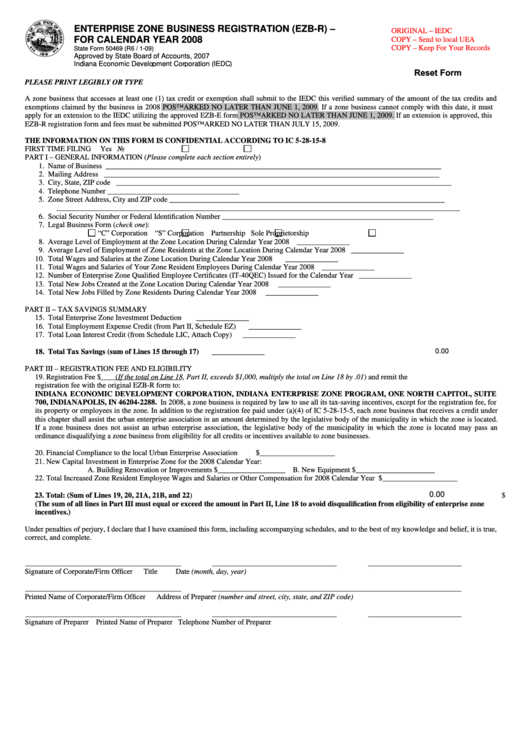

ENTERPRISE ZONE BUSINESS REGISTRATION (EZB-R) –

ORIGINAL – IEDC

FOR CALENDAR YEAR 2008

COPY – Send to local UEA

COPY – Keep For Your Records

State Form 50469 (R6 / 1-09)

Approved by State Board of Accounts, 2007

Indiana Economic Development Corporation (IEDC)

Reset Form

PLEASE PRINT LEGIBLY OR TYPE

A zone business that accesses at least one (1) tax credit or exemption shall submit to the IEDC this verified summary of the amount of the tax credits and

exemptions claimed by the business in 2008 POSTMARKED NO LATER THAN JUNE 1, 2009. If a zone business cannot comply with this date, it must

apply for an extension to the IEDC utilizing the approved EZB-E form POSTMARKED NO LATER THAN JUNE 1, 2009. If an extension is approved, this

EZB-R registration form and fees must be submitted POSTMARKED NO LATER THAN JULY 15, 2009.

THE INFORMATION ON THIS FORM IS CONFIDENTIAL ACCORDING TO IC 5-28-15-8

FIRST TIME FILING

Yes

No

PART I – GENERAL INFORMATION (Please complete each section entirely)

1. Name of Business

_________________________________________________________________________________________

2. Mailing Address

_________________________________________________________________________________________

3. City, State, ZIP code

_________________________________________________________________________________________

4. Telephone Number

___________________________________

5. Zone Street Address, City and ZIP code

_________________________________________________________________________

___________________________________________________________________________________________________________

6. Social Security Number or Federal Identification Number

________________________________________________________

7. Legal Business Form (check one):

“C” Corporation

“S” Corporation

Partnership

Sole Proprietorship

8. Average Level of Employment at the Zone Location During Calendar Year 2008

______________

9. Average Level of Employment of Zone Residents at the Zone Location During Calendar Year 2008

______________

10. Total Wages and Salaries at the Zone Location During Calendar Year 2008

______________

11. Total Wages and Salaries of Your Zone Resident Employees During Calendar Year 2008

______________

12. Number of Enterprise Zone Qualified Employee Certificates (IT-40QEC) Issued for the Calendar Year

______________

13. Total New Jobs Created at the Zone Location During Calendar Year 2008

______________

14. Total New Jobs Filled by Zone Residents During Calendar Year 2008

______________

PART II – TAX SAVINGS SUMMARY

15. Total Enterprise Zone Investment Deduction

______________

16. Total Employment Expense Credit (from Part II, Schedule EZ)

______________

17. Total Loan Interest Credit (from Schedule LIC, Attach Copy)

______________

0.00

18. Total Tax Savings (sum of Lines 15 through 17)

______________

PART III – REGISTRATION FEE AND ELIGIBILITY

19. Registration Fee $

(If the total on Line 18, Part II, exceeds $1,000, multiply the total on Line 18 by .01) and remit the

registration fee with the original EZB-R form to:

INDIANA ECONOMIC DEVELOPMENT CORPORATION, INDIANA ENTERPRISE ZONE PROGRAM, ONE NORTH CAPITOL, SUITE

700, INDIANAPOLIS, IN 46204-2288. In 2008, a zone business is required by law to use all its tax-saving incentives, except for the registration fee, for

its property or employees in the zone. In addition to the registration fee paid under (a)(4) of IC 5-28-15-5, each zone business that receives a credit under

this chapter shall assist the urban enterprise association in an amount determined by the legislative body of the municipality in which the zone is located.

If a zone business does not assist an urban enterprise association, the legislative body of the municipality in which the zone is located may pass an

ordinance disqualifying a zone business from eligibility for all credits or incentives available to zone businesses.

20. Financial Compliance to the local Urban Enterprise Association

$____________________

21. New Capital Investment in Enterprise Zone for the 2008 Calendar Year:

A. Building Renovation or Improvements $__________________

B. New Equipment $_____________________

22. Total Increased Zone Resident Employee Wages and Salaries or Other Compensation for 2008 Calendar Year

$____________________

0.00

23. Total: (Sum of Lines 19, 20, 21A, 21B, and 22)

$____________________

(The sum of all lines in Part III must equal or exceed the amount in Part II, Line 18 to avoid disqualification from eligibility of enterprise zone

incentives.)

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules, and to the best of my knowledge and belief, it is true,

correct, and complete.

Signature of Corporate/Firm Officer

Title

Date (month, day, year)

Printed Name of Corporate/Firm Officer

Address of Preparer (number and street, city, state, and ZIP code)

Signature of Preparer

Printed Name of Preparer

Telephone Number of Preparer

1

1