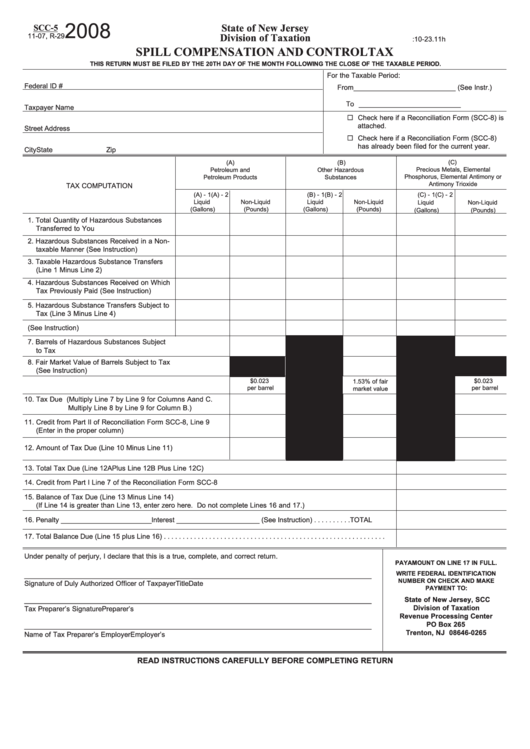

2008

State of New Jersey

SCC-5

11-07, R-29

Division of Taxation

N.J.S.A. 58:10-23.11h

SPILL COMPENSATION AND CONTROL TAX

THIS RETURN MUST BE FILED BY THE 20TH DAY OF THE MONTH FOLLOWING THE CLOSE OF THE TAXABLE PERIOD.

For the Taxable Period:

Federal ID #

From ___________________________ (See Instr.)

To ___________________________

Taxpayer Name

Check here if a Reconciliation Form (SCC-8) is

attached.

Street Address

Check here if a Reconciliation Form (SCC-8)

has already been filed for the current year.

City

State

Zip

(A)

(B)

(C)

Petroleum and

Other Hazardous

Precious Metals, Elemental

Phosphorus, Elemental Antimony or

Petroleum Products

Substances

Antimony Trioxide

TAX COMPUTATION

(A) - 1

(A) - 2

(B) - 1

(B) - 2

(C) - 1

(C) - 2

Liquid

Non-Liquid

Liquid

Non-Liquid

Liquid

Non-Liquid

(Gallons)

(Pounds)

(Gallons)

(Pounds)

(Gallons)

(Pounds)

1. Total Quantity of Hazardous Substances

Transferred to You

2. Hazardous Substances Received in a Non-

taxable Manner (See Instruction)

3. Taxable Hazardous Substance Transfers

(Line 1 Minus Line 2)

4. Hazardous Substances Received on Which

Tax Previously Paid (See Instruction)

5. Hazardous Substance Transfers Subject to

Tax (Line 3 Minus Line 4)

6. Conversion to Barrels (See Instruction)

7. Barrels of Hazardous Substances Subject

to Tax

8. Fair Market Value of Barrels Subject to Tax

(See Instruction)

$0.023

$0.023

1.53% of fair

9. Tax Rate

per barrel

per barrel

market value

10. Tax Due (Multiply Line 7 by Line 9 for Columns A and C.

Multiply Line 8 by Line 9 for Column B.)

11. Credit from Part II of Reconciliation Form SCC-8, Line 9

(Enter in the proper column)

12. Amount of Tax Due (Line 10 Minus Line 11)

13. Total Tax Due (Line 12A Plus Line 12B Plus Line 12C)

14. Credit from Part I Line 7 of the Reconciliation Form SCC-8

15. Balance of Tax Due (Line 13 Minus Line 14)

(If Line 14 is greater than Line 13, enter zero here. Do not complete Lines 16 and 17.)

16. Penalty ________________________

Interest ______________________ (See Instruction) . . . . . . . . . .TOTAL

17. Total Balance Due (Line 15 plus Line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Under penalty of perjury, I declare that this is a true, complete, and correct return.

PAY AMOUNT ON LINE 17 IN FULL.

WRITE FEDERAL IDENTIFICATION

____________________________________________________________________________________________

NUMBER ON CHECK AND MAKE

Signature of Duly Authorized Officer of Taxpayer

Title

Date

PAYMENT TO:

State of New Jersey, SCC

____________________________________________________________________________________________

Division of Taxation

Tax Preparer’s Signature

Preparer’s I.D. Number

Date

Revenue Processing Center

PO Box 265

____________________________________________________________________________________________

Trenton, NJ 08646-0265

Name of Tax Preparer’s Employer

Employer’s I.D. Number

Date

READ INSTRUCTIONS CAREFULLY BEFORE COMPLETING RETURN

1

1 2

2 3

3 4

4 5

5