Instructions For The Tc-61 Return And Schedules

ADVERTISEMENT

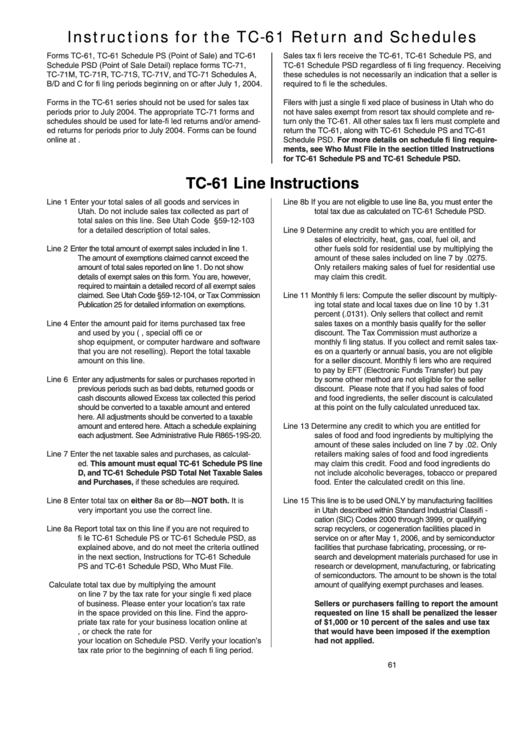

Instructions for the TC-61 Return and Schedules

Forms TC-61, TC-61 Schedule PS (Point of Sale) and TC-61

Sales tax fi lers receive the TC-61, TC-61 Schedule PS, and

Schedule PSD (Point of Sale Detail) replace forms TC-71,

TC-61 Schedule PSD regardless of fi ling frequency. Receiving

TC-71M, TC-71R, TC-71S, TC-71V, and TC-71 Schedules A,

these schedules is not necessarily an indication that a seller is

B/D and C for fi ling periods beginning on or after July 1, 2004.

required to fi le the schedules.

Forms in the TC-61 series should not be used for sales tax

Filers with just a single fi xed place of business in Utah who do

periods prior to July 2004. The appropriate TC-71 forms and

not have sales exempt from resort tax should complete and re-

schedules should be used for late-fi led returns and/or amend-

turn only the TC-61. All other sales tax fi lers must complete and

ed returns for periods prior to July 2004. Forms can be found

return the TC-61, along with TC-61 Schedule PS and TC-61

online at tax.utah.gov/forms.

Schedule PSD. For more details on schedule fi ling require-

ments, see Who Must File in the section titled Instructions

for TC-61 Schedule PS and TC-61 Schedule PSD.

TC-61 Line Instructions

Line 1

Enter your total sales of all goods and services in

Line 8b If you are not eligible to use line 8a, you must enter the

Utah. Do not include sales tax collected as part of

total tax due as calculated on TC-61 Schedule PSD.

total sales on this line. See Utah Code §59-12-103

for a detailed description of total sales.

Line 9

Determine any credit to which you are entitled for

sales of electricity, heat, gas, coal, fuel oil, and

Line 2

Enter the total amount of exempt sales included in line 1.

other fuels sold for residential use by multiplying the

The amount of exemptions claimed cannot exceed the

amount of these sales included on line 7 by .0275.

amount of total sales reported on line 1. Do not show

Only retailers making sales of fuel for residential use

details of exempt sales on this form. You are, however,

may claim this credit.

required to maintain a detailed record of all exempt sales

claimed. See Utah Code §59-12-104, or Tax Commission

Line 11 Monthly fi lers: Compute the seller discount by multiply-

Publication 25 for detailed information on exemptions.

ing total state and local taxes due on line 10 by 1.31

percent (.0131). Only sellers that collect and remit

Line 4

Enter the amount paid for items purchased tax free

sales taxes on a monthly basis qualify for the seller

and used by you (e.g. offi ce supplies, special offi ce or

discount. The Tax Commission must authorize a

shop equipment, or computer hardware and software

monthly fi ling status. If you collect and remit sales tax-

that you are not reselling). Report the total taxable

es on a quarterly or annual basis, you are not eligible

amount on this line.

for a seller discount. Monthly fi lers who are required

to pay by EFT (Electronic Funds Transfer) but pay

Line 6

Enter any adjustments for sales or purchases reported in

by some other method are not eligible for the seller

previous periods such as bad debts, returned goods or

discount. Please note that if you had sales of food

cash discounts allowed Excess tax collected this period

and food ingredients, the seller discount is calculated

should be converted to a taxable amount and entered

at this point on the fully calculated unreduced tax.

here. All adjustments should be converted to a taxable

amount and entered here. Attach a schedule explaining

Line 13 Determine any credit to which you are entitled for

each adjustment. See Administrative Rule R865-19S-20.

sales of food and food ingredients by multiplying the

amount of these sales included on line 7 by .02. Only

Line 7

Enter the net taxable sales and purchases, as calculat-

retailers making sales of food and food ingredients

ed. This amount must equal TC-61 Schedule PS line

may claim this credit. Food and food ingredients do

D, and TC-61 Schedule PSD Total Net Taxable Sales

not include alcoholic beverages, tobacco or prepared

and Purchases, if these schedules are required.

food. Enter the calculated credit on this line.

Line 8

Enter total tax on either 8a or 8b—NOT both. It is

Line 15 This line is to be used ONLY by manufacturing facilities

very important you use the correct line.

in Utah described within Standard Industrial Classifi -

cation (SIC) Codes 2000 through 3999, or qualifying

Line 8a Report total tax on this line if you are not required to

scrap recyclers, or cogeneration facilities placed in

fi le TC-61 Schedule PS or TC-61 Schedule PSD, as

service on or after May 1, 2006, and by semiconductor

explained above, and do not meet the criteria outlined

facilities that purchase fabricating, processing, or re-

in the next section, Instructions for TC-61 Schedule

search and development materials purchased for use in

PS and TC-61 Schedule PSD, Who Must File.

research or development, manufacturing, or fabricating

of semiconductors. The amount to be shown is the total

Calculate total tax due by multiplying the amount

amount of qualifying exempt purchases and leases.

on line 7 by the tax rate for your single fi xed place

of business. Please enter your location’s tax rate

Sellers or purchasers failing to report the amount

in the space provided on this line. Find the appro-

requested on line 15 shall be penalized the lesser

priate tax rate for your business location online at

of $1,000 or 10 percent of the sales and use tax

tax.utah.gov/sales/rates.html, or check the rate for

that would have been imposed if the exemption

your location on Schedule PSD. Verify your location’s

had not applied.

tax rate prior to the beginning of each fi ling period.

61 Instructions.indd

Rev. 3/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3