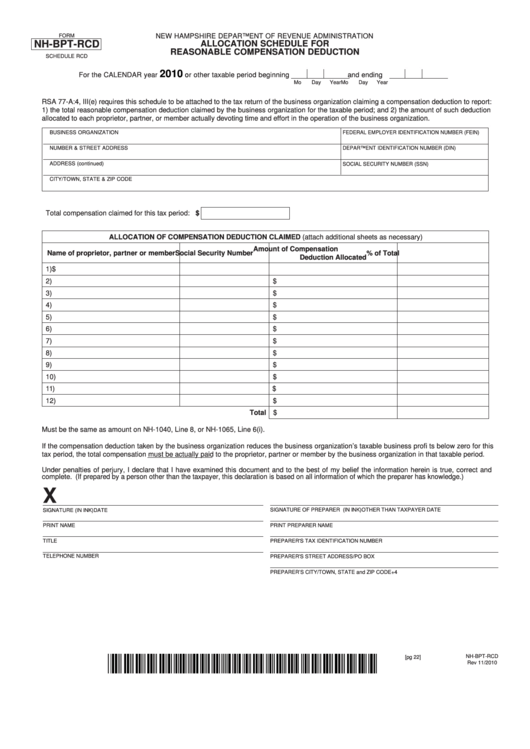

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

NH-BPT-RCD

ALLOCATION SCHEDULE FOR

REASONABLE COMPENSATION DEDUCTION

SCHEDULE RCD

2010

For the CALENDAR year

or other taxable period beginning

and ending

Mo

Day

Year

Mo

Day

Year

RSA 77-A:4, III(e) requires this schedule to be attached to the tax return of the business organization claiming a compensation deduction to report:

1) the total reasonable compensation deduction claimed by the business organization for the taxable period; and 2) the amount of such deduction

allocated to each proprietor, partner, or member actually devoting time and effort in the operation of the business organization.

BUSINESS ORGANIZATION

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)

NUMBER & STREET ADDRESS

DEPARTMENT IDENTIFICATION NUMBER (DIN)

ADDRESS (continued)

SOCIAL SECURITY NUMBER (SSN)

CITY/TOWN, STATE & ZIP CODE

Total compensation claimed for this tax period: $

ALLOCATION OF COMPENSATION DEDUCTION CLAIMED (attach additional sheets as necessary)

Amount of Compensation

Name of proprietor, partner or member

Social Security Number

% of Total

Deduction Allocated

1)

$

2)

$

3)

$

4)

$

5)

$

6)

$

7)

$

8)

$

9)

$

10)

$

11)

$

12)

$

Total $

Must be the same as amount on NH-1040, Line 8, or NH-1065, Line 6(i).

If the compensation deduction taken by the business organization reduces the business organization’s taxable business profi ts below zero for this

tax period, the total compensation must be actually paid to the proprietor, partner or member by the business organization in that taxable period.

Under penalties of perjury, I declare that I have examined this document and to the best of my belief the information herein is true, correct and

complete. (If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.)

X

SIGNATURE OF PREPARER (IN INK) OTHER THAN TAXPAYER

DATE

SIGNATURE (IN INK)

DATE

PRINT NAME

PRINT PREPARER NAME

TITLE

PREPARER'S TAX IDENTIFICATION NUMBER

TELEPHONE NUMBER

PREPARER'S STREET ADDRESS/PO BOX

PREPARER’S CITY/TOWN, STATE and ZIP CODE+4

NH-BPT-RCD

[pg 22]

Rev 11/2010

1

1