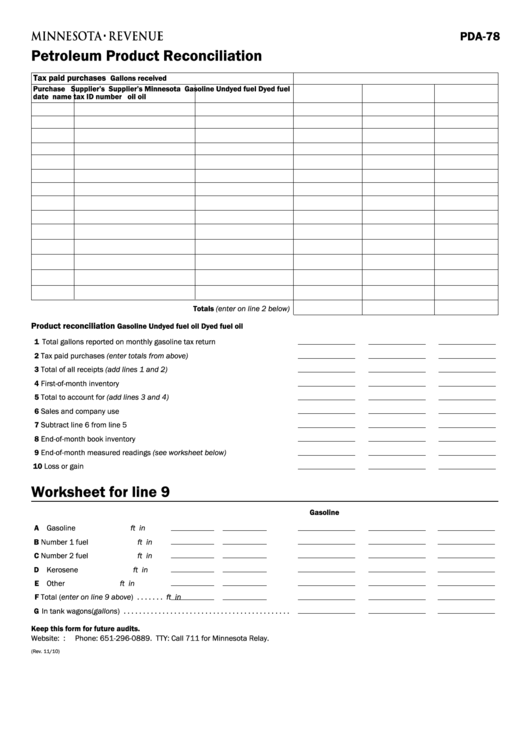

PDA-78

Petroleum Product Reconciliation

Tax paid purchases

Gallons received

Purchase

Supplier’s

Supplier’s Minnesota

Gasoline

Undyed fuel

Dyed fuel

date

name

tax ID number

oil

oil

Totals (enter on line 2 below)

Product reconciliation

Gasoline

Undyed fuel oil

Dyed fuel oil

1 Total gallons reported on monthly gasoline tax return . . . . . . . . . . . . . . . . . . .

2 Tax paid purchases (enter totals from above) . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Total of all receipts (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 First-of-month inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Total to account for (add lines 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Sales and company use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 End-of-month book inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 End-of-month measured readings (see worksheet below) . . . . . . . . . . . . . . . .

10 Loss or gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Worksheet for line 9

Gasoline

Undyed fuel oil

Dyed fuel oil

A Gasoline . . . . . . . . . . . . . . . . . . . . . . .

ft

in . . . . .

B Number 1 fuel . . . . . . . . . . . . . . . . . .

ft

in . . . . .

ft

in . . . . .

C Number 2 fuel . . . . . . . . . . . . . . . . . .

D Kerosene . . . . . . . . . . . . . . . . . . . . . . .

ft

in . . . . .

E Other . . . . . . . . . . . . . . . . . . . . . . . . . .

ft

in . . . . .

F Total (enter on line 9 above) . . . . . . .

ft

in . . . . .

G In tank wagons (gallons) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Keep this form for future audits.

Website: Email: Petroleum.Tax@state.mn.us. Phone: 651-296-0889. TTY: Call 711 for Minnesota Relay.

(Rev. 11/10)

1

1