Suggested Guidelines To Complete The Solicitation Report - Olympia - Washington

ADVERTISEMENT

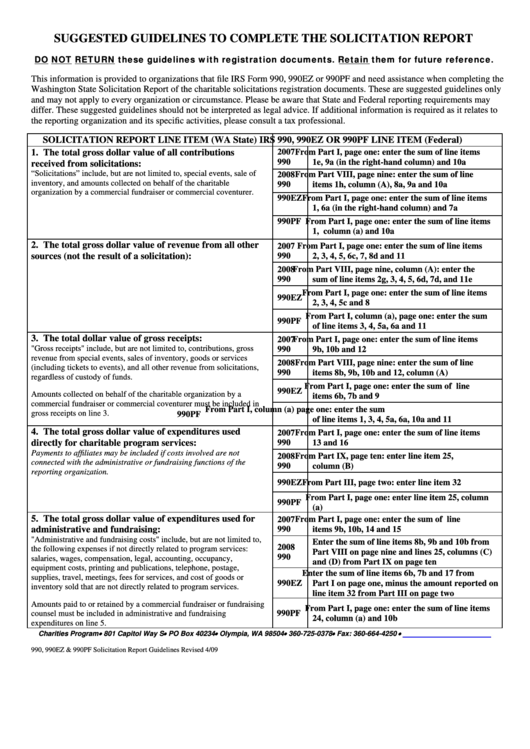

SUGGESTED GUIDELINES TO COMPLETE THE SOLICITATION REPORT

DO NOT RETURN these guidelines with registration documents. Retain them for future reference.

This information is provided to organizations that file IRS Form 990, 990EZ or 990PF and need assistance when completing the

Washington State Solicitation Report of the charitable solicitations registration documents. These are suggested guidelines only

and may not apply to every organization or circumstance. Please be aware that State and Federal reporting requirements may

differ. These suggested guidelines should not be interpreted as legal advice. If additional information is required as it relates to

the reporting organization and its specific activities, please consult a tax professional.

SOLICITATION REPORT LINE ITEM (WA State)

IRS 990, 990EZ OR 990PF LINE ITEM (Federal)

1. The total gross dollar value of all contributions

2007

From Part I, page one: enter the sum of line items

990

1e, 9a (in the right-hand column) and 10a

received from solicitations:

“Solicitations” include, but are not limited to, special events, sale of

2008

From Part VIII, page nine: enter the sum of line

inventory, and amounts collected on behalf of the charitable

990

items 1h, column (A), 8a, 9a and 10a

organization by a commercial fundraiser or commercial coventurer.

990EZ

From Part I, page one: enter the sum of line items

1, 6a (in the right-hand column) and 7a

990PF

From Part I, page one: enter the sum of line items

1, column (a) and 10a

2. The total gross dollar value of revenue from all other

2007

From Part I, page one: enter the sum of line items

sources (not the result of a solicitation):

990

2, 3, 4, 5, 6c, 7, 8d and 11

2008

From Part VIII, page nine, column (A): enter the

990

sum of line items 2g, 3, 4, 5, 6d, 7d, and 11e

From Part I, page one: enter the sum of line items

990EZ

2, 3, 4, 5c and 8

From Part I, column (a), page one: enter the sum

990PF

of line items 3, 4, 5a, 6a and 11

3. The total dollar value of gross receipts:

2007

From Part I, page one: enter the sum of line items

"Gross receipts" include, but are not limited to, contributions, gross

990

9b, 10b and 12

revenue from special events, sales of inventory, goods or services

2008

From Part VIII, page nine: enter the sum of line

(including tickets to events), and all other revenue from solicitations,

990

items 8b, 9b, 10b and 12, column (A)

regardless of custody of funds.

From Part I, page one: enter the sum of line

990EZ

Amounts collected on behalf of the charitable organization by a

items 6b, 7b and 9

commercial fundraiser or commercial coventurer must be included in

From Part I, column (a) page one: enter the sum

gross receipts on line 3.

990PF

of line items 1, 3, 4, 5a, 6a, 10a and 11

4. The total gross dollar value of expenditures used

2007

From Part I, page one: enter the sum of line items

directly for charitable program services:

990

13 and 16

Payments to affiliates may be included if costs involved are not

2008

From Part IX, page ten: enter line item 25,

connected with the administrative or fundraising functions of the

990

column (B)

reporting organization.

990EZ

From Part III, page two: enter line item 32

From Part I, page one: enter line item 25, column

990PF

(a)

5. The total gross dollar value of expenditures used for

2007

From Part I, page one: enter the sum of line

administrative and fundraising:

990

items 9b, 10b, 14 and 15

"Administrative and fundraising costs" include, but are not limited to,

Enter the sum of line items 8b, 9b and 10b from

2008

the following expenses if not directly related to program services:

Part VIII on page nine and lines 25, columns (C)

990

salaries, wages, compensation, legal, accounting, occupancy,

and (D) from Part IX on page ten

equipment costs, printing and publications, telephone, postage,

Enter the sum of line items 6b, 7b and 17 from

supplies, travel, meetings, fees for services, and cost of goods or

990EZ

Part I on page one, minus the amount reported on

inventory sold that are not directly related to program services.

line item 32 from Part III on page two

Amounts paid to or retained by a commercial fundraiser or fundraising

From Part I, page one: enter the sum of line items

990PF

counsel must be included in administrative and fundraising

24, column (a) and 10b

expenditures on line 5.

•

•

•

•

•

•

Charities Program

801 Capitol Way S

PO Box 40234

Olympia, WA 98504

360-725-0378

Fax: 360-664-4250

charities@secstate.wa.gov

990, 990EZ & 990PF Solicitation Report Guidelines Revised 4/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2