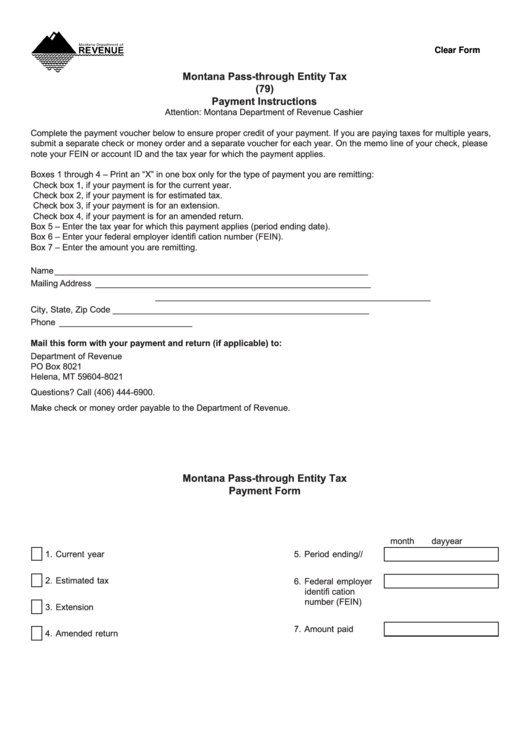

Clear Form

Montana Pass-through Entity Tax

(79)

Payment Instructions

Attention: Montana Department of Revenue Cashier

Complete the payment voucher below to ensure proper credit of your payment. If you are paying taxes for multiple years,

submit a separate check or money order and a separate voucher for each year. On the memo line of your check, please

note your FEIN or account ID and the tax year for which the payment applies.

Boxes 1 through 4 – Print an “X” in one box only for the type of payment you are remitting:

Check box 1, if your payment is for the current year.

Check box 2, if your payment is for estimated tax.

Check box 3, if your payment is for an extension.

Check box 4, if your payment is for an amended return.

Box 5 –

Enter the tax year for which this payment applies (period ending date).

Box 6 –

Enter your federal employer identifi cation number (FEIN).

Box 7 –

Enter the amount you are remitting.

Name __________________________________________________________________

Mailing Address __________________________________________________________

__________________________________________________________

City, State, Zip Code ______________________________________________________

Phone ____________________________

Mail this form with your payment and return (if applicable) to:

Department of Revenue

PO Box 8021

Helena, MT 59604-8021

Questions? Call (406) 444-6900.

Make check or money order payable to the Department of Revenue.

Montana Pass-through Entity Tax

Payment Form

month

day

year

1. Current year

5. Period ending

/

/

2. Estimated tax

6. Federal employer

identifi cation

number (FEIN)

3. Extension

7. Amount paid

4. Amended return

1

1