Instructions For Schedule R - Apportionment And Allocation Of Income - California Franchise Tax Board - 1998

ADVERTISEMENT

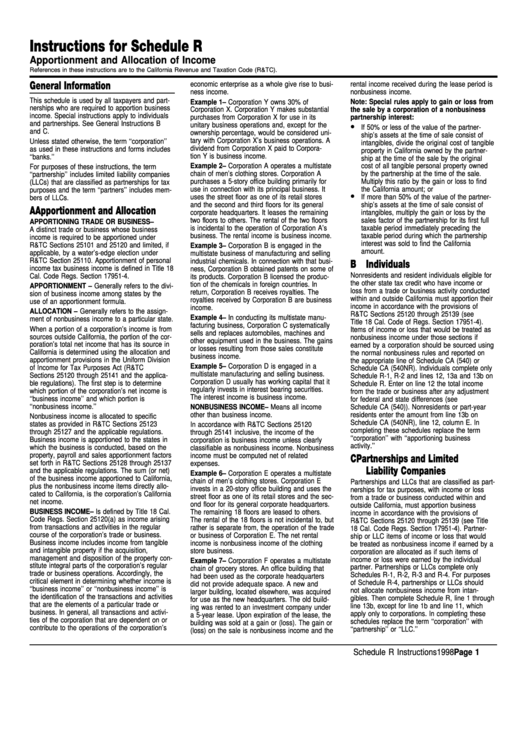

Instructions for Schedule R

Apportionment and Allocation of Income

References in these instructions are to the California Revenue and Taxation Code (R&TC).

General Information

economic enterprise as a whole give rise to busi-

rental income received during the lease period is

ness income.

nonbusiness income.

This schedule is used by all taxpayers and part-

Example 1 – Corporation Y owns 30% of

Note: Special rules apply to gain or loss from

nerships who are required to apportion business

Corporation X. Corporation Y makes substantial

the sale by a corporation of a nonbusiness

income. Special instructions apply to individuals

purchases from Corporation X for use in its

partnership interest:

•

and partnerships. See General Instructions B

unitary business operations and, except for the

If 50% or less of the value of the partner-

and C.

ownership percentage, would be considered uni-

ship’s assets at the time of sale consist of

tary with Corporation X’s business operations. A

Unless stated otherwise, the term ‘‘corporation’’

intangibles, divide the original cost of tangible

dividend from Corporation X paid to Corpora-

as used in these instructions and forms includes

property in California owned by the partner-

tion Y is business income.

‘‘banks.’’

ship at the time of the sale by the original

Example 2 – Corporation A operates a multistate

cost of all tangible personal property owned

For purposes of these instructions, the term

chain of men’s clothing stores. Corporation A

by the partnership at the time of the sale.

‘‘partnership’’ includes limited liability companies

purchases a 5-story office building primarily for

Multiply this ratio by the gain or loss to find

(LLCs) that are classified as partnerships for tax

use in connection with its principal business. It

the California amount; or

purposes and the term ‘‘partners’’ includes mem-

•

uses the street floor as one of its retail stores

If more than 50% of the value of the partner-

bers of LLCs.

and the second and third floors for its general

ship’s assets at the time of sale consist of

A Apportionment and Allocation

corporate headquarters. It leases the remaining

intangibles, multiply the gain or loss by the

two floors to others. The rental of the two floors

sales factor of the partnership for its first full

APPORTIONING TRADE OR BUSINESS –

is incidental to the operation of Corporation A’s

taxable period immediately preceding the

A distinct trade or business whose business

business. The rental income is business income.

taxable period during which the partnership

income is required to be apportioned under

interest was sold to find the California

R&TC Sections 25101 and 25120 and limited, if

Example 3 – Corporation B is engaged in the

amount.

applicable, by a water’s-edge election under

multistate business of manufacturing and selling

R&TC Section 25110. Apportionment of personal

industrial chemicals. In connection with that busi-

B Individuals

income tax business income is defined in Title 18

ness, Corporation B obtained patents on some of

Nonresidents and resident individuals eligible for

Cal. Code Regs. Section 17951-4.

its products. Corporation B licensed the produc-

the other state tax credit who have income or

tion of the chemicals in foreign countries. In

APPORTIONMENT – Generally refers to the divi-

loss from a trade or business activity conducted

return, Corporation B receives royalties. The

sion of business income among states by the

within and outside California must apportion their

royalties received by Corporation B are business

use of an apportionment formula.

income in accordance with the provisions of

income.

ALLOCATION – Generally refers to the assign-

R&TC Sections 25120 through 25139 (see

Example 4 – In conducting its multistate manu-

ment of nonbusiness income to a particular state.

