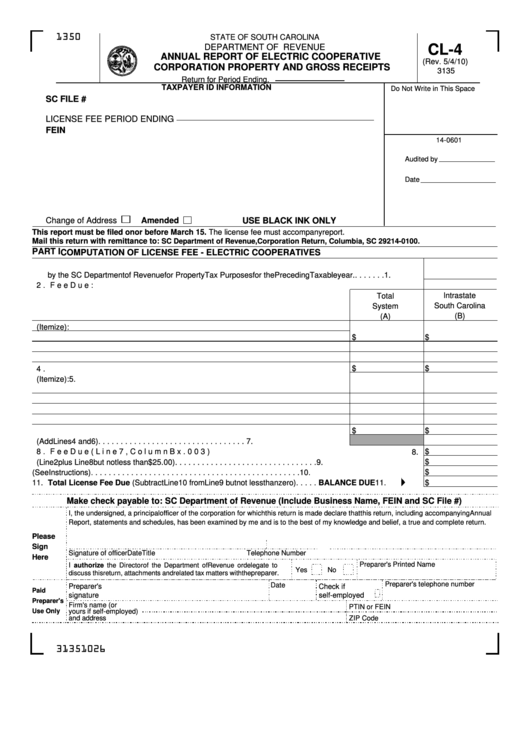

Form Cl-4 - Annual Report Of Electric Cooperative Corporation Property And Gross Receipts - 2010

ADVERTISEMENT

1350

STATE OF SOUTH CAROLINA

CL-4

DEPARTMENT OF REVENUE

ANNUAL REPORT OF ELECTRIC COOPERATIVE

(Rev. 5/4/10)

CORPORATION PROPERTY AND GROSS RECEIPTS

3135

Return for Period Ending

.

TAXPAYER ID INFORMATION

Do Not Write in This Space

SC FILE #

LICENSE FEE PERIOD ENDING

FEIN

14-0601

Audited by

Date

Change of Address

Amended

USE BLACK INK ONLY

This report must be filed on or before March 15. The license fee must accompany report.

Mail this return with remittance to:

SC Department of Revenue, Corporation Return, Columbia, SC 29214-0100.

PART I

COMPUTATION OF LICENSE FEE - ELECTRIC COOPERATIVES

1. Fair Market Value of Property Owned and Used in the Conduct of Business in South Carolina as determined

by the SC Department of Revenue for Property Tax Purposes for the Preceding Taxable year. . . . . . . .

1.

2. Fee Due: Line 1 x .001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

Intrastate

Total

South Carolina

System

(B)

(A)

3. Operating Revenues. (Itemize):

$

$

$

$

4. Total Operating Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Other Receipts. (Itemize):

5.

6. Total Other Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

$

$

7. Total Gross Receipts (Add Lines 4 and 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

$

8. Fee Due (Line 7, Column B x .003). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

$

9. License Fee Due (Line 2 plus Line 8 but not less than $25.00) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

$

10. Section 12-20-105 credit (See Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

$

11. Total License Fee Due (Subtract Line 10 from Line 9 but not less than zero) . . . . . BALANCE DUE

11.

Make check payable to: SC Department of Revenue (Include Business Name, FEIN and SC File #)

I, the undersigned, a principal officer of the corporation for which this return is made declare that this return, including accompanying Annual

Report, statements and schedules, has been examined by me and is to the best of my knowledge and belief, a true and complete return.

Please

Sign

Signature of officer

Date

Title

Telephone Number

Here

Preparer's Printed Name

I authorize the Director of the Department of Revenue or delegate to

Yes

No

discuss this return, attachments and related tax matters with the preparer.

Preparer's telephone number

Date

Preparer's

Check if

Paid

signature

self-employed

Preparer's

Firm's name (or

PTIN or FEIN

Use Only

yours if self-employed)

and address

ZIP Code

31351026

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2