Instructions For Idaho Form 55 - 1998

ADVERTISEMENT

T C 5 5 9 7 1 - 2

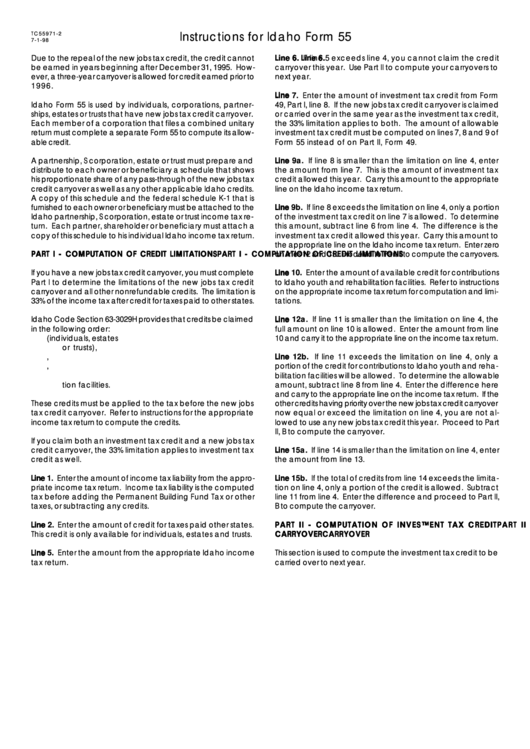

Instructions for Idaho Form 55

7-1-98

Due to the repeal of the new jobs tax credit, the credit cannot

Line 6.

Line 6.

Line 6.

Line 6.

Line 6. If line 5 exceeds line 4, you cannot claim the credit

be earned in years beginning after December 31, 1995. How-

carryover this year. Use Part II to compute your carryovers to

ever, a three-year carryover is allowed for credit earned prior to

next year.

1996.

Line 7.

Line 7.

Line 7.

Line 7.

Line 7. Enter the amount of investment tax credit from Form

Idaho Form 55 is used by individuals, corporations, partner-

49, Part I, line 8. If the new jobs tax credit carryover is claimed

ships, estates or trusts that have new jobs tax credit carryover.

or carried over in the same year as the investment tax credit,

Each member of a corporation that files a combined unitary

the 33% limitation applies to both. The amount of allowable

return must complete a separate Form 55 to compute its allow-

investment tax credit must be computed on lines 7, 8 and 9 of

able credit.

Form 55 instead of on Part II, Form 49.

A partnership, S corporation, estate or trust must prepare and

Line 9a.

Line 9a.

Line 9a.

Line 9a.

Line 9a. If line 8 is smaller than the limitation on line 4, enter

distribute to each owner or beneficiary a schedule that shows

the amount from line 7. This is the amount of investment tax

his proportionate share of any pass-through of the new jobs tax

credit allowed this year. Carry this amount to the appropriate

credit carryover as well as any other applicable Idaho credits.

line on the Idaho income tax return.

A copy of this schedule and the federal schedule K-1 that is

furnished to each owner or beneficiary must be attached to the

Line 9b.

Line 9b.

Line 9b.

Line 9b.

Line 9b. If line 8 exceeds the limitation on line 4, only a portion

Idaho partnership, S corporation, estate or trust income tax re-

of the investment tax credit on line 7 is allowed. To determine

turn. Each partner, shareholder or beneficiary must attach a

this amount, subtract line 6 from line 4. The difference is the

copy of this schedule to his individual Idaho income tax return.

investment tax credit allowed this year. Carry this amount to

the appropriate line on the Idaho income tax return. Enter zero

PART I - COMPUTATION OF CREDIT LIMITATIONS

PART I - COMPUTATION OF CREDIT LIMITATIONS

PART I - COMPUTATION OF CREDIT LIMITATIONS

on lines 12 and 15. Proceed to Part II to compute the carryovers.

PART I - COMPUTATION OF CREDIT LIMITATIONS

PART I - COMPUTATION OF CREDIT LIMITATIONS

Line 10.

Line 10.

If you have a new jobs tax credit carryover, you must complete

Line 10.

Line 10.

Line 10. Enter the amount of available credit for contributions

Part I to determine the limitations of the new jobs tax credit

to Idaho youth and rehabilitation facilities. Refer to instructions

carryover and all other nonrefundable credits. The limitation is

on the appropriate income tax return for computation and limi-

33% of the income tax after credit for taxes paid to other states.

tations.

Line 12a.

Line 12a.

Idaho Code Section 63-3029H provides that credits be claimed

Line 12a.

Line 12a.

Line 12a. If line 11 is smaller than the limitation on line 4, the

in the following order:

full amount on line 10 is allowed. Enter the amount from line

1 . Credit for taxes paid other states (individuals, estates

10 and carry it to the appropriate line on the income tax return.

or trusts),

2 . Credit for contributions to educational entities,

Line 12b.

Line 12b.

Line 12b.

Line 12b.

Line 12b. If line 11 exceeds the limitation on line 4, only a

3 . Investment tax credit,

portion of the credit for contributions to Idaho youth and reha-

4 . Credit for contributions to Idaho youth and rehabilita-

bilitation facilities will be allowed. To determine the allowable

tion facilities.

amount, subtract line 8 from line 4. Enter the difference here

and carry to the appropriate line on the income tax return. If the

These credits must be applied to the tax before the new jobs

other credits having priority over the new jobs tax credit carryover

tax credit carryover. Refer to instructions for the appropriate

now equal or exceed the limitation on line 4, you are not al-

income tax return to compute the credits.

lowed to use any new jobs tax credit this year. Proceed to Part

II, B to compute the carryover.

If you claim both an investment tax credit and a new jobs tax

credit carryover, the 33% limitation applies to investment tax

Line 15a.

Line 15a.

Line 15a. If line 14 is smaller than the limitation on line 4, enter

Line 15a.

Line 15a.

credit as well.

the amount from line 13.

Line 1.

Line 1.

Line 1. Enter the amount of income tax liability from the appro-

Line 15b.

Line 15b.

Line 15b. If the total of credits from line 14 exceeds the limita-

Line 1.

Line 1.

Line 15b.

Line 15b.

priate income tax return. Income tax liability is the computed

tion on line 4, only a portion of the credit is allowed. Subtract

tax before adding the Permanent Building Fund Tax or other

line 11 from line 4. Enter the difference and proceed to Part II,

taxes, or subtracting any credits.

B to compute the carryover.

Line 2.

Line 2.

Line 2. Enter the amount of credit for taxes paid other states.

PART II - COMPUTATION OF INVESTMENT TAX CREDIT

PART II - COMPUTATION OF INVESTMENT TAX CREDIT

PART II - COMPUTATION OF INVESTMENT TAX CREDIT

Line 2.

Line 2.

PART II - COMPUTATION OF INVESTMENT TAX CREDIT

PART II - COMPUTATION OF INVESTMENT TAX CREDIT

This credit is only available for individuals, estates and trusts.

CARRYOVER

CARRYOVER

CARRYOVER

CARRYOVER

CARRYOVER

Line 5.

Line 5.

Line 5. Enter the amount from the appropriate Idaho income

This section is used to compute the investment tax credit to be

Line 5.

Line 5.

tax return.

carried over to next year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1