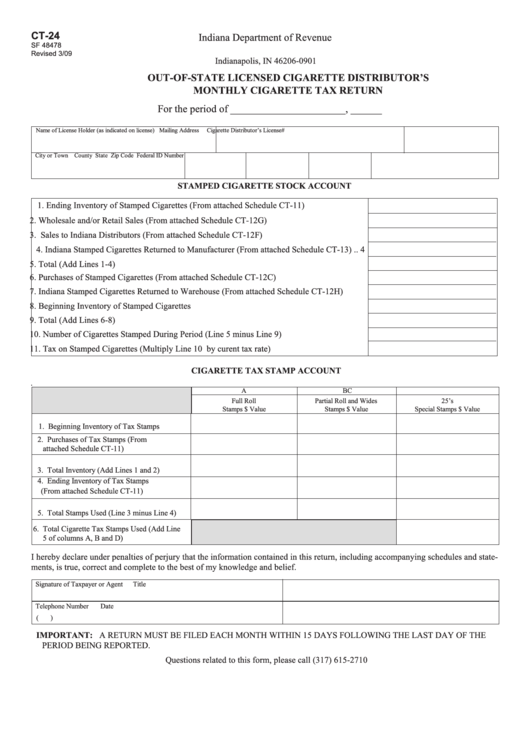

CT-24

Indiana Department of Revenue

SF 48478

P.O. Box 901

Revised 3/09

Indianapolis, IN 46206-0901

OUT-OF-STATE LICENSED CIGARETTE DISTRIBUTOR’S

MONTHLY CIGARETTE TAX RETURN

For the period of ______________________, ______

Name of License Holder (as indicated on license)

Mailing Address

Cigarette Distributor’s License#

City or Town

County

State

Zip Code

Federal ID Number

STAMPED CIGARETTE STOCk ACCOUNT

1. Ending Inventory of Stamped Cigarettes (From attached Schedule CT-11) ......................... 1

2. Wholesale and/or Retail Sales (From attached Schedule CT-12G) ...................................... 2

3. Sales to Indiana Distributors (From attached Schedule CT-12F) ......................................... 3

4. Indiana Stamped Cigarettes Returned to Manufacturer (From attached Schedule CT-13) ..

4

5. Total (Add Lines 1-4) ...........................................................................................................

5

6. Purchases of Stamped Cigarettes (From attached Schedule CT-12C) .................................. 6

7. Indiana Stamped Cigarettes Returned to Warehouse (From attached Schedule CT-12H) .... 7

8. Beginning Inventory of Stamped Cigarettes ......................................................................... 8

9. Total (Add Lines 6-8) ...........................................................................................................

9

10. Number of Cigarettes Stamped During Period (Line 5 minus Line 9) ................................. 10

11. Tax on Stamped Cigarettes (Multiply Line 10 by curent tax rate) ....................................... 11

CIGARETTE TAX STAMP ACCOUNT

A

B

C

Full Roll

Partial Roll and Wides

25’s

Stamps $ Value

Stamps $ Value

Special Stamps $ Value

1. Beginning Inventory of Tax Stamps

2. Purchases of Tax Stamps (From

attached Schedule CT-11)

3. Total Inventory (Add Lines 1 and 2)

4. Ending Inventory of Tax Stamps

(From attached Schedule CT-11)

5. Total Stamps Used (Line 3 minus Line 4)

6. Total Cigarette Tax Stamps Used (Add Line

5 of columns A, B and D)

I hereby declare under penalties of perjury that the information contained in this return, including accompanying schedules and state-

ments, is true, correct and complete to the best of my knowledge and belief.

Signature of Taxpayer or Agent

Title

Telephone Number

Date

(

)

IMPORTANT: A RETURN MUST BE FILED EACH MONTH WITHIN 15 DAYS FOLLOWING THE LAST DAY OF THE

PERIOD BEING REPORTED.

Questions related to this form, please call (317) 615-2710

1

1 2

2