Instructions For Schedule D-1 - Sales Of Business Property - California Franchise Tax Board

ADVERTISEMENT

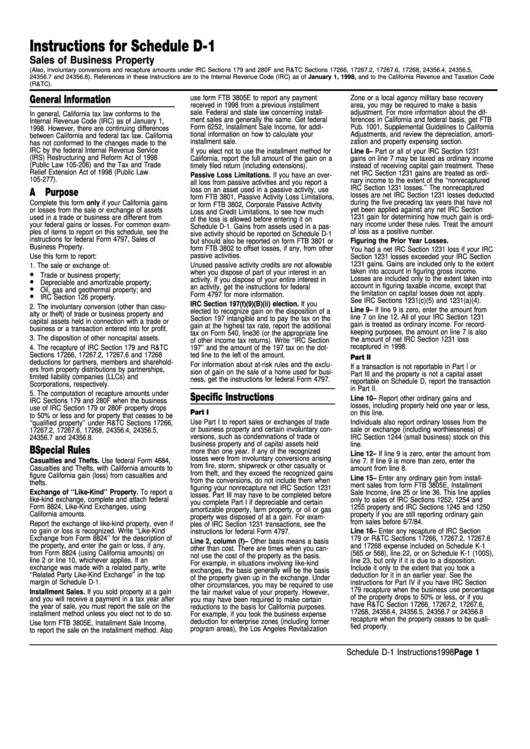

Instructions for Schedule D-1

Sales of Business Property

(Also, involuntary conversions and recapture amounts under IRC Sections 179 and 280F and R&TC Sections 17266, 17267.2, 17267.6, 17268, 24356.4, 24356.5,

24356.7 and 24356.8). References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 1998, and to the California Revenue and Taxation Code

(R&TC).

use form FTB 3805E to report any payment

Zone or a local agency military base recovery

General Information

received in 1998 from a previous installment

area, you may be required to make a basis

sale. Federal and state law concerning install-

adjustment. For more information about the dif-

In general, California tax law conforms to the

ment sales are generally the same. Get federal

ferences in California and federal basis, get FTB

Internal Revenue Code (IRC) as of January 1,

Form 6252, Installment Sale Income, for addi-

Pub. 1001, Supplemental Guidelines to California

1998. However, there are continuing differences

tional information on how to calculate your

Adjustments, and review the depreciation, amorti-

between California and federal tax law. California

installment sale.

zation and property expensing section.

has not conformed to the changes made to the

IRC by the federal Internal Revenue Service

If you elect not to use the installment method for

Line 8 – Part or all of your IRC Section 1231

(IRS) Restructuring and Reform Act of 1998

California, report the full amount of the gain on a

gains on line 7 may be taxed as ordinary income

(Public Law 105-206) and the Tax and Trade

timely filed return (including extensions).

instead of receiving capital gain treatment. These

Relief Extension Act of 1998 (Public Law

net IRC Section 1231 gains are treated as ordi-

Passive Loss Limitations. If you have an over-

105-277).

nary income to the extent of the ‘‘nonrecaptured

all loss from passive activities and you report a

IRC Section 1231 losses.’’ The nonrecaptured

loss on an asset used in a passive activity, use

A Purpose

losses are net IRC Section 1231 losses deducted

form FTB 3801, Passive Activity Loss Limitations,

during the five preceding tax years that have not

Complete this form only if your California gains

or form FTB 3802, Corporate Passive Activity

yet been applied against any net IRC Section

or losses from the sale or exchange of assets

Loss and Credit Limitations, to see how much

1231 gain for determining how much gain is ordi-

used in a trade or business are different from

of the loss is allowed before entering it on

nary income under these rules. Treat the amount

your federal gains or losses. For common exam-

Schedule D-1. Gains from assets used in a pas-

of loss as a positive number.

ples of items to report on this schedule, see the

sive activity should be reported on Schedule D-1

instructions for federal Form 4797, Sales of

Figuring the Prior Year Losses.

but should also be reported on form FTB 3801 or

Business Property.

form FTB 3802 to offset losses, if any, from other

You had a net IRC Section 1231 loss if your IRC

passive activities.

Use this form to report:

Section 1231 losses exceeded your IRC Section

1231 gains. Gains are included only to the extent

Unused passive activity credits are not allowable

1. The sale or exchange of:

•

taken into account in figuring gross income.

when you dispose of part of your interest in an

Trade or business property;

•

Losses are included only to the extent taken into

activity. If you dispose of your entire interest in

Depreciable and amortizable property;

•

account in figuring taxable income, except that

an activity, get the instructions for federal

Oil, gas and geothermal property; and

•

the limitation on capital losses does not apply.

Form 4797 for more information.

IRC Section 126 property.

See IRC Sections 1231(c)(5) and 1231(a)(4).

