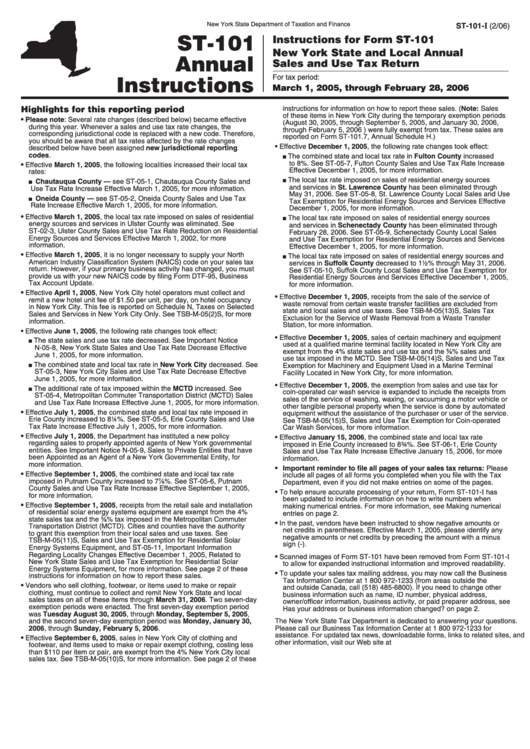

Instructions For Form St-101

ADVERTISEMENT

New York State Department of Taxation and Finance

I

ST-101-

(2/06)

ST-101

Instructions for Form ST-101

New York State and Local Annual

Annual

Sales and Use Tax Return

Instructions

For tax period:

March 1, 2005, through February 28, 2006

Highlights for this reporting period

instructions for information on how to report these sales. (Note: Sales

of these items in New York City during the temporary exemption periods

•

Please note: Several rate changes (described below) became effective

(August 30, 2005, through September 5, 2005, and January 30, 2006,

during this year. Whenever a sales and use tax rate changes, the

through February 5, 2006 ) were fully exempt from tax. These sales are

corresponding jurisdictional code is replaced with a new code. Therefore,

reported on Form ST-101.7, Annual Schedule H.)

you should be aware that all tax rates affected by the rate changes

• Effective December 1, 2005, the following rate changes took effect:

described below have been assigned new jurisdictional reporting

codes.

The combined state and local tax rate in Fulton County increased

to 8%. See ST-05-7, Fulton County Sales and Use Tax Rate Increase

•

Effective March 1, 2005, the following localities increased their local tax

Effective December 1, 2005, for more information.

rates:

The local tax rate imposed on sales of residential energy sources

Chautauqua County — see ST-05-1, Chautauqua County Sales and

and services in St. Lawrence County has been eliminated through

Use Tax Rate Increase Effective March 1, 2005, for more information.

May 31, 2006. See ST-05-8, St. Lawrence County Local Sales and Use

Oneida County — see ST-05-2, Oneida County Sales and Use Tax

Tax Exemption for Residential Energy Sources and Services Effective

Rate Increase Effective March 1, 2005, for more information.

December 1, 2005, for more information.

•

Effective March 1, 2005, the local tax rate imposed on sales of residential

The local tax rate imposed on sales of residential energy sources

energy sources and services in Ulster County was eliminated. See

and services in Schenectady County has been eliminated through

ST-02-3, Ulster County Sales and Use Tax Rate Reduction on Residential

February 28, 2006. See ST-05-9, Schenectady County Local Sales

Energy Sources and Services Effective March 1, 2002, for more

and Use Tax Exemption for Residential Energy Sources and Services

information.

Effective December 1, 2005, for more information.

•

Effective March 1, 2005, it is no longer necessary to supply your North

The local tax rate imposed on sales of residential energy sources and

American Industry Classification System (NAICS) code on your sales tax

services in Suffolk County decreased to 1½% through May 31, 2006.

return. However, if your primary business activity has changed, you must

See ST-05-10, Suffolk County Local Sales and Use Tax Exemption for

provide us with your new NAICS code by filing Form DTF-95, Business

Residential Energy Sources and Services Effective December 1, 2005,

Tax Account Update.

for more information.

•

Effective April 1, 2005, New York City hotel operators must collect and

• Effective December 1, 2005, receipts from the sale of the service of

remit a new hotel unit fee of $1.50 per unit, per day, on hotel occupancy

waste removal from certain waste transfer facilities are excluded from

in New York City. This fee is reported on Schedule N, Taxes on Selected

state and local sales and use taxes. See TSB-M-05(13)S, Sales Tax

Sales and Services in New York City Only. See TSB-M-05(2)S, for more

Exclusion for the Service of Waste Removal from a Waste Transfer

information.

Station, for more information.

