Form Str-46-A - Application For Refund Of Sales Or Use Tax

ADVERTISEMENT

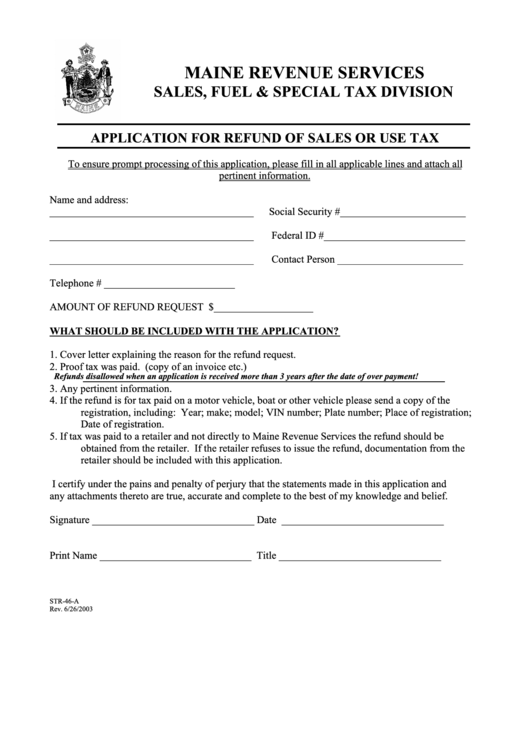

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

APPLICATION FOR REFUND OF SALES OR USE TAX

To ensure prompt processing of this application, please fill in all applicable lines and attach all

pertinent information.

Name and address:

_______________________________________

Social Security #________________________

_______________________________________

Federal ID #___________________________

_______________________________________

Contact Person ________________________

Telephone # _________________________

AMOUNT OF REFUND REQUEST $___________________

WHAT SHOULD BE INCLUDED WITH THE APPLICATION?

1.

Cover letter explaining the reason for the refund request.

2.

Proof tax was paid. (copy of an invoice etc.)

Refunds disallowed when an application is received more than 3 years after the date of over payment!

3.

Any pertinent information.

4.

If the refund is for tax paid on a motor vehicle, boat or other vehicle please send a copy of the

registration, including: Year; make; model; VIN number; Plate number; Place of registration;

Date of registration.

5.

If tax was paid to a retailer and not directly to Maine Revenue Services the refund should be

obtained from the retailer. If the retailer refuses to issue the refund, documentation from the

retailer should be included with this application.

I certify under the pains and penalty of perjury that the statements made in this application and

any attachments thereto are true, accurate and complete to the best of my knowledge and belief.

Signature _______________________________

Date _______________________________

Print Name _____________________________

Title _______________________________

STR-46-A

Rev. 6/26/2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1