TAB through to navigate. Use mouse to check

Save

Print

Clear

Instructions

applicable boxes, press spacebar, or press Enter.

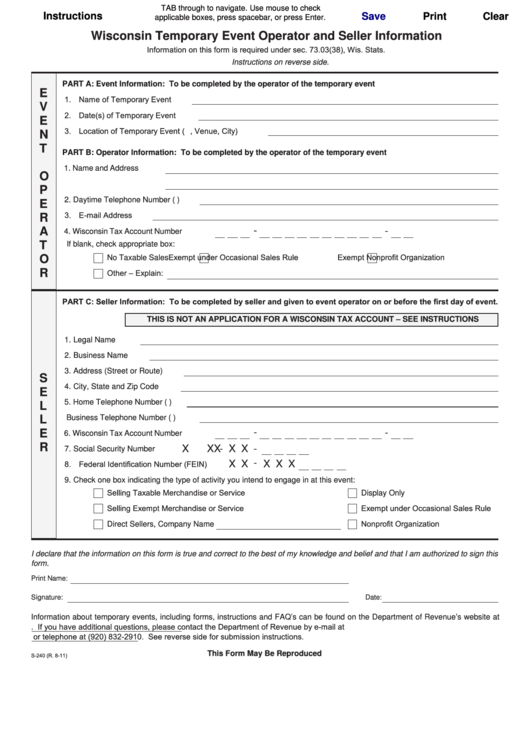

Wisconsin Temporary Event Operator and Seller Information

Information on this form is required under sec. 73.03(38), Wis. Stats.

Instructions on reverse side.

PART A:

Event Information: To be completed by the operator of the temporary event

E

1. Name of Temporary Event

V

2. Date(s) of Temporary Event

E

3. Location of Temporary Event (e.g., Venue, City)

N

T

PART B: Operator Information: To be completed by the operator of the temporary event

1. Name and Address

O

P

2. Daytime Telephone Number

(

)

E

3. E-mail Address

R

-

A

-

4. Wisconsin Tax Account Number

T

If blank, check appropriate box:

Exempt under Occasional Sales Rule

Exempt Nonprofit Organization

O

No Taxable Sales

R

Other – Explain:

PART C: Seller Information: To be completed by seller and given to event operator on or before the first day of event.

THIS IS NOT AN APPLICATION FOR A WISCONSIN TAX ACCOUNT – SEE INSTRUCTIONS

1. Legal Name

2. Business Name

3. Address (Street or Route)

S

4. City, State and Zip Code

E

5. Home Telephone Number (

)

L

Business Telephone Number (

)

L

-

-

E

6. Wisconsin Tax Account Number

R

X

X

X

-

X X

-

7. Social Security Number

-

8. Federal Identification Number (FEIN)

X X

X X X

9. Check one box indicating the type of activity you intend to engage in at this event:

Selling Taxable Merchandise or Service

Display Only

Selling Exempt Merchandise or Service

Exempt under Occasional Sales Rule

Nonprofit Organization

Direct Sellers, Company Name

I declare that the information on this form is true and correct to the best of my knowledge and belief and that I am authorized to sign this

form.

Print Name:

Signature:

Date:

Information about temporary events, including forms, instructions and FAQ’s can be found on the Department of Revenue’s website at

If you have additional questions, please contact the Department of Revenue by e-mail at

tempevtprg@revenue.wi.gov or telephone at (920) 832-2910. See reverse side for submission instructions.

This Form May Be Reproduced

S-240 (R. 8-11)

1

1 2

2