Instructions For Form 926 - Return By A U.s. Transferor Of Property To A Foreign Corporation - Service

ADVERTISEMENT

Department of the Treasury

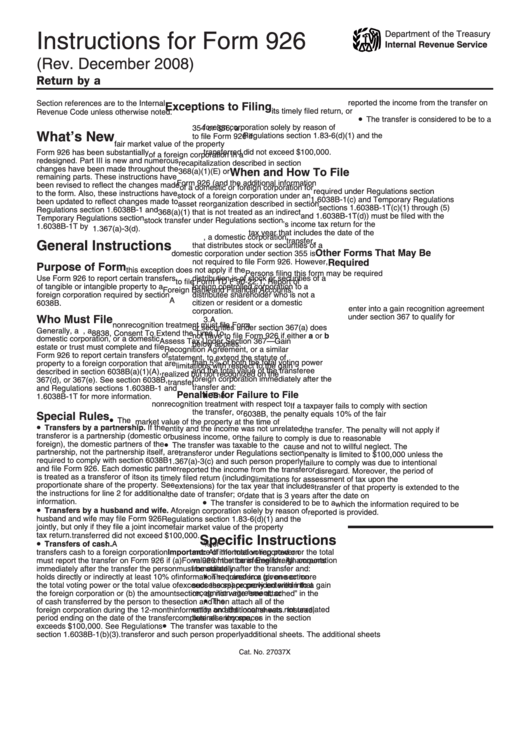

Instructions for Form 926

Internal Revenue Service

(Rev. December 2008)

Return by a U.S. Transferor of Property to a Foreign Corporation

reported the income from the transfer on

Section references are to the Internal

Exceptions to Filing

its timely filed return, or

Revenue Code unless otherwise noted.

•

The transfer is considered to be to a

1. For exchanges described in section

foreign corporation solely by reason of

354 or 356, a U.S. person does not have

What’s New

Regulations section 1.83-6(d)(1) and the

to file Form 926 if:

fair market value of the property

a. The U.S. person exchanges stock

transferred did not exceed $100,000.

Form 926 has been substantially

of a foreign corporation in a

redesigned. Part III is new and numerous

recapitalization described in section

changes have been made throughout the

When and How To File

368(a)(1)(E) or

remaining parts. These instructions have

b. The U.S. person exchanges stock

Form 926 (and the additional information

been revised to reflect the changes made

of a domestic or foreign corporation for

required under Regulations section

to the form. Also, these instructions have

stock of a foreign corporation under an

1.6038B-1(c) and Temporary Regulations

been updated to reflect changes made to

asset reorganization described in section

sections 1.6038B-1T(c)(1) through (5)

Regulations section 1.6038B-1 and

368(a)(1) that is not treated as an indirect

and 1.6038B-1T(d)) must be filed with the

Temporary Regulations section

stock transfer under Regulations section

U.S. transferor’s income tax return for the

1.6038B-1T by T.D. 9243 and T.D. 9300.

1.367(a)-3(d).

tax year that includes the date of the

2. Generally, a domestic corporation

transfer.

General Instructions

that distributes stock or securities of a

Other Forms That May Be

domestic corporation under section 355 is

not required to file Form 926. However,

Required

Purpose of Form

this exception does not apply if the

Persons filing this form may be required

Use Form 926 to report certain transfers

distribution is of stock or securities of a

to file Form TD F 90-22.1, Report of

of tangible or intangible property to a

foreign controlled corporation to a

Foreign Bank and Financial Accounts.

foreign corporation required by section

distributee shareholder who is not a U.S.

A U.S. transferor that is required to

6038B.

citizen or resident or a domestic

enter into a gain recognition agreement

corporation.

under section 367 to qualify for

Who Must File

3. A U.S. person that transfers stock

nonrecognition treatment must file Form

or securities under section 367(a) does

Generally, a U.S. citizen or resident, a

8838, Consent To Extend the Time To

not have to file Form 926 if either a or b

domestic corporation, or a domestic

Assess Tax Under Section 367 — Gain

below applies.

estate or trust must complete and file

Recognition Agreement, or a similar

a. The U.S. transferor owned less

Form 926 to report certain transfers of

statement, to extend the statute of

than 5% of both the total voting power

property to a foreign corporation that are

limitations with respect to the gain

and the total value of the transferee

described in section 6038B(a)(1)(A),

realized but not recognized on the

foreign corporation immediately after the

367(d), or 367(e). See section 6038B,

transfer.

transfer and:

and Regulations sections 1.6038B-1 and

•

Penalties for Failure to File

The U.S. transferor qualified for

1.6038B-1T for more information.

nonrecognition treatment with respect to

If a taxpayer fails to comply with section

the transfer, or

6038B, the penalty equals 10% of the fair

Special Rules

•

The U.S. transferor is a tax-exempt

market value of the property at the time of

•

Transfers by a partnership. If the

entity and the income was not unrelated

the transfer. The penalty will not apply if

transferor is a partnership (domestic or

business income, or

the failure to comply is due to reasonable

•

foreign), the domestic partners of the

The transfer was taxable to the U.S.

cause and not to willful neglect. The

partnership, not the partnership itself, are

transferor under Regulations section

penalty is limited to $100,000 unless the

required to comply with section 6038B

1.367(a)-3(c) and such person properly

failure to comply was due to intentional

and file Form 926. Each domestic partner

reported the income from the transferor

disregard. Moreover, the period of

is treated as a transferor of its

on its timely filed return (including

limitations for assessment of tax upon the

proportionate share of the property. See

extensions) for the tax year that includes

transfer of that property is extended to the

the instructions for line 2 for additional

the date of transfer; or

date that is 3 years after the date on

•

information.

The transfer is considered to be to a

which the information required to be

•

Transfers by a husband and wife. A

foreign corporation solely by reason of

reported is provided.

husband and wife may file Form 926

Regulations section 1.83-6(d)(1) and the

jointly, but only if they file a joint income

fair market value of the property

tax return.

transferred did not exceed $100,000.

Specific Instructions

•

Transfers of cash. A U.S. person that

b. The U.S. transferor owned 5% or

more of the total voting power or the total

transfers cash to a foreign corporation

Important: All information reported on

value of the transferee foreign corporation

must report the transfer on Form 926 if (a)

Form 926 must be in English. All amounts

immediately after the transfer the person

immediately after the transfer and:

must be stated in U.S. dollars. If the

•

The transferor (or one or more

holds directly or indirectly at least 10% of

information required in a given section

the total voting power or the total value of

successors) properly entered into a gain

exceeds the space provided within that

recognition agreement, or

the foreign corporation or (b) the amount

section, do not write “see attached” in the

•

of cash transferred by the person to the

The U.S. transferor is a tax-exempt

section and then attach all of the

foreign corporation during the 12-month

entity and the income was not unrelated

information on additional sheets. Instead,

period ending on the date of the transfer

business income, or

complete all entry spaces in the section

•

exceeds $100,000. See Regulations

The transfer was taxable to the U.S.

and attach the remaining information on

section 1.6038B-1(b)(3).

transferor and such person properly

additional sheets. The additional sheets

Cat. No. 27037X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4