Instructions For Schedule S - Federal Income Tax Return - Wisconsin Department Of Revenue

ADVERTISEMENT

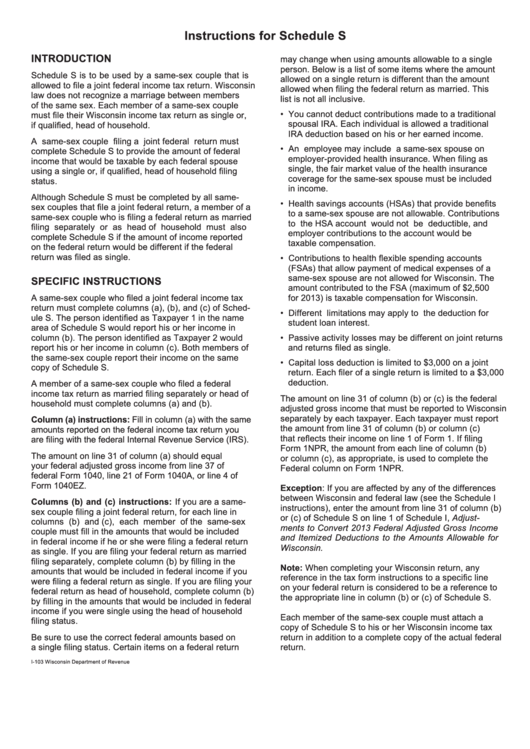

Instructions for Schedule S

INTRODUCTION

may change when using amounts allowable to a single

person. Below is a list of some items where the amount

Schedule S is to be used by a same-sex couple that is

allowed on a single return is different than the amount

allowed to file a joint federal income tax return. Wisconsin

allowed when filing the federal return as married. This

law does not recognize a marriage between members

list is not all inclusive.

of the same sex. Each member of a same-sex couple

• You cannot deduct contributions made to a traditional

must file their Wisconsin income tax return as single or,

spousal IRA. Each individual is allowed a traditional

if qualified, head of household.

IRA deduction based on his or her earned income.

A same-sex couple filing a joint federal return must

• An employee may include a same-sex spouse on

complete Schedule S to provide the amount of federal

employer-provided health insurance. When filing as

income that would be taxable by each federal spouse

single, the fair market value of the health insurance

using a single or, if qualified, head of household filing

coverage for the same-sex spouse must be included

status.

in income.

Although Schedule S must be completed by all same-

• Health savings accounts (HSAs) that provide benefits

sex couples that file a joint federal return, a member of a

to a same-sex spouse are not allowable. Contributions

same-sex couple who is filing a federal return as married

to the HSA account would not be deductible, and

filing separately or as head of household must also

employer contributions to the account would be

complete Schedule S if the amount of income reported

taxable compensation.

on the federal return would be different if the federal

return was filed as single.

• Contributions to health flexible spending accounts

(FSAs) that allow payment of medical expenses of a

same-sex spouse are not allowed for Wisconsin. The

SPECIFIC INSTRUCTIONS

amount contributed to the FSA (maximum of $2,500

A same-sex couple who filed a joint federal income tax

for 2013) is taxable compensation for Wisconsin.

return must complete columns (a), (b), and (c) of Sched-

• Different limitations may apply to the deduction for

ule S. The person identified as Taxpayer 1 in the name

student loan interest.

area of Schedule S would report his or her income in

column (b). The person identified as Taxpayer 2 would

• Passive activity losses may be different on joint returns

report his or her income in column (c). Both members of

and returns filed as single.

the same-sex couple report their income on the same

• Capital loss deduction is limited to $3,000 on a joint

copy of Schedule S.

return. Each filer of a single return is limited to a $3,000

deduction.

A member of a same-sex couple who filed a federal

income tax return as married filing separately or head of

The amount on line 31 of column (b) or (c) is the federal

household must complete columns (a) and (b).

adjusted gross income that must be reported to Wisconsin

separately by each taxpayer. Each taxpayer must report

Column (a) instructions: Fill in column (a) with the same

the amount from line 31 of column (b) or column (c)

amounts reported on the federal income tax return you

that reflects their income on line 1 of Form 1. If filing

are filing with the federal Internal Revenue Service (IRS).

Form 1NPR, the amount from each line of column (b)

The amount on line 31 of column (a) should equal

or column (c), as appropriate, is used to complete the

your federal adjusted gross income from line 37 of

Federal column on Form 1NPR.

federal Form 1040, line 21 of Form 1040A, or line 4 of

Form 1040EZ.

Exception: If you are affected by any of the differences

between Wisconsin and federal law (see the Schedule I

Columns (b) and (c) instructions: If you are a same-

instructions), enter the amount from line 31 of column (b)

sex couple filing a joint federal return, for each line in

or (c) of Schedule S on line 1 of Schedule I, Adjust-

columns (b) and (c), each member of the same-sex

ments to Convert 2013 Federal Adjusted Gross Income

couple must fill in the amounts that would be included

and Itemized Deductions to the Amounts Allowable for

in federal income if he or she were filing a federal return

Wisconsin.

as single. If you are filing your federal return as married

filing separately, complete column (b) by filling in the

Note: When completing your Wisconsin return, any

amounts that would be included in federal income if you

reference in the tax form instructions to a specific line

were filing a federal return as single. If you are filing your

on your federal return is considered to be a reference to

federal return as head of household, complete column (b)

the appropriate line in column (b) or (c) of Schedule S.

by filling in the amounts that would be included in federal

income if you were single using the head of household

Each member of the same-sex couple must attach a

filing status.

copy of Schedule S to his or her Wisconsin income tax

Be sure to use the correct federal amounts based on

return in addition to a complete copy of the actual federal

a single filing status. Certain items on a federal return

return.

I-103

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2