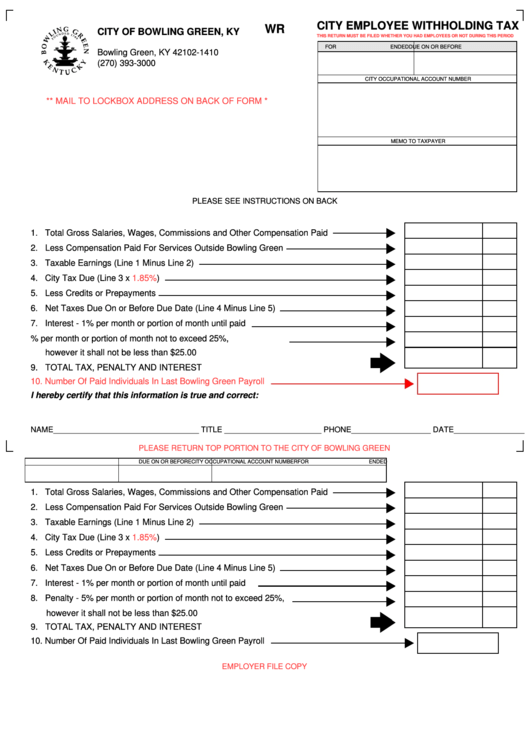

CITY EMPLOYEE WITHHOLDING TAX

WR

CITY OF BOWLING GREEN, KY

THIS RETURN MUST BE FILED WHETHER YOU HAD EMPLOYEES OR NOT DURING THIS PERIOD

P.O. Box 1410

FOR

ENDED

DUE ON OR BEFORE

Bowling Green, KY 42102-1410

(270) 393-3000

CITY OCCUPATIONAL ACCOUNT NUMBER

** MAIL TO LOCKBOX ADDRESS ON BACK OF FORM *

MEMO TO TAXPAYER

PLEASE SEE INSTRUCTIONS ON BACK

1. Total Gross Salaries, Wages, Commissions and Other Compensation Paid

2. Less Compensation Paid For Services Outside Bowling Green

3. Taxable Earnings (Line 1 Minus Line 2)

4. City Tax Due (Line 3 x 1.85%)

5. Less Credits or Prepayments

6. Net Taxes Due On or Before Due Date (Line 4 Minus Line 5)

7. Interest - 1% per month or portion of month until paid

8. Penalty - 5% per month or portion of month not to exceed 25%,

however it shall not be less than $25.00

9. TOTAL TAX, PENALTY AND INTEREST

10. Number Of Paid Individuals In Last Bowling Green Payroll

I hereby certify that this information is true and correct:

NAME_________________________________ TITLE ______________________ PHONE__________________ DATE________________

PLEASE RETURN TOP PORTION TO THE CITY OF BOWLING GREEN

FOR

ENDED

DUE ON OR BEFORE

CITY OCCUPATIONAL ACCOUNT NUMBER

1. Total Gross Salaries, Wages, Commissions and Other Compensation Paid

2. Less Compensation Paid For Services Outside Bowling Green

3. Taxable Earnings (Line 1 Minus Line 2)

4. City Tax Due (Line 3 x 1.85%)

5. Less Credits or Prepayments

6. Net Taxes Due On or Before Due Date (Line 4 Minus Line 5)

7. Interest - 1% per month or portion of month until paid

8. Penalty - 5% per month or portion of month not to exceed 25%,

however it shall not be less than $25.00

9. TOTAL TAX, PENALTY AND INTEREST

10. Number Of Paid Individuals In Last Bowling Green Payroll

EMPLOYER FILE COPY

1

1