IRC Section 197(f)(9)(B)(ii) election. If you

2. The involuntary conversion (other than casu-

Line 9 – If line 9 is zero, enter the amount from

elected to recognize gain on the disposition of a

alty or theft) of trade or business property and

line 7 on line 12. All of your IRC Section 1231

Section 197 intangible and to pay the tax on the

capital assets held in connection with a trade or

gain is treated as ordinary income. For record-

gain at the highest tax rate, report the additional

business or a transaction entered into for profit.

keeping purposes, the amount on line 7 is also

tax on Form 540, line 36 (or the appropriate line

3. The disposition of other noncapital assets.

the amount of net IRC Section 1231 loss

of other income tax returns). Write ‘‘IRC Section

recaptured in 1998.

4. The recapture of IRC Section 179 and R&TC

197’’ and the amount of the 197 tax on the dot-

Sections 17266, 17267.2, 17267.6 and 17268

ted line to the left of the amount.

Part II

deductions for partners, members and sharehold-

For information about at-risk rules and the exclu-

If a transaction is not reportable in Part I or

ers from property distributions by partnerships,

sion of gain on the sale of a home used for busi-

Part III and the property is not a capital asset

limited liability companies (LLCs) and

ness, get the instructions for federal Form 4797.

reportable on Schedule D, report the transaction

S corporations, respectively.

in Part II.

5. The computation of recapture amounts under

Specific Instructions

Line 10 – Report other ordinary gains and

IRC Sections 179 and 280F when the business

losses, including property held one year or less,

use of IRC Section 179 or 280F property drops

Part I

on this line.

to 50% or less and for property that ceases to be

Use Part I to report sales or exchanges of trade

Individuals also report ordinary losses from the

‘‘qualified property’’ under R&TC Sections 17266,

or business property and certain involuntary con-

sale or exchange (including worthlessness) of

17267.2, 17267.6, 17268, 24356.4, 24356.5,

versions, such as condemnations of trade or

IRC Section 1244 (small business) stock on this

24356.7 and 24356.8.

business property and of capital assets held

line.

B Special Rules

more than one year. If any of the recognized

Line 12 – If line 9 is zero, enter the amount from

losses were from involuntary conversions arising

Casualties and Thefts. Use federal Form 4684,

line 7. If line 9 is more than zero, enter the

from fire, storm, shipwreck or other casualty or

Casualties and Thefts, with California amounts to

amount from line 8.

from theft, and they exceed the recognized gains

figure California gain (loss) from casualties and

Line 15 – Enter any ordinary gain from install-

from the conversions, do not include them when

thefts.

ment sales from form FTB 3805E, Installment

figuring your nonrecapture net IRC Section 1231

Exchange of ‘‘Like-Kind’’ Property. To report a

Sale Income, line 25 or line 36. This line applies

losses. Part III may have to be completed before

like-kind exchange, complete and attach federal

only to sales of IRC Sections 1252, 1254 and

you complete Part I if depreciable and certain

Form 8824, Like-Kind Exchanges, using

1255 property and IRC Sections 1245 and 1250

amortizable property, farm property, or oil or gas

California amounts.

property if you are still reporting ordinary gain

property was disposed of at a gain. For exam-

from sales before 6/7/84.

Report the exchange of like-kind property, even if

ples of IRC Section 1231 transactions, see the

no gain or loss is recognized. Write ‘‘Like-Kind

Line 16 – Enter any recapture of IRC Section

instructions for federal Form 4797.

Exchange from Form 8824’’ for the description of

179 or R&TC Sections 17266, 17267.2, 17267.6

Line 2, column (f) – Other basis means a basis

the property, and enter the gain or loss, if any,

and 17268 expense included on Schedule K-1

other than cost. There are times when you can-

from Form 8824 (using California amounts) on

(565 or 568), line 22, or on Schedule K-1 (100S),

not use the cost of the property as the basis.

line 2 or line 10, whichever applies. If an

line 23, but only if it is due to a disposition.

For example, in situations involving like-kind

exchange was made with a related party, write

Include it only to the extent that you took a

exchanges, the basis generally will be the basis

‘‘Related Party Like-Kind Exchange’’ in the top

deduction for it in an earlier year. See the

of the property given up in the exchange. Under

margin of Schedule D-1.

instructions for Part IV if you have IRC Section

other circumstances, you may be required to use

179 recapture when the business use percentage

Installment Sales. If you sold property at a gain

the fair market value of your property. However,

of the property drops to 50% or less, or if you

and you will receive a payment in a tax year after

you may have been required to make certain

have R&TC Section 17266, 17267.2, 17267.6,

the year of sale, you must report the sale on the

reductions to the basis for California purposes.

17268, 24356.4, 24356.5, 24356.7 or 24356.8

installment method unless you elect not to do so.

For example, if you took the business expense

recapture when the property ceases to be quali-

deduction for enterprise zones (including former

Use form FTB 3805E, Installment Sale Income,

fied property.

program areas), the Los Angeles Revitalization

to report the sale on the installment method. Also

Schedule D-1 Instructions 1998

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2