• Effective June 1, 2005, the following rate changes took effect:

• Effective December 1, 2005, sales of certain machinery and equipment

The state sales and use tax rate decreased. See Important Notice

used at a qualified marine terminal facility located in New York City are

N-05-8, New York State Sales and Use Tax Rate Decrease Effective

exempt from the 4% state sales and use tax and the ⅜% sales and

June 1, 2005, for more information.

use tax imposed in the MCTD. See TSB-M-05(14)S, Sales and Use Tax

The combined state and local tax rate in New York City decreased. See

Exemption for Machinery and Equipment Used in a Marine Terminal

ST-05-3, New York City Sales and Use Tax Rate Decrease Effective

Facility Located in New York City, for more information.

June 1, 2005, for more information.

• Effective December 1, 2005, the exemption from sales and use tax for

The additional rate of tax imposed within the MCTD increased. See

coin-operated car wash service is expanded to include the receipts from

ST-05-4, Metropolitan Commuter Transportation District (MCTD) Sales

sales of the service of washing, waxing, or vacuuming a motor vehicle or

and Use Tax Rate Increase Effective June 1, 2005, for more information.

other tangible personal property when the service is done by automated

•

Effective July 1, 2005, the combined state and local tax rate imposed in

equipment without the assistance of the purchaser or user of the service.

Erie County increased to 8¼%. See ST-05-5, Erie County Sales and Use

See TSB-M-05(15)S, Sales and Use Tax Exemption for Coin-operated

Tax Rate Increase Effective July 1, 2005, for more information.

Car Wash Services, for more information.

•

Effective July 1, 2005, the Department has instituted a new policy

• Effective January 15, 2006, the combined state and local tax rate

regarding sales to properly appointed agents of New York governmental

imposed in Erie County increased to 8¾%. See ST-06-1, Erie County

entities. See Important Notice N-05-9, Sales to Private Entities that have

Sales and Use Tax Rate Increase Effective January 15, 2006, for more

been Appointed as an Agent of a New York Governmental Entity, for

information.

more information.

•

Important reminder to file all pages of your sales tax returns: Please

•

Effective September 1, 2005, the combined state and local tax rate

include all pages of all forms you completed when you file with the Tax

imposed in Putnam County increased to 7⅞%. See ST-05-6, Putnam

Department, even if you did not make entries on some of the pages.

County Sales and Use Tax Rate Increase Effective September 1, 2005,

•

To help ensure accurate processing of your return, Form ST-101-I has

for more information.

been updated to include information on how to write numbers when

•

Effective September 1, 2005, receipts from the retail sale and installation

making numerical entries. For more information, see Making numerical

of residential solar energy systems equipment are exempt from the 4%

entries on page 2.

state sales tax and the ⅜% tax imposed in the Metropolitan Commuter

•

In the past, vendors have been instructed to show negative amounts or

Transportation District (MCTD). Cities and counties have the authority

net credits in parentheses. Effective March 1, 2005, please identify any

to grant this exemption from their local sales and use taxes. See

negative amounts or net credits by preceding the amount with a minus

TSB-M-05(11)S, Sales and Use Tax Exemption for Residential Solar

sign (-).

Energy Systems Equipment, and ST-05-11, Important Information

Regarding Locality Changes Effective December 1, 2005, Related to

•

Scanned images of Form ST-101 have been removed from Form ST-101-I

New York State Sales and Use Tax Exemption for Residential Solar

to allow for expanded instructional information and improved readability.

Energy Systems Equipment, for more information. See page 2 of these

•

To update your sales tax mailing address, you may now call the Business

instructions for information on how to report these sales.

Tax Information Center at 1 800 972-1233 (from areas outside the U.S.

•

Vendors who sell clothing, footwear, or items used to make or repair

and outside Canada, call (518) 485-6800). If you need to change other

clothing, must continue to collect and remit New York State and local

business information such as name, ID number, physical address,

sales taxes on all of these items through March 31, 2006. Two seven-day

owner/officer information, business activity, or paid preparer address, see

exemption periods were enacted. The first seven-day exemption period

Has your address or business information changed? on page 2.

was Tuesday August 30, 2005, through Monday, September 5, 2005,

and the second seven-day exemption period was Monday, January 30,

The New York State Tax Department is dedicated to answering your questions.

2006, through Sunday, February 5, 2006.

Please call our Business Tax Information Center at 1 800 972-1233 for

assistance. For updated tax news, downloadable forms, links to related sites, and

•

Effective September 6, 2005, sales in New York City of clothing and

other information, visit our Web site at

footwear, and items used to make or repair exempt clothing, costing less

than $110 per item or pair, are exempt from the 4% New York City local

sales tax. See TSB-M-05(10)S, for more information. See page 2 of these

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5