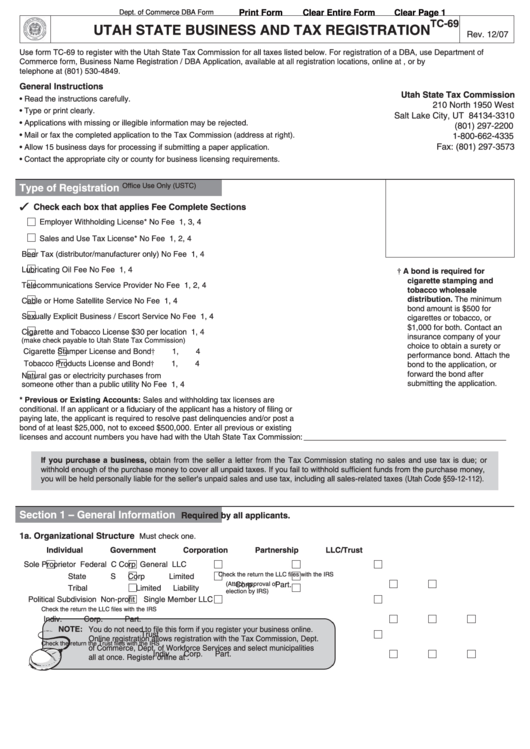

Dept. of Commerce DBA Form

Print Form

Clear Entire Form

Clear Page 1

TC-69

UTAH STATE BUSINESS AND TAX REGISTRATION

Rev. 12/07

Use form TC-69 to register with the Utah State Tax Commission for all taxes listed below. For registration of a DBA, use Department of

Commerce form, Business Name Registration / DBA Application, available at all registration locations, online at commerce.utah.gov, or by

telephone at (801) 530-4849.

General Instructions

Utah State Tax Commission

• Read the instructions carefully.

210 North 1950 West

• Type or print clearly.

Salt Lake City, UT 84134-3310

• Applications with missing or illegible information may be rejected.

(801) 297-2200

• Mail or fax the completed application to the Tax Commission (address at right).

1-800-662-4335

Fax: (801) 297-3573

• Allow 15 business days for processing if submitting a paper application.

• Contact the appropriate city or county for business licensing requirements.

Office Use Only (USTC)

Type of Registration

Check each box that applies

Fee

Complete Sections

Employer Withholding License*

No Fee

1, 3, 4

Sales and Use Tax License*

No Fee

1, 2, 4

Beer Tax (distributor/manufacturer only)

No Fee

1, 4

Lubricating Oil Fee

No Fee

1, 4

† A bond is required for

cigarette stamping and

Telecommunications Service Provider

No Fee

1, 2, 4

tobacco wholesale

distribution. The minimum

Cable or Home Satellite Service

No Fee

1, 4

bond amount is $500 for

Sexually Explicit Business / Escort Service

No Fee

1, 4

cigarettes or tobacco, or

$1,000 for both. Contact an

Cigarette and Tobacco License

$30 per location

1, 4

insurance company of your

(make check payable to Utah State Tax Commission)

choice to obtain a surety or

Cigarette Stamper

License and Bond†

1, 4

performance bond. Attach the

Tobacco Products

License and Bond†

1, 4

bond to the application, or

forward the bond after

Natural gas or electricity purchases from

submitting the application.

someone other than a public utility

No Fee

1, 4

* Previous or Existing Accounts: Sales and withholding tax licenses are

conditional. If an applicant or a fiduciary of the applicant has a history of filing or

paying late, the applicant is required to resolve past delinquencies and/or post a

bond of at least $25,000, not to exceed $500,000. Enter all previous or existing

licenses and account numbers you have had with the Utah State Tax Commission: ______________________________________________

If you purchase a business, obtain from the seller a letter from the Tax Commission stating no sales and use tax is due; or

withhold enough of the purchase money to cover all unpaid taxes. If you fail to withhold sufficient funds from the purchase money,

you will be held personally liable for the seller's unpaid sales and use tax, including all sales-related taxes (Utah Code §59-12-112).

Section 1 – General Information

Required by all applicants.

1a. Organizational Structure

Must check one.

Individual

Government

Corporation

Partnership

LLC/Trust

Sole Proprietor

Federal

C Corp

General

LLC

Check the return the LLC files with the IRS

State

S Corp

Limited

(Attach approval of

Corp.

Part.

Tribal

Limited Liability

election by IRS)

Political Subdivision

Non-profit

Single Member LLC

Check the return the LLC files with the IRS

Indiv.

Corp.

Part.

NOTE: You do not need to file this form if you register your business online.

Trust

Online registration allows registration with the Tax Commission, Dept.

Check the return the Trust files with the IRS

of Commerce, Dept. of Workforce Services and select municipalities

Indiv.

Corp.

Part.

all at once. Register online at business.utah.gov/registration.

1

1 2

2 3

3 4

4