filing.

•

To correct errors on the Notice of Value about the

Are there any other filing requirements for TC108?

physical description of your property. Only Finance

can correct this information in its records. Submit to

1. Make a photocopy. File the original. Keep the copy

Finance a Request to Update Property Data form,

for your records and to use at your hearing. If TC201 is

which is available online at nyc.gov/finance.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4