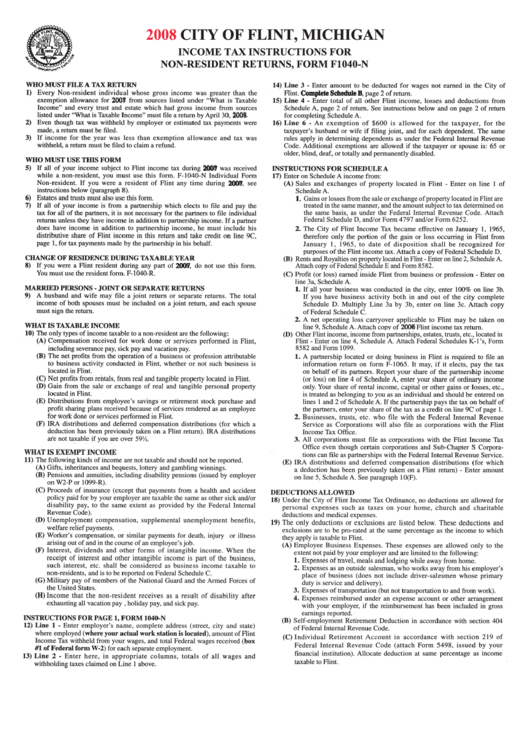

Instructions For Form F1040-N - City Of Flint, Michigan

ADVERTISEMENT

2008

CITY OF FLINT, MICHIGAN

INCOME TAX INSTRUCTIONS FOR

NON-RESIDENT RETURNS, FORM F1040-N

2007

2007

2007

Complete Schedule B

Complete Schedule B

Complete Schedule B

2008

2008

2008

2007

2007

Complete Schedule B

2008

Complete Schedule B

2009.

2008

2008

2007

2007

2007

2008

2007

2007

2007

2007

2007

2008,

2007

2007

Gains or losses from the sale or exchange of property located in Flint are

treated in the same manner, and the amount subject to tax determined on

the same basis, as under the Federal Internal Revenue Code. Attach

Federal Schedule D, and/or Form 4797 and/or Form 6252.

2007

2007

Rents and Royalties on property located in Flint - Enter on line 2, Schedule A.

2007

2008,

Attach copy of Federal Schedule E and Form 8582.

2007

2007

2007

2006

2006

2006

Other Flint income, income from partnerships, estates, trusts, etc., located in

2006

Flint - Enter on line 4, Schedule A. Attach Federal Schedules K-1’s, Form

2006

8582 and Form 1099.

59½.

(into this taxing area only,

(into this taxing area only,

Complete Schedule B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2