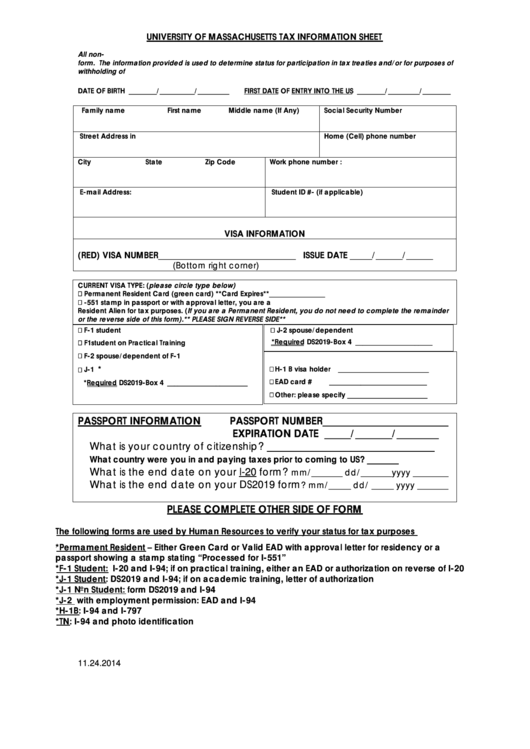

UNIVERSITY OF MASSACHUSETTS TAX INFORMATION SHEET

All non-U.S. citizens who receive compensation/scholarships/fellowships from the University must complete this

form. The information provided is used to determine status for participation in tax treaties and/or for purposes of

withholding of U.S. income taxes from paychecks. It is NOT used for immigration purposes.

DATE OF BIRTH ________/__________/_________

FIRST DATE OF ENTRY INTO THE US ________/_________/________

Family name

First name

Middle name (If Any)

U.S. Social Security Number

Street Address in U.S.

Home (Cell) phone number

City

State

Zip Code

Work phone number :

E-mail Address:

Student ID #- (if applicable)

VISA INFORMATION

(RED) VISA NUMBER _______________________________ ISSUE DATE _____/______/______

(Bottom right corner)

CURRENT VISA TYPE: (please circle type below)

Permanent Resident Card (green card) **Card Expires**________________

U.S. Permanent Resident with green card or with an I-551 stamp in passport or with approval letter, you are a

Resident Alien for tax purposes. (If you are a Permanent Resident, you do not need to complete the remainder

or the reverse side of this form).** PLEASE SIGN REVERSE SIDE**

F-1 student

J-2 spouse/dependent

*Required DS2019-Box 4 ______________________

F1student on Practical Training

F-2 spouse/dependent of F-1

*

J-1

H-1 B visa holder

__________________________

EAD card #

____________________________

*Required DS2019-Box 4 _______________________

Other: please specify _______________________

PASSPORT INFORMATION

PASSPORT NUMBER________________________

EXPIRATION DATE _____/_______/________

What is your country of citizenship? ________________________________

______

What country were you in and paying taxes prior to coming to US?

What is the end date on your I-20 form?

mm/_______ dd/_______yyyy ________

What is the end date on your DS2019 form

? mm/_____ dd/ _____ yyyy _______

PLEASE COMPLETE OTHER SIDE OF FORM

The following forms are used by Human Resources to verify your status for tax purposes

*Permament Resident – Either Green Card or Valid EAD with approval letter for residency or a

passport showing a stamp stating “Processed for I-551”

*F-1 Student: I-20 and I-94; if on practical training, either an EAD or authorization on reverse of I-20

*J-1 Student: DS2019 and I-94; if on academic training, letter of authorization

*J-1 Non Student: form DS2019 and I-94

*J-2 with employment permission: EAD and I-94

*H-1B: I-94 and I-797

*TN: I-94 and photo identification

11.24.2014

1

1 2

2