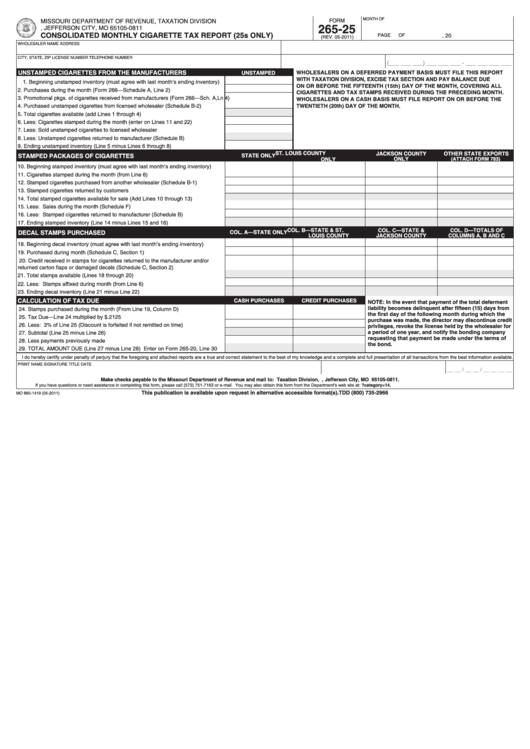

Reset 265-25

Print Form

MONTH OF

MISSOURI DEPARTMENT OF REVENUE, TAXATION DIVISION

FORM

265-25

P.O. BOX 811, JEFFERSON CITY, MO 65105-0811

CONSOLIDATED MONTHLY CIGARETTE TAX REPORT (25s ONLY)

, 20

PAGE

OF

(REV. 05-2011)

WHOLESALER NAME

ADDRESS

CITY, STATE, ZIP

LICENSE NUMBER

TELEPHONE NUMBER

(___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

UNSTAMPED CIGARETTES FROM THE MANUFACTURERS

UNSTAMPED

WHOLESALERS ON A DEFERRED PAYMENT BASIS MUST FILE THIS REPORT

WITH TAXATION DIVISION, EXCISE TAX SECTION AND PAY BALANCE DUE

1. Beginning unstamped inventory (must agree with last month’s ending inventory) ....

ON OR BEFORE THE FIFTEENTH (15th) DAY OF THE MONTH, COVERING ALL

2. Purchases during the month (Form 266—Schedule A, Line 2) ....................................

CIGARETTES AND TAX STAMPS RECEIVED DURING THE PRECEDING MONTH.

3. Promotional pkgs. of cigarettes received from manufacturers (Form 266—Sch. A,Ln 4) ....

WHOLESALERS ON A CASH BASIS MUST FILE REPORT ON OR BEFORE THE

4. Purchased unstamped cigarettes from licensed wholesaler (Schedule B-2) ..........

TWENTIETH (20th) DAY OF THE MONTH.

5. Total cigarettes available (add Lines 1 through 4) ..................................................

6. Less: Cigarettes stamped during the month (enter on Lines 11 and 22) ................

7. Less: Sold unstamped cigarettes to licensed wholesaler ........................................

8. Less: Unstamped cigarettes returned to manufacturer (Schedule B) .....................

9. Ending unstamped inventory (Line 5 minus Lines 6 through 8) ..............................

ST. LOUIS COUNTY

JACKSON COUNTY

OTHER STATE EXPORTS

STAMPED PACKAGES OF CIGARETTES

STATE ONLY

ONLY

ONLY

(ATTACH FORM 783)

10. Beginning stamped inventory (must agree with last month’s ending inventory) ......

11. Cigarettes stamped during the month (from Line 6) ................................................

12. Stamped cigarettes purchased from another wholesaler (Schedule B-1) ...............

13. Stamped cigarettes returned by customers .............................................................

14. Total stamped cigarettes available for sale (Add Lines 10 through 13) ..................

15. Less: Sales during the month (Schedule F) ...........................................................

16. Less: Stamped cigarettes returned to manufacturer (Schedule B) ........................

17. Ending stamped inventory (Line 14 minus Lines 15 and 16) ..................................

COL. B—STATE & ST.

COL. C—STATE &

COL. D—TOTALS OF

DECAL STAMPS PURCHASED

COL. A—STATE ONLY

LOUIS COUNTY

JACKSON COUNTY

COLUMNS A, B AND C

18. Beginning decal inventory (must agree with last month’s ending inventory) ...........

19. Purchased during month (Schedule C, Section 1) ..................................................

20. Credit received in stamps for cigarettes returned to the manufacturer and/or

returned carton flaps or damaged decals (Schedule C, Section 2) .........................

21. Total stamps available (Lines 18 through 20) .........................................................

22. Less: Stamps affixed during month (from Line 6) ...................................................

23. Ending decal inventory (Line 21 minus Line 22) .....................................................

CALCULATION OF TAX DUE

CASH PURCHASES

CREDIT PURCHASES

NOTE: In the event that payment of the total deferment

liability becomes delinquent after fifteen (15) days from

24. Stamps purchased during the month (From Line 19, Column D) ............................

the first day of the following month during which the

25. Tax Due—Line 24 multiplied by $.2125 ..................................................................

purchase was made, the director may discontinue credit

26. Less: 3% of Line 25 (Discount is forfeited if not remitted on time) .........................

privileges, revoke the license held by the wholesaler for

a period of one year, and notify the bonding company

27. Subtotal (Line 25 minus Line 26) .............................................................................

requesting that payment be made under the terms of

28. Less payments previously made .............................................................................

the bond.

29. TOTAL AMOUNT DUE (Line 27 minus Line 28) Enter on Form 265-20, Line 30 .....

I do hereby certify under penalty of perjury that the foregoing and attached reports are a true and correct statement to the best of my knowledge and a complete and full presentation of all transactions from the best information available.

PRINT NAME

SIGNATURE

TITLE

DATE

__ __ / __ __ / __ __ __ __

Make checks payable to the Missouri Department of Revenue and mail to: Taxation Division, P.O. Box 811, Jefferson City, MO 65105-0811.

If you have questions or need assistance in completing this form, please call (573) 751-7163 or e-mail excise@dor.mo.gov. You may also obtain this form from the Department’s web site at:

This publication is available upon request in alternative accessible format(s). TDD (800) 735-2966

MO 860-1419 (05-2011)

1

1 2

2