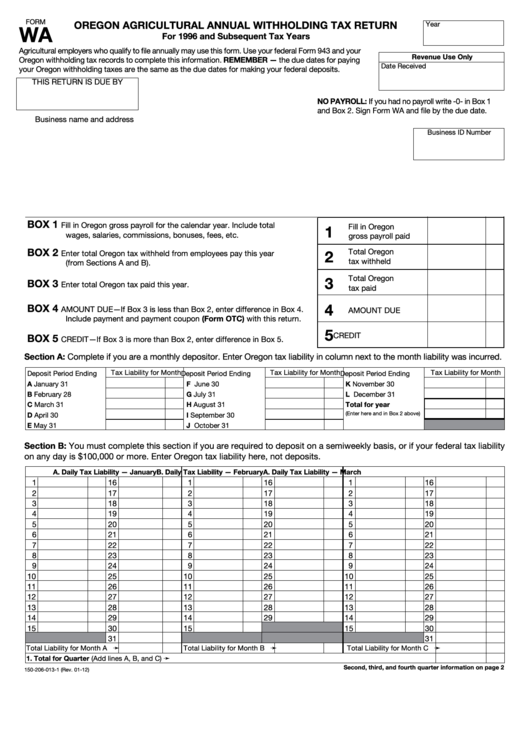

Form Wa - Oregon Agricultural Annual Withholding Tax Return

ADVERTISEMENT

FORM

OREGON AGRICULTURAL ANNUAL WITHHOLDING TAX RETURN

Year

WA

For 1996 and Subsequent Tax Years

Agricultural employers who qualify to file annually may use this form. Use your federal Form 943 and your

Revenue Use Only

Oregon withholding tax records to complete this information. REMEMBER — the due dates for paying

Date Received

your Oregon withholding taxes are the same as the due dates for making your federal deposits.

THIS RETURN IS DUE BY

NO PAYROLL: If you had no payroll write -0- in Box 1

and Box 2. Sign Form WA and file by the due date.

Business name and address

Business ID Number

BOX 1

Fill in Oregon gross payroll for the calendar year. Include total

1

Fill in Oregon

wages, salaries, commissions, bonuses, fees, etc.

gross payroll paid

BOX 2

Total Oregon

2

Enter total Oregon tax withheld from employees pay this year

tax withheld

(from Sections A and B).

3

Total Oregon

BOX 3

Enter total Oregon tax paid this year.

tax paid

4

BOX 4

AMOUNT DUE—If Box 3 is less than Box 2, enter difference in Box 4.

AMOUNT DUE

Include payment and payment coupon (Form OTC) with this return.

5

CREDIT

BOX 5

CREDIT—If Box 3 is more than Box 2, enter difference in Box 5.

Section A: Complete if you are a monthly depositor. Enter Oregon tax liability in column next to the month liability was incurred.

Tax Liability for Month

Tax Liability for Month Deposit Period Ending

Tax Liability for Month

Deposit Period Ending

Deposit Period Ending

A January 31 ..................

F June 30 .......................

K November 30 ..............

B February 28 ................

G July 31 .......................

L December 31 ..............

C March 31 ....................

H August 31 ...................

Total for year .................

(Enter here and in Box 2 above)

D April 30 .......................

I September 30 .............

E May 31 ........................

J October 31 .................

Section B: You must complete this section if you are required to deposit on a semiweekly basis, or if your federal tax liability

on any day is $100,000 or more. Enter Oregon tax liability here, not deposits.

A. Daily Tax Liability — January

B. Daily Tax Liability — February

A. Daily Tax Liability — March

1

16

1

16

1

16

2

17

2

17

2

17

3

18

3

18

3

18

4

19

4

19

4

19

5

20

5

20

5

20

6

21

6

21

6

21

7

22

7

22

7

22

8

23

8

23

8

23

9

24

9

24

9

24

10

25

10

25

10

25

11

26

11

26

11

26

12

27

12

27

12

27

13

28

13

28

13

28

14

29

14

29

14

29

15

30

15

15

30

31

31

Total Liability for Month A ➛

Total Liability for Month B ➛

Total Liability for Month C ➛

1. Total for Quarter (Add lines A, B, and C) ........................................................................................................................................ ➛

Second, third, and fourth quarter information on page 2

150-206-013-1 (Rev. 01-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2