Instructions For Filing Regulation A Sales Tax Returns

ADVERTISEMENT

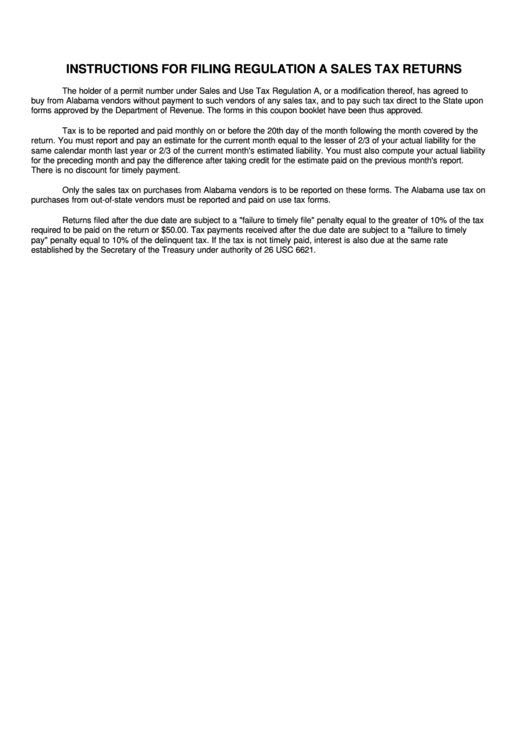

INSTRUCTIONS FOR FILING REGULATION A SALES TAX RETURNS

The holder of a permit number under Sales and Use Tax Regulation A, or a modification thereof, has agreed to

buy from Alabama vendors without payment to such vendors of any sales tax, and to pay such tax direct to the State upon

forms approved by the Department of Revenue. The forms in this coupon booklet have been thus approved.

Tax is to be reported and paid monthly on or before the 20th day of the month following the month covered by the

return. You must report and pay an estimate for the current month equal to the lesser of 2/3 of your actual liability for the

same calendar month last year or 2/3 of the current month's estimated liability. You must also compute your actual liability

for the preceding month and pay the difference after taking credit for the estimate paid on the previous month's report.

There is no discount for timely payment.

Only the sales tax on purchases from Alabama vendors is to be reported on these forms. The Alabama use tax on

purchases from out-of-state vendors must be reported and paid on use tax forms.

Returns filed after the due date are subject to a "failure to timely file" penalty equal to the greater of 10% of the tax

required to be paid on the return or $50.00. Tax payments received after the due date are subject to a "failure to timely

pay" penalty equal to 10% of the delinquent tax. If the tax is not timely paid, interest is also due at the same rate

established by the Secretary of the Treasury under authority of 26 USC 6621.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1