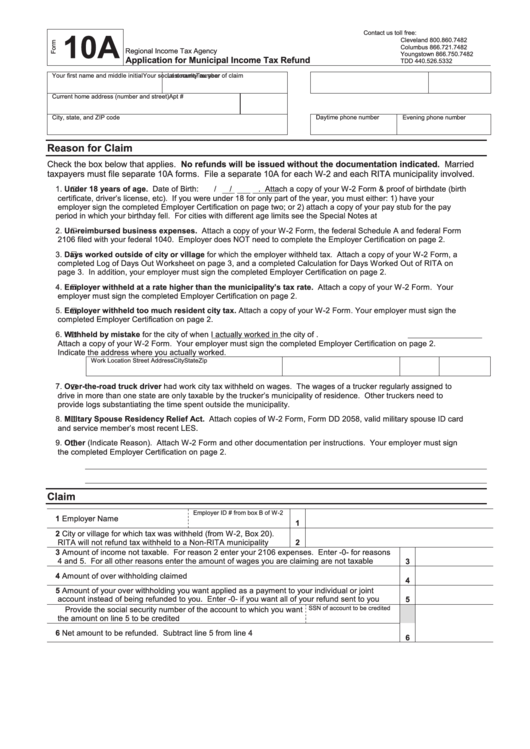

Form 10a - Regional Income Tax Agency Application For Municipal Income Tax Refund

ADVERTISEMENT

Contact us toll free:

10A

Cleveland

800.860.7482

Columbus

866.721.7482

Regional Income Tax Agency

Youngstown

866.750.7482

Application for Municipal Income Tax Refund

TDD

440.526.5332

Your first name and middle initial

Last name

Your social security number

Tax year of claim

Current home address (number and street)

Apt #

Daytime phone number

Evening phone number

City, state, and ZIP code

Reason for Claim

Check the box below that applies. No refunds will be issued without the documentation indicated. Married

taxpayers must file separate 10A forms. File a separate 10A for each W-2 and each RITA municipality involved.

1.

Under 18 years of age. Date of Birth:

/

/

. Attach a copy of your W-2 Form & proof of birthdate (birth

certificate, driver’s license, etc). If you were under 18 for only part of the year, you must either: 1) have your

employer sign the completed Employer Certification on page two; or 2) attach a copy of your pay stub for the pay

period in which your birthday fell. For cities with different age limits see the Special Notes at

2.

Un-reimbursed business expenses. Attach a copy of your W-2 Form, the federal Schedule A and federal Form

2106 filed with your federal 1040. Employer does NOT need to complete the Employer Certification on page 2.

3.

Days worked outside of city or village for which the employer withheld tax. Attach a copy of your W-2 Form, a

completed Log of Days Out Worksheet on page 3, and a completed Calculation for Days Worked Out of RITA on

page 3. In addition, your employer must sign the completed Employer Certification on page 2.

4.

Employer withheld at a rate higher than the municipality’s tax rate. Attach a copy of your W-2 Form. Your

employer must sign the completed Employer Certification on page 2.

5.

Employer withheld too much resident city tax. Attach a copy of your W-2 Form. Your employer must sign the

completed Employer Certification on page 2.

6.

Withheld by mistake for the city of

when I actually worked in the city of

.

Attach a copy of your W-2 Form. Your employer must sign the completed Employer Certification on page 2.

Indicate the address where you actually worked.

Work Location Street Address

City

State

Zip

7.

Over-the-road truck driver had work city tax withheld on wages. The wages of a trucker regularly assigned to

drive in more than one state are only taxable by the trucker’s municipality of residence. Other truckers need to

provide logs substantiating the time spent outside the municipality.

8.

Military Spouse Residency Relief Act. Attach copies of W-2 Form, Form DD 2058, valid military spouse ID card

and service member’s most recent LES.

9.

Other (Indicate Reason). Attach W-2 Form and other documentation per instructions. Your employer must sign

the completed Employer Certification on page 2.

Claim

Employer ID # from box B of W-2

1 Employer Name

1

2 City or village for which tax was withheld (from W-2, Box 20).

RITA will not refund tax withheld to a Non-RITA municipality

2

3 Amount of income not taxable. For reason 2 enter your 2106 expenses. Enter -0- for reasons

4 and 5. For all other reasons enter the amount of wages you are claiming are not taxable

3

4 Amount of over withholding claimed

4

5 Amount of your over withholding you want applied as a payment to your individual or joint

account instead of being refunded to you. Enter -0- if you want all of your refund sent to you

5

SSN of account to be credited

Provide the social security number of the account to which you want

the amount on line 5 to be credited

6 Net amount to be refunded. Subtract line 5 from line 4

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3