Credit For Educational Opportunity Worksheet For Employers - 2009

ADVERTISEMENT

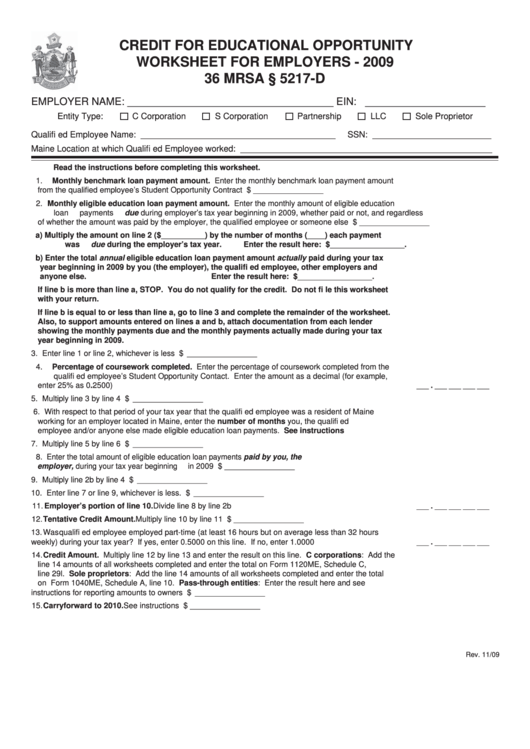

CREDIT FOR EDUCATIONAL OPPORTUNITY

WORKSHEET FOR EMPLOYERS - 2009

36 MRSA § 5217-D

EMPLOYER NAME: ____________________________________ EIN: _____________________

Entity Type:

C Corporation

S Corporation

Partnership

LLC

Sole Proprietor

Qualifi ed Employee Name: _________________________________________

SSN: _________________________

Maine Location at which Qualifi ed Employee worked: _____________________________________________________

Read the instructions before completing this worksheet.

1. Monthly benchmark loan payment amount. Enter the monthly benchmark loan payment amount

from the qualifi ed employee’s Student Opportunity Contract ................................................................... 1. $ ________________

2. Monthly eligible education loan payment amount. Enter the monthly amount of eligible education

loan payments due during employer’s tax year beginning in 2009, whether paid or not, and regardless

of whether the amount was paid by the employer, the qualifi ed employee or someone else .................. 2. $ ________________

a) Multiply the amount on line 2 ($__________) by the number of months (____) each payment

was due during the employer’s tax year.

Enter the result here: $_________________.

b) Enter the total annual eligible education loan payment amount actually paid during your tax

year beginning in 2009 by you (the employer), the qualifi ed employee, other employers and

anyone else.

Enter the result here: $_________________.

If line b is more than line a, STOP. You do not qualify for the credit. Do not fi le this worksheet

with your return.

If line b is equal to or less than line a, go to line 3 and complete the remainder of the worksheet.

Also, to support amounts entered on lines a and b, attach documentation from each lender

showing the monthly payments due and the monthly payments actually made during your tax

year beginning in 2009.

3. Enter line 1 or line 2, whichever is less .................................................................................................... 3. $ ________________

4. Percentage of coursework completed. Enter the percentage of coursework completed from the

qualifi ed employee’s Student Opportunity Contact. Enter the amount as a decimal (for example,

enter 25% as 0.2500) ............................................................................................................................... 4.

___ . ___ ___ ___ ___

5. Multiply line 3 by line 4 ............................................................................................................................. 5. $ ________________

6. With respect to that period of your tax year that the qualifi ed employee was a resident of Maine

working for an employer located in Maine, enter the number of months you, the qualifi ed

employee and/or anyone else made eligible education loan payments. See instructions .................... 6.

________________

7. Multiply line 5 by line 6 ............................................................................................................................. 7. $ ________________

8. Enter the total amount of eligible education loan payments paid by you, the

employer, during your tax year beginning in 2009 .................................................................................... 8. $ ________________

9. Multiply line 2b by line 4 ........................................................................................................................... 9. $ ________________

10. Enter line 7 or line 9, whichever is less. ................................................................................................. 10. $ ________________

11. Employer’s portion of line 10. Divide line 8 by line 2b ........................................................................11.

___ . ___ ___ ___ ___

12. Tentative Credit Amount. Multiply line 10 by line 11 ........................................................................... 12. $ ________________

13. Was qualifi ed employee employed part-time (at least 16 hours but on average less than 32 hours

weekly) during your tax year? If yes, enter 0.5000 on this line. If no, enter 1.0000 ............................. 13.

___ . ___ ___ ___ ___

14. Credit Amount. Multiply line 12 by line 13 and enter the result on this line. C corporations: Add the

line 14 amounts of all worksheets completed and enter the total on Form 1120ME, Schedule C,

line 29l. Sole proprietors: Add the line 14 amounts of all worksheets completed and enter the total

on Form 1040ME, Schedule A, line 10. Pass-through entities: Enter the result here and see

instructions for reporting amounts to owners ......................................................................................... 14. $ ________________

15. Carryforward to 2010. See instructions ............................................................................................... 15. $ ________________

Rev. 11/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1