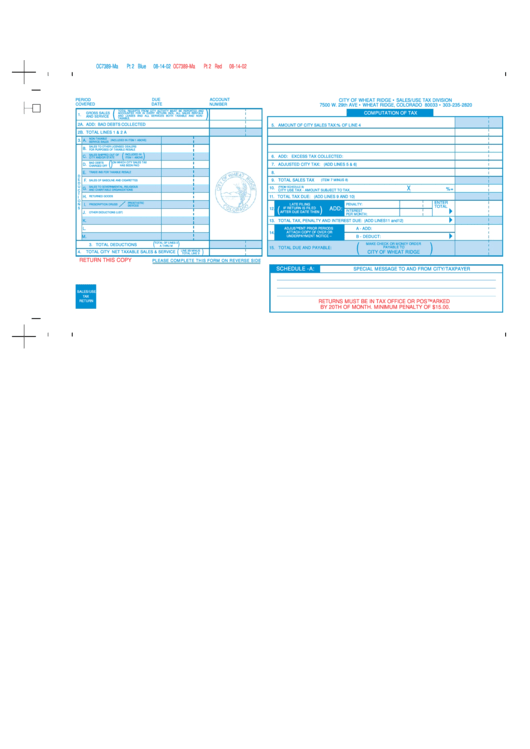

Form Oc7389-Ma - Computation Of Tax - Wheat Ridge - Colorado

ADVERTISEMENT

OC7389-Ma

Pt 2 Blue

08-14-02

OC7389-Ma

Pt 2 Red

08-14-02

PERIOD

DUE

ACCOUNT

CITY OF WHEAT RIDGE • SALES/USE TAX DIVISION

COVERED

DATE

NUMBER

7500 W. 29th AVE • WHEAT RIDGE, COLORADO 80033 • 303-235-2820

(

)

TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE REPORTED AND

COMPUTATION OF TAX

GROSS SALES

ACCOUNTED FOR IN EVERY RETURN INCL. ALL SALES RENTALS

1.

AND LEASES AND ALL SERVICES BOTH TAXABLE AND NON–

AND SERVICE

TAXABLE.

2A.

ADD: BAD DEBTS COLLECTED

15.MAMOUNT OF CITY SALES TAX:

% OF LINE 4

2B.

TOTAL LINES 1 & 2 A

NON-TAXABLE

3. A.

(INCLUDED IN ITEM 1 ABOVE)

SERVICE SALES

SALES TO OTHER LICENSED DEALERS

B.

FOR PURPOSES OF TAXABLE RESALE

(

)

SALES SHIPPED OUT OF

INCLUDED IN

C.

16.MADD:MEXCESS TAX COLLECTED:

ITEM 1 ABOVE

CITY AND/OR STATE

(MMMM..M)

BAD DEBTS

ON WHICH CITY SALES TAX

D.

17.MADJUSTED CITY TAX:M(ADD LINES 5 & 6)

HAS BEEN PAID

CHARGED OFF

E.

18.

TRADE-INS FOR TAXABLE RESALE

D

E

F.

19.MTOTAL SALES TAX

(ITEM 7 MINUS 8)

SALES OF GASOLINE AND CIGARETTES

D

U

SALES TO GOVERNMENTAL, RELIGIOUS

(FROM SCHEDULE B)

X

10.M

G.

%=

C

AND CHARITABLE ORGANIZATIONS

CITY USE TAX - AMOUNT SUBJECT TO TAX_______________________________________

M10.

T

H.

11.MTOTAL TAX DUE:M(ADD LINES 9 AND 10)

RETURNED GOODS

I

O

ENTER

PROSTHETIC

I.

LATE FILING

N

PRESCRIPTION DRUGS

PENALTY:

DEVICES

TOTAL

(

)

S

ADD:

12.

IF RETURN IS FILED

INTEREST

J.

AFTER DUE DATE THEN

OTHER DEDUCTIONS (LIST)

PER MONTH:

K.

13.MTOTAL TAX, PENALTY AND INTEREST DUE: (ADD LINES 11 and 12)

L.

ADJUSTMENT PRIOR PERIODS

A - ADD:

ATTACH COPY OF OVER OR

14.

M.

UNDERPAYMENT NOTICE –

B - DEDUCT:

(

)

TOTAL OF LINES 3

(MMMNM.M)

MAKE CHECK OR MONEY ORDER

3.MTOTAL DEDUCTIONS

A THRU M

15. TOTAL DUE AND PAYABLE:

PAYABLE TO

(

)

LINE 2B MINUS

4.

TOTAL CITY NET TAXABLE SALES & SERVICE

CITY OF WHEAT RIDGE

TOTAL LINE 3

RETURN THIS COPY

PLEASE COMPLETE THIS FORM ON REVERSE SIDE

SCHEDULE -A:

SPECIAL MESSAGE TO AND FROM CITY/TAXPAYER

SALES/USE

TAX

RETURNS MUST BE IN TAX OFFICE OR POSTMARKED

RETURN

RETURNS MUST BE IN TAX OFFICE OR POSTMARKED

BY 20TH OF MONTH. MINIMUM PENALTY OF $15.00

BY 20TH OF MONTH. MINIMUM PENALTY OF $15.00.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3