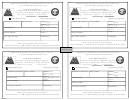

2009

2009

Estimated Multnomah County Business Income Tax

Estimated Multnomah County Business Income Tax

City of Portland Business License Tax

City of Portland Business License Tax

Form Q-2009 Quarter 1

Form Q-2009 Quarter 3

Calendar Year payment due April 15, 2009

Calendar Year payment due September 15, 2009

th

th

th

th

Fiscal Year - Payment due 15

day of 4

month

Fiscal Year - Payment due 15

day of 9

month

Fiscal Year

/2009 to

Fiscal Year

/2009 to

¨

Mailing Address Change

Apply Amount by Program

Mailing Address Change

Apply Amount by Program

Account #

Federal Employer ID/SS #

Account #

Federal Employer ID/SS #

$0.00

MCBIT

MCBIT

$0.00

$0.00

$0.00

PBL

PBL

Business Name

Business Name

Check (Payment) Total:

Check (Payment) Total:

$0.00

$0.00

Mailing Address

Check #

Mailing Address

Check #

City, State, Zip Code

Telephone #

City, State, Zip Code

Telephone #

Make check payable to: City of Portland

Make check payable to: City of Portland

Revenue Bureau, 111 SW Columbia, Suite 600 , Portland OR 97201-5840

Revenue Bureau, 111 SW Columbia, Suite 600, Portland OR 97201-5840

Reset Form

Revised 12/8/2008

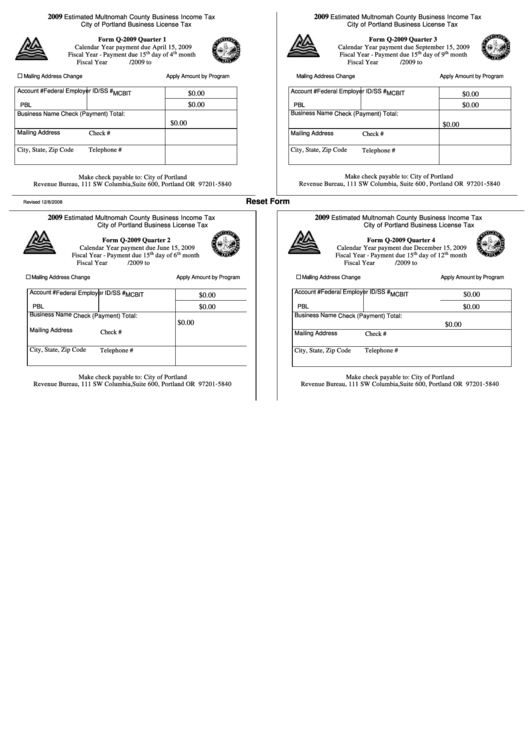

2009

2009

Estimated Multnomah County Business Income Tax

Estimated Multnomah County Business Income Tax

City of Portland Business License Tax

City of Portland Business License Tax

Form Q-2009 Quarter 2

Form Q-2009 Quarter 4

Calendar Year payment due June 15, 2009

Calendar Year payment due December 15, 2009

th

th

th

th

Fiscal Year - Payment due 15

day of 6

month

Fiscal Year - Payment due 15

day of 12

month

Fiscal Year

/2009 to

Fiscal Year

/2009 to

¨

¨

Mailing Address Change

Apply Amount by Program

Mailing Address Change

Apply Amount by Program

Account #

Account #

Federal Employer ID/SS #

Federal Employer ID/SS #

$0.00

MCBIT

$0.00

MCBIT

PBL

$0.00

PBL

$0.00

Business Name

Business Name

Check (Payment) Total:

Check (Payment) Total:

$0.00

$0.00

Mailing Address

Check #

Mailing Address

Check #

City, State, Zip Code

Telephone #

City, State, Zip Code

Telephone #

Make check payable to: City of Portland

Make check payable to: City of Portland

Revenue Bureau, 111 SW Columbia, Suite 600, Portland OR 97201-5840

Revenue Bureau, 111 SW Columbia, Suite 600, Portland OR 97201-5840

1

1