Form Crb - Maine Franchise Tax Combined Report For Unitary Members - 2009

ADVERTISEMENT

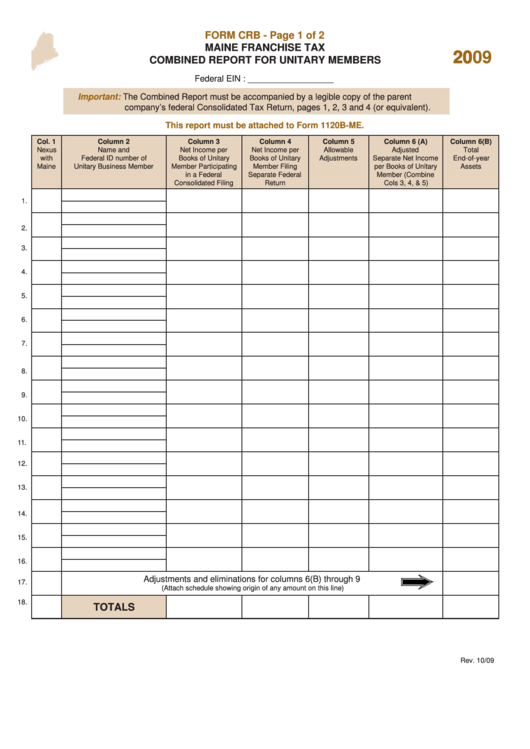

FORM CRB - Page 1 of 2

MAINE FRANCHISE TAX

2009

COMBINED REPORT FOR UNITARY MEMBERS

Federal EIN : __________________

Important:

The Combined Report must be accompanied by a legible copy of the parent

company’s federal Consolidated Tax Return, pages 1, 2, 3 and 4 (or equivalent).

This report must be attached to Form 1120B-ME.

Col. 1

Column 2

Column 3

Column 4

Column 5

Column 6 (A)

Column 6(B)

Nexus

Name and

Net Income per

Net Income per

Allowable

Adjusted

Total

with

Federal ID number of

Books of Unitary

Books of Unitary

Adjustments

Separate Net Income

End-of-year

Maine

Unitary Business Member

Member Participating

Member Filing

per Books of Unitary

Assets

in a Federal

Separate Federal

Member (Combine

Consolidated Filing

Return

Cols 3, 4, & 5)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

Adjustments and eliminations for columns 6(B) through 9

17.

(Attach schedule showing origin of any amount on this line)

18.

TOTALS

Rev. 10/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2