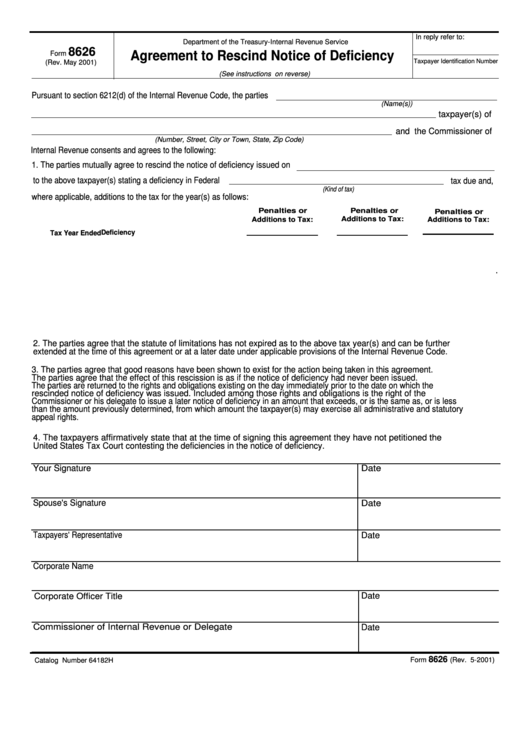

In reply refer to:

Department of the Treasury-Internal Revenue Service

8626

Agreement to Rescind Notice of Deficiency

Form

Taxpayer Identification Number

(Rev. May 2001)

(See instructions on reverse)

Pursuant to section 6212(d) of the Internal Revenue Code, the parties

(Name(s))

taxpayer(s) of

and the Commissioner of

(Number, Street, City or Town, State, Zip Code)

Internal Revenue consents and agrees to the following:

1. The parties mutually agree to rescind the notice of deficiency issued on

to the above taxpayer(s) stating a deficiency in Federal

tax due and,

(Kind of tax)

where applicable, additions to the tax for the year(s) as follows:

Penalties or

Penalties or

Penalties or

Additions to Tax:

Additions to Tax:

Additions to Tax:

Deficiency

Tax Year Ended

.

2. The parties agree that the statute of limitations has not expired as to the above tax year(s) and can be further

extended at the time of this agreement or at a later date under applicable provisions of the Internal Revenue Code.

3. The parties agree that good reasons have been shown to exist for the action being taken in this agreement.

The parties agree that the effect of this rescission is as if the notice of deficiency had never been issued.

The parties are returned to the rights and obligations existing on the day immediately prior to the date on which the

rescinded notice of deficiency was issued. Included among those rights and obligations is the right of the

Commissioner or his delegate to issue a later notice of deficiency in an amount that exceeds, or is the same as, or is less

than the amount previously determined, from which amount the taxpayer(s) may exercise all administrative and statutory

appeal rights.

4. The taxpayers affirmatively state that at the time of signing this agreement they have not petitioned the

United States Tax Court contesting the deficiencies in the notice of deficiency.

Your Signature

Date

Spouse's Signature

Date

Taxpayers' Representative

Date

Corporate Name

Date

Corporate Officer Title

Commissioner of Internal Revenue or Delegate

Date

8626

Form

(Rev. 5-2001)

Catalog Number 64182H

1

1