Instructions For Form 472 - Attorney Occupational Tax Return - Connecticut Department Of Revenue Services

ADVERTISEMENT

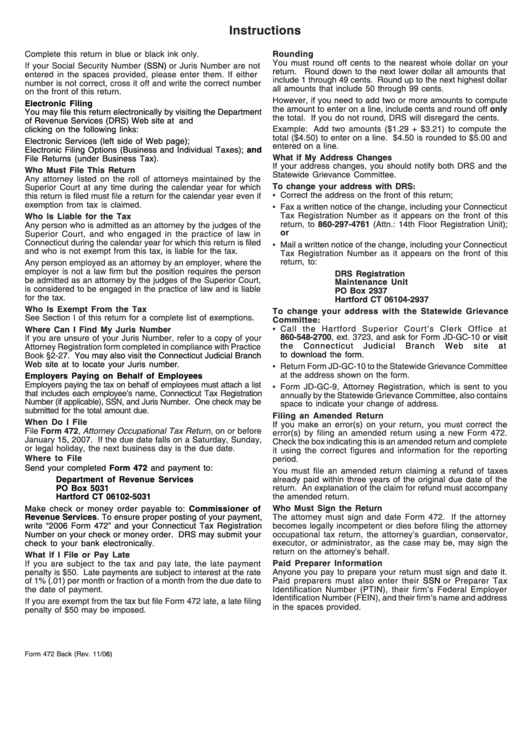

Instructions

Complete this return in blue or black ink only.

Rounding

You must round off cents to the nearest whole dollar on your

If your Social Security Number

(SSN)

or Juris Number are not

return.

Round down to the next lower dollar all amounts that

entered in the spaces provided, please enter them. If either

include 1 through 49 cents. Round up to the next highest dollar

number is not correct, cross it off and write the correct number

all amounts that include 50 through 99 cents.

on the front of this return.

However, if you need to add two or more amounts to compute

Electronic Filing

the amount to enter on a line, include cents and round off only

You may file this return electronically by visiting the Department

the total. If you do not round, DRS will disregard the cents.

of Revenue Services (DRS) Web site at and

Example: Add two amounts ($1.29 + $3.21) to compute the

clicking on the following links:

total ($4.50) to enter on a line. $4.50 is rounded to $5.00 and

Electronic Services (left side of Web page);

entered on a line.

Electronic Filing Options (Business and Individual Taxes); and

What if My Address Changes

File Returns (under Business Tax).

If your address changes, you should notify both DRS and the

Who Must File This Return

Statewide Grievance Committee.

Any attorney listed on the roll of attorneys maintained by the

To change your address with DRS:

Superior Court at any time during the calendar year for which

• Correct the address on the front of this return;

this return is filed must file a return for the calendar year even if

exemption from tax is claimed.

• Fax a written notice of the change, including your Connecticut

Tax Registration Number as it appears on the front of this

Who Is Liable for the Tax

return, to 860-297-4761 (Attn.: 14th Floor Registration Unit);

Any person who is admitted as an attorney by the judges of the

or

Superior Court, and who engaged in the practice of law in

Connecticut during the calendar year for which this return is filed

• Mail a written notice of the change, including your Connecticut

and who is not exempt from this tax, is liable for the tax.

Tax Registration Number as it appears on the front of this

return, to:

Any person employed as an attorney by an employer, where the

employer is not a law firm but the position requires the person

DRS Registration

be admitted as an attorney by the judges of the Superior Court,

Maintenance Unit

is considered to be engaged in the practice of law and is liable

PO Box 2937

for the tax.

Hartford CT 06104-2937

Who Is Exempt From the Tax

To change your address with the Statewide Grievance

See Section I of this return for a complete list of exemptions.

Committee:

• Call the Hartford Superior Court’s Clerk Office at

Where Can I Find My Juris Number

860-548-2700, ext. 3723, and ask for Form JD-GC-10

or visit

If you are unsure of your Juris Number, refer to a copy of your

the

Connecticut

Judicial

Branch

Web

site

at

Attorney Registration form completed in compliance with Practice

to download the form.

Book

§2-27. You may also visit the Connecticut Judicial Branch

Web site at to locate your Juris number.

• Return Form JD-GC-10 to the Statewide Grievance Committee

at the address shown on the form.

Employers Paying on Behalf of Employees

Employers paying the tax on behalf of employees must attach a list

• Form JD-GC-9, Attorney Registration, which is sent to you

that includes each employee’s name, Connecticut Tax Registration

annually by the Statewide Grievance Committee, also contains

Number (if applicable), SSN, and Juris Number. One check may be

space to indicate your change of address.

submitted for the total amount due.

Filing an Amended Return

When Do I File

If you make an error(s) on your return, you must correct the

File Form 472, Attorney Occupational Tax Return, on or before

error(s) by filing an amended return using a new Form 472.

January

15, 2007.

If the due date falls on a Saturday, Sunday,

Check the box indicating this is an amended return and complete

or legal holiday, the next business day is the due date.

it using the correct figures and information for the reporting

Where to File

period.

Send your completed Form 472 and payment to:

You must file an amended return claiming a refund of taxes

Department of Revenue Services

already paid within three years of the original due date of the

PO Box 5031

return. An explanation of the claim for refund must accompany

Hartford CT 06102-5031

the amended return.

Who Must Sign the Return

Make check or money order payable to: Commissioner of

The attorney must sign and date Form 472. If the attorney

Revenue Services. To ensure proper posting of your payment,

write “2006 Form 472” and your Connecticut Tax Registration

becomes legally incompetent or dies before filing the attorney

Number on your check or money order. DRS may submit your

occupational tax return, the attorney’s guardian, conservator,

check to your bank electronically.

executor, or administrator, as the case may be, may sign the

return on the attorney’s behalf.

What if I File or Pay Late

If you are subject to the tax and pay late, the late payment

Paid Preparer Information

penalty is $50. Late payments are subject to interest at the rate

Anyone you pay to prepare your return must sign and date it.

of 1% (.01) per month or fraction of a month from the due date to

Paid preparers must also enter their

SSN

or Preparer Tax

Identification Number (PTIN), their firm’s Federal Employer

the date of payment.

Identification Number (FEIN), and their firm’s name and address

If you are exempt from the tax but file Form 472 late, a late filing

in the spaces provided.

penalty of $50 may be imposed.

Form 472 Back (Rev.

11/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1