Form 8400 - Employee Plans Deficiency Checksheet

ADVERTISEMENT

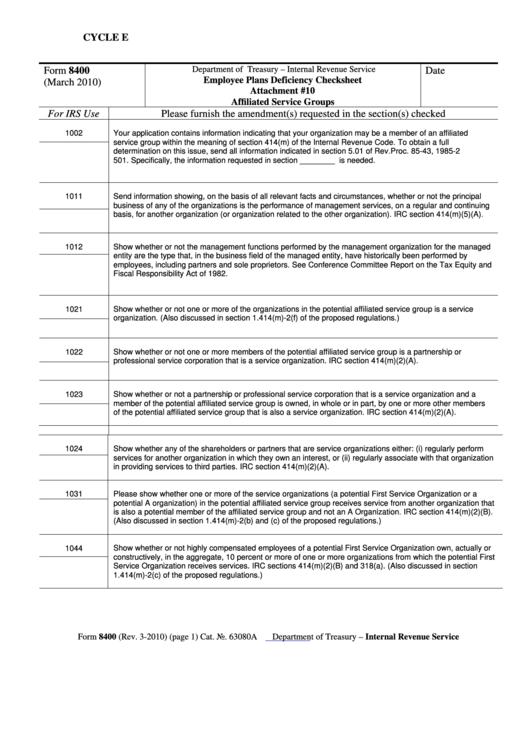

CYCLE E

Department of Treasury – Internal Revenue Service

Form 8400

Date

Employee Plans Deficiency Checksheet

(March 2010)

Attachment #10

Affiliated Service Groups

For IRS Use

Please furnish the amendment(s) requested in the section(s) checked

1002

Your application contains information indicating that your organization may be a member of an affiliated

service group within the meaning of section 414(m) of the Internal Revenue Code. To obtain a full

I.a.

determination on this issue, send all information indicated in section 5.01 of Rev. Proc. 85-43, 1985-2 C.B.

501. Specifically, the information requested in section ________ is needed.

1011

Send information showing, on the basis of all relevant facts and circumstances, whether or not the principal

business of any of the organizations is the performance of management services, on a regular and continuing

II.a.

basis, for another organization (or organization related to the other organization). IRC section 414(m)(5)(A).

1012

Show whether or not the management functions performed by the management organization for the managed

entity are the type that, in the business field of the managed entity, have historically been performed by

II.b..

employees, including partners and sole proprietors. See Conference Committee Report on the Tax Equity and

Fiscal Responsibility Act of 1982.

1021

Show whether or not one or more of the organizations in the potential affiliated service group is a service

organization. (Also discussed in section 1.414(m)-2(f) of the proposed regulations.)

III.a.

1022

Show whether or not one or more members of the potential affiliated service group is a partnership or

professional service corporation that is a service organization. IRC section 414(m)(2)(A).

III.b.

1023

Show whether or not a partnership or professional service corporation that is a service organization and a

member of the potential affiliated service group is owned, in whole or in part, by one or more other members

III.c.

of the potential affiliated service group that is also a service organization. IRC section 414(m)(2)(A).

1024

Show whether any of the shareholders or partners that are service organizations either: (i) regularly perform

services for another organization in which they own an interest, or (ii) regularly associate with that organization

III.d.

in providing services to third parties. IRC section 414(m)(2)(A).

1031

Please show whether one or more of the service organizations (a potential First Service Organization or a

potential A organization) in the potential affiliated service group receives service from another organization that

IV.a.

is also a potential member of the affiliated service group and not an A Organization. IRC section 414(m)(2)(B).

(Also discussed in section 1.414(m)-2(b) and (c) of the proposed regulations.)

1044

Show whether or not highly compensated employees of a potential First Service Organization own, actually or

constructively, in the aggregate, 10 percent or more of one or more organizations from which the potential First

IV.b.

Service Organization receives services. IRC sections 414(m)(2)(B) and 318(a). (Also discussed in section

1.414(m)-2(c) of the proposed regulations.)

Form 8400 (Rev. 3-2010) (page 1) Cat. No. 63080A

Department of Treasury – Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2