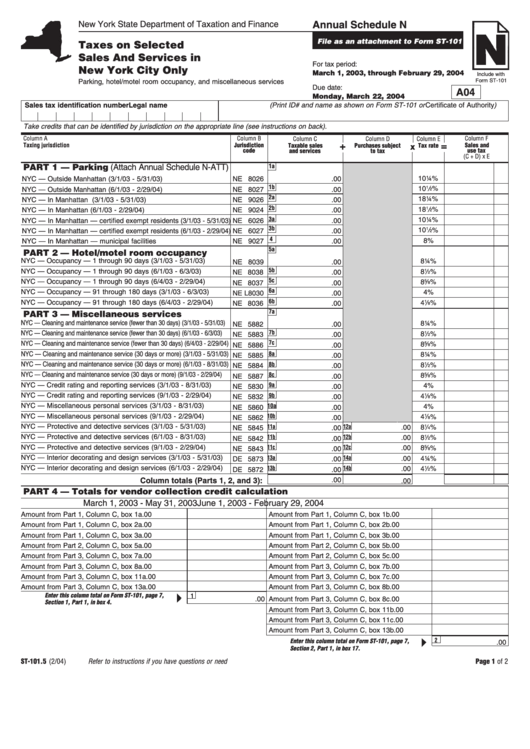

Form St-101.5 - Annual Schedule N - Taxes On Selected Sales And Services In New York City Only - New York State Department Of Taxation And Finance

ADVERTISEMENT

New York State Department of Taxation and Finance

Annual Schedule N

File as an attachment to Form ST-101

Taxes on Selected

Sales And Services in

For tax period:

New York City Only

March 1, 2003, through February 29, 2004

Include with

Form ST-101

Parking, hotel/motel room occupancy, and miscellaneous services

Due date:

A04

Monday, March 22, 2004

Legal name (Print ID# and name as shown on Form ST-101 or Certificate of Authority )

Sales tax identification number

Take credits that can be identified by jurisdiction on the appropriate line (see instructions on back).

Column A

Column B

Column F

Column C

Column D

Column E

Taxing jurisdiction

Jurisdiction

+

=

Sales and

Taxable sales

Purchases subject

Tax rate

X

code

and services

to tax

use tax

(C + D) x E

PART 1 — Parking (Attach Annual Schedule N-ATT )

1a

10¼%

NYC — Outside Manhattan (3/1/03 - 5/31/03)

NE 8026

.00

1b

10

1

/

%

NYC — Outside Manhattan (6/1/03 - 2/29/04)

NE 8027

.00

2

2a

18¼%

NYC — In Manhattan (3/1/03 - 5/31/03)

NE 9026

.00

2b

1

/

18

%

NYC — In Manhattan (6/1/03 - 2/29/04)

NE 9024

.00

2

3a

10¼%

NYC — In Manhattan — certified exempt residents (3/1/03 - 5/31/03)

NE 6026

.00

3b

10

1

/

%

NYC — In Manhattan — certified exempt residents (6/1/03 - 2/29/04)

NE 6027

.00

2

4

8%

NYC — In Manhattan — municipal facilities

NE 9027

.00

5a

PART 2 — Hotel/motel room occupancy

NYC — Occupancy — 1 through 90 days (3/1/03 - 5/31/03)

8¼%

NE 8039

.00

5b

NYC — Occupancy — 1 through 90 days (6/1/03 - 6/3/03)

1

/

8

%

NE 8038

.00

2

5c

NYC — Occupancy — 1 through 90 days (6/4/03 - 2/29/04)

8

5

/

%

NE 8037

.00

8

6a

NYC — Occupancy — 91 through 180 days (3/1/03 - 6/3/03)

4%

NE L8030

.00

6b

NYC — Occupancy — 91 through 180 days (6/4/03 - 2/29/04)

4

1

/

%

NE 8036

.00

8

7a

PART 3 — Miscellaneous services

NYC — Cleaning and maintenance service (fewer than 30 days) (3/1/03 - 5/31/03)

8¼%

NE 5882

.00

7b

NYC — Cleaning and maintenance service (fewer than 30 days) (6/1/03 - 6/3/03)

8

1

/

%

NE 5883

.00

2

7c

NYC — Cleaning and maintenance service (fewer than 30 days) (6/4/03 - 2/29/04)

8

5

/

%

NE 5886

.00

8

NYC — Cleaning and maintenance service (30 days or more) (3/1/03 - 5/31/03)

8a

8¼%

NE 5885

.00

NYC — Cleaning and maintenance service (30 days or more) (6/1/03 - 8/31/03)

8b

1

8

/

%

NE 5884

.00

2

NYC — Cleaning and maintenance service (30 days or more) (9/1/03 - 2/29/04)

8c

5

8

/

%

NE 5887

.00

8

NYC — Credit rating and reporting services (3/1/03 - 8/31/03)

9a

4%

NE 5830

.00

NYC — Credit rating and reporting services (9/1/03 - 2/29/04)

9b

4

1

/

%

NE 5832

.00

8

NYC — Miscellaneous personal services (3/1/03 - 8/31/03)

10a

4%

NE 5860

.00

NYC — Miscellaneous personal services (9/1/03 - 2/29/04)

10b

4

1

/

%

NE 5862

.00

8

NYC — Protective and detective services (3/1/03 - 5/31/03)

11a

12a

1

.00

8

/

%

NE 5845

.00

4

NYC — Protective and detective services (6/1/03 - 8/31/03)

11b

12b

1

/

.00

8

%

NE 5842

.00

2

NYC — Protective and detective services (9/1/03 - 2/29/04)

11c

12c

.00

8

5

/

%

NE 5843

.00

8

NYC — Interior decorating and design services (3/1/03 - 5/31/03)

13a

14a

.00

4¼%

DE 5873

.00

NYC — Interior decorating and design services (6/1/03 - 2/29/04)

13b

14b

.00

4

1

/

%

DE 5872

.00

2

.00

Column totals (Parts 1, 2, and 3):

.00

PART 4 — Totals for vendor collection credit calculation

March 1, 2003 - May 31, 2003

June 1, 2003 - February 29, 2004

Amount from Part 1, Column C, box 1a

.00

Amount from Part 1, Column C, box 1b

.00

Amount from Part 1, Column C, box 2a

.00

Amount from Part 1, Column C, box 2b

.00

Amount from Part 1, Column C, box 3a

.00

Amount from Part 1, Column C, box 3b

.00

Amount from Part 2, Column C, box 5a

.00

Amount from Part 2, Column C, box 5b

.00

Amount from Part 3, Column C, box 7a

.00

Amount from Part 2, Column C, box 5c

.00

Amount from Part 3, Column C, box 8a

.00

Amount from Part 3, Column C, box 7b

.00

Amount from Part 3, Column C, box 11a

.00

Amount from Part 3, Column C, box 7c

.00

Amount from Part 3, Column C, box 13a

.00

Amount from Part 3, Column C, box 8b

.00

Enter this column total on Form ST-101, page 7,

1

.00

Amount from Part 3, Column C, box 8c

.00

Section 1, Part 1, in box 4.

Amount from Part 3, Column C, box 11b

.00

Amount from Part 3, Column C, box 11c

.00

Amount from Part 3, Column C, box 13b

.00

2

Enter this column total on Form ST-101, page 7,

.00

Section 2, Part 1, in box 17.

ST-101.5 (2/04)

Refer to instructions if you have questions or need help.

Please be sure to keep a completed copy for your records.

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1