Title 18 Cal. Code of Regs. Section 17951-4).

facturing business, Corporation C systematically

When a portion of a corporation’s income is from

Items of income or loss that would be treated as

sells and replaces automobiles, machines and

sources outside California, the portion of the cor-

nonbusiness income under those sections if

other equipment used in the business. The gains

poration’s total net income that has its source in

earned by a corporation should be sourced using

or losses resulting from those sales constitute

California is determined using the allocation and

the normal nonbusiness rules and reported on

business income.

apportionment provisions in the Uniform Division

the appropriate line of Schedule CA (540) or

Example 5 – Corporation D is engaged in a

of Income for Tax Purposes Act (R&TC

Schedule CA (540NR). Individuals complete only

multistate manufacturing and selling business.

Sections 25120 through 25141 and the applica-

Schedule R-1, R-2 and lines 12, 13a and 13b on

Corporation D usually has working capital that it

ble regulations). The first step is to determine

Schedule R. Enter on line 12 the total income

regularly invests in interest bearing securities.

which portion of the corporation’s net income is

from the trade or business after any adjustment

The interest income is business income.

‘‘business income’’ and which portion is

for federal and state differences (see

‘‘nonbusiness income.’’

NONBUSINESS INCOME – Means all income

Schedule CA (540)). Nonresidents or part-year

other than business income.

residents enter the amount from line 13b on

Nonbusiness income is allocated to specific

Schedule CA (540NR), line 12, column E. In

states as provided in R&TC Sections 25123

In accordance with R&TC Sections 25120

completing these schedules replace the term

through 25127 and the applicable regulations.

through 25141 inclusive, the income of the

‘‘corporation’’ with ‘‘apportioning business

Business income is apportioned to the states in

corporation is business income unless clearly

activity.’’

which the business is conducted, based on the

classifiable as nonbusiness income. Nonbusiness

property, payroll and sales apportionment factors

income must be computed net of related

C Partnerships and Limited

set forth in R&TC Sections 25128 through 25137

expenses.

Liability Companies

and the applicable regulations. The sum (or net)

Example 6 – Corporation E operates a multistate

of the business income apportioned to California,

chain of men’s clothing stores. Corporation E

Partnerships and LLCs that are classified as part-

plus the nonbusiness income items directly allo-

invests in a 20-story office building and uses the

nerships for tax purposes, with income or loss

cated to California, is the corporation’s California

street floor as one of its retail stores and the sec-

from a trade or business conducted within and

net income.

ond floor for its general corporate headquarters.

outside California, must apportion business

BUSINESS INCOME – Is defined by Title 18 Cal.

The remaining 18 floors are leased to others.

income in accordance with the provisions of

Code Regs. Section 25120(a) as income arising

The rental of the 18 floors is not incidental to, but

R&TC Sections 25120 through 25139 (see Title

from transactions and activities in the regular

rather is separate from, the operation of the trade

18 Cal. Code Regs. Section 17951-4). Partner-

course of the corporation’s trade or business.

or business of Corporation E. The net rental

ship or LLC items of income or loss that would

Business income includes income from tangible

income is nonbusiness income of the clothing

be treated as nonbusiness income if earned by a

and intangible property if the acquisition,

store business.

corporation are allocated as if such items of

management and disposition of the property con-

income or loss were earned by the individual

Example 7 – Corporation F operates a multistate

stitute integral parts of the corporation’s regular

partner. Partnerships or LLCs complete only

chain of grocery stores. An office building that

trade or business operations. Accordingly, the

Schedules R-1, R-2, R-3 and R-4. For purposes

had been used as the corporate headquarters

critical element in determining whether income is

of Schedule R-4, partnerships or LLCs should

did not provide adequate space. A new and

‘‘business income’’ or ‘‘nonbusiness income’’ is

not allocate nonbusiness income from intan-

larger building, located elsewhere, was acquired

the identification of the transactions and activities

gibles. Then complete Schedule R, line 1 through

for use as the new headquarters. The old build-

that are the elements of a particular trade or

line 13b, except for line 1b and line 11, which

ing was rented to an investment company under

business. In general, all transactions and activi-

apply only to corporations. In completing these

a 5-year lease. Upon expiration of the lease, the

ties of the corporation that are dependent on or

schedules replace the term ‘‘corporation’’ with

building was sold at a gain or (loss). The gain or

contribute to the operations of the corporation’s

‘‘partnership’’ or ‘‘LLC.’’

(loss) on the sale is nonbusiness income and the

Schedule R Instructions 1998

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4