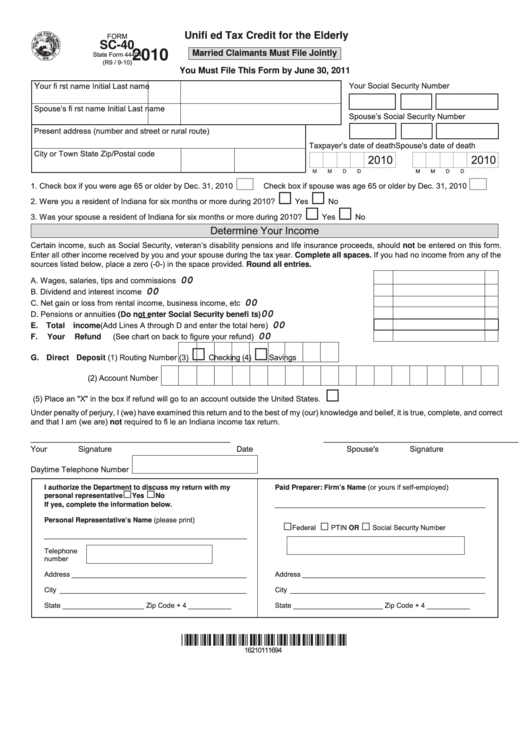

Unifi ed Tax Credit for the Elderly

FORM

SC-40

2010

Married Claimants Must File Jointly

State Form 44404

(R9 / 9-10)

You Must File This Form by June 30, 2011

Y

Your Social Security Number

our fi rst name

Initial

Last name

Spouse’s fi rst name

Initial

Last name

Spouse’s Social Security Number

Present address (number and street or rural route)

Taxpayer’s date of death

Spouse's date of death

City or Town

State

Zip/Postal code

2010

2010

M

M

D

D

M

M

D

D

□

□

1. Check box if you were age 65 or older by Dec. 31, 2010

Check box if spouse was age 65 or older by Dec. 31, 2010

□

□

2. Were you a resident of Indiana for six months or more during 2010?

Yes

No

3. Was your spouse a resident of Indiana for six months or more during 2010?

Yes

No

Determine Your Income

Certain income, such as Social Security, veteran’s disability pensions and life insurance proceeds, should not be entered on this form.

Enter all other income received by you and your spouse during the tax year. Complete all spaces. If you had no income from any of the

sources listed below, place a zero (-0-) in the space provided. Round all entries.

A.

Wages, salaries, tips and commissions ....................................................................................

A

00

B.

Dividend and interest income ....................................................................................................

B

00

C. Net gain or loss from rental income, business income, etc .......................................................

C

00

D. Pensions or annuities (Do not enter Social Security benefi ts) ..............................................

D

00

Total income (Add Lines A through D and enter the total here) ...............................................

E

00

E.

Your Refund (See chart on back to fi gure your refund) ..........................................................

F

00

F.

□

□

G. Direct Deposit (1) Routing Number

(3)

Checking (4)

Savings

(2) Account Number

□

(5) Place an "X" in the box if refund will go to an account outside the United States.

Under penalty of perjury, I (we) have examined this return and to the best of my (our) knowledge and belief, it is true, complete, and correct

and that I am (we are) not required to fi le an Indiana income tax return.

__________________________________________

_________________________________________

Your Signature

Date

Spouse's Signature

Date

Daytime Telephone Number

Paid Preparer: Firm’s Name (or yours if self-employed)

□

□

I authorize the Department to discuss my return with my

personal representative

Yes

No

______________________________________________________

If yes, complete the information below.

Personal Representative’s Name (please print)

□

□

□

Federal I.D. Number

PTIN OR

Social Security Number

____________________________________________________

Telephone

number

Address _____________________________________________

Address _______________________________________________

City ________________________________________________

City __________________________________________________

State _____________________

Zip Code + 4 ___________

State _______________________

Zip Code + 4 ___________

16210111694

1

1