Declaration Of Estimated Tax Form - 2004

ADVERTISEMENT

IMPOSITION OF T

IMPOSITION OF T

AX FOR DECLARA

AX FOR DECLARA

TIONS

TIONS

IMPOSITION OF T

IMPOSITION OF T

IMPOSITION OF TAX FOR DECLARA

AX FOR DECLARA

AX FOR DECLARATIONS

TIONS

TIONS

THIS IS THE ONL

THIS IS THE ONL

Y TIME THESE VOUCHERS WILL BE SENT

Y TIME THESE VOUCHERS WILL BE SENT

THIS IS THE ONL

THIS IS THE ONL

THIS IS THE ONLY TIME THESE VOUCHERS WILL BE SENT

Y TIME THESE VOUCHERS WILL BE SENT

Y TIME THESE VOUCHERS WILL BE SENT

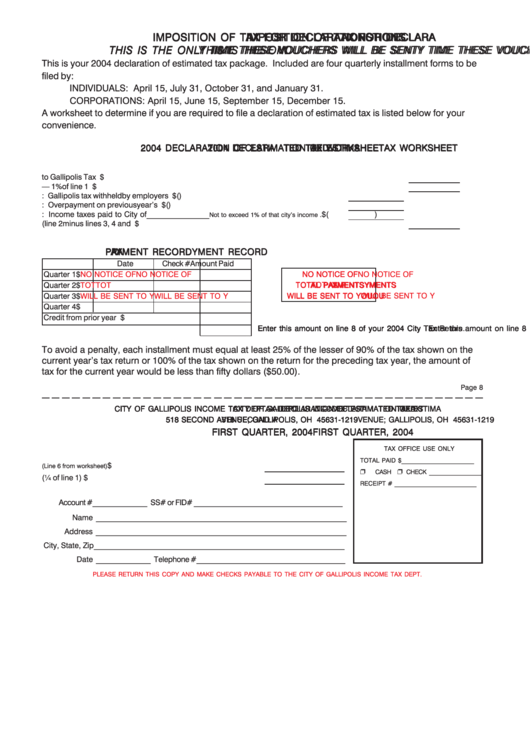

This is your 2004 declaration of estimated tax package. Included are four quarterly installment forms to be

filed by:

INDIVIDUALS: April 15, July 31, October 31, and January 31.

CORPORATIONS: April 15, June 15, September 15, December 15.

A worksheet to determine if you are required to file a declaration of estimated tax is listed below for your

convenience.

2004 DECLARA

2004 DECLARA

TION OF ESTIMA

TION OF ESTIMA

TED T

TED T

AX WORKSHEET

AX WORKSHEET

2004 DECLARA

2004 DECLARA

2004 DECLARATION OF ESTIMA

TION OF ESTIMA

TION OF ESTIMATED T

TED T

TED TAX WORKSHEET

AX WORKSHEET

AX WORKSHEET

1. Total income subject to Gallipolis Tax ............................................................................................................$

2. Gallipolis income tax — 1% of line 1 amount ................................................................................................$

3. Less: Gallipolis tax withheld by employers ...................................................................... $(

)

4. Less: Overpayment on previous year’s return ................................................................. $(

)

5. Less: Income taxes paid to City of________________

$(

)

Not to exceed 1% of that city’s income .

6. Net estimated tax due (line 2 minus lines 3, 4 and 5 .....................................................................................$

P P P P P A A A A A YMENT RECORD

YMENT RECORD

YMENT RECORD

YMENT RECORD

YMENT RECORD

Date

Check #

Amount Paid

Quarter 1

$

NO NOTICE OF

NO NOTICE OF

NO NOTICE OF

NO NOTICE OF

NO NOTICE OF

Quarter 2

$

TOT

TOT

TOT

TOT

TOTAL P

AL P

AL P

AL PA A A A A YMENTS

AL P

YMENTS

YMENTS

YMENTS

YMENTS

WILL BE SENT TO Y

WILL BE SENT TO Y

OU

OU

Quarter 3

$

WILL BE SENT TO Y

WILL BE SENT TO Y

WILL BE SENT TO YOU

OU

OU

Quarter 4

$

Credit from prior year ...................................... $

Enter this amount on line 8 of your 2004 City T

Enter this amount on line 8 of your 2004 City Tax Return.

Enter this amount on line 8 of your 2004 City T

ax Return.

ax Return.

ax Return.

Enter this amount on line 8 of your 2004 City T

Enter this amount on line 8 of your 2004 City T

ax Return.

To avoid a penalty, each installment must equal at least 25% of the lesser of 90% of the tax shown on the

current year’s tax return or 100% of the tax shown on the return for the preceding tax year, the amount of

tax for the current year would be less than fifty dollars ($50.00).

Page 8

CITY OF GALLIPOLIS INCOME T

CITY OF GALLIPOLIS INCOME T

CITY OF GALLIPOLIS INCOME T

CITY OF GALLIPOLIS INCOME T

CITY OF GALLIPOLIS INCOME TAX DEPT

AX DEPT

AX DEPT

AX DEPT

AX DEPT. — DECLARA

. — DECLARA

. — DECLARA

. — DECLARA

. — DECLARATION OF ESTIMA

TION OF ESTIMA

TION OF ESTIMA

TION OF ESTIMA

TION OF ESTIMATED T

TED T

TED T

TED T

TED TAX

AX

AX

AX

AX

518 SECOND A

518 SECOND A

518 SECOND AVENUE; GALLIPOLIS, OH 45631-1219

VENUE; GALLIPOLIS, OH 45631-1219

VENUE; GALLIPOLIS, OH 45631-1219

VENUE; GALLIPOLIS, OH 45631-1219

518 SECOND A

518 SECOND A

VENUE; GALLIPOLIS, OH 45631-1219

FIRST QUARTER, 2004

FIRST QUARTER, 2004

FIRST QUARTER, 2004

FIRST QUARTER, 2004

FIRST QUARTER, 2004

TAX OFFICE USE ONLY

TOTAL PAID $ _______________________

1. Total Estimated Tax

.................................... $

(Line 6 from worksheet)

❐

❐

CASH

CHECK _________________

2. Amount Enclosed (¼ of line 1) .................................................. $

RECEIPT # __________________________

Account # ______________ SS# or FID# ______________________________________

Name ________________________________________________________________

Address ________________________________________________________________

City, State, Zip ________________________________________________________________

Date ______________ Telephone # ______________________________________

PLEASE RETURN THIS COPY AND MAKE CHECKS PAYABLE TO THE CITY OF GALLIPOLIS INCOME TAX DEPT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2