Form Pte-1 - Income Taxable To Owners - 2008

ADVERTISEMENT

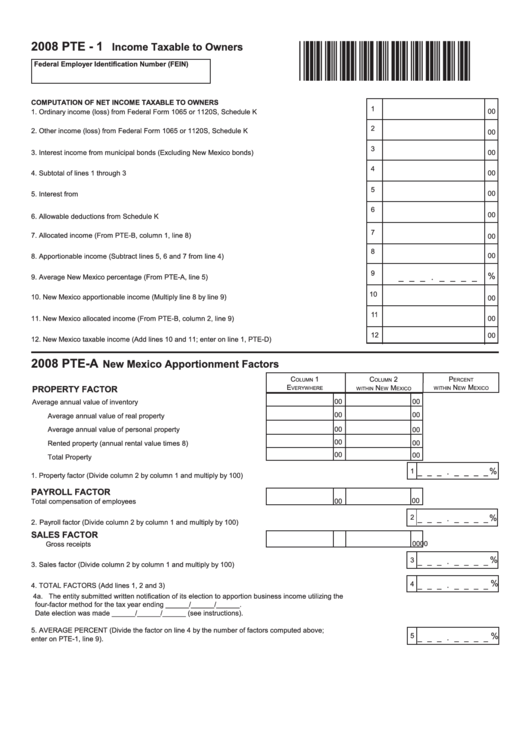

2008 PTE - 1

Income Taxable to Owners

*87190100*

Federal Employer Identification Number (FEIN)

COMPUTATION OF NET INCOME TAXABLE TO OWNERS

1

00

1.

Ordinary income (loss) from Federal Form 1065 or 1120S, Schedule K .....................................................

2

2.

Other income (loss) from Federal Form 1065 or 1120S, Schedule K .........................................................

00

3

3.

Interest income from municipal bonds (Excluding New Mexico bonds) ......................................................

00

4

4.

Subtotal of lines 1 through 3 ........................................................................................................................

00

5

00

5.

Interest from U.S. government obligations or federally taxed New Mexico bonds ......................................

6

00

6.

Allowable deductions from Schedule K .......................................................................................................

7

7.

Allocated income (From PTE-B, column 1, line 8) ......................................................................................

00

8

00

8.

Apportionable income (Subtract lines 5, 6 and 7 from line 4) ......................................................................

9

%

_ _ _ . _ _ _ _

9.

Average New Mexico percentage (From PTE-A, line 5) .............................................................................

10

10. New Mexico apportionable income (Multiply line 8 by line 9) ......................................................................

00

11

11. New Mexico allocated income (From PTE-B, column 2, line 9) ..................................................................

00

12

00

12. New Mexico taxable income (Add lines 10 and 11; enter on line 1, PTE-D) ...............................................

2008 PTE-A

New Mexico Apportionment Factors

C

1

P

C

2

olumn

erCent

olumn

e

n

m

n

m

PROPERTY FACTOR

verywhere

within

ew

exiCo

within

ew

exiCo

Average annual value of inventory .........................................................

00

00

00

00

Average annual value of real property ...................................................

00

Average annual value of personal property ............................................

00

00

00

Rented property (annual rental value times 8) .......................................

00

00

Total Property ........................................................................................

_ _ _ . _ _ _ _

%

1

1.

Property factor (Divide column 2 by column 1 and multiply by 100) ...............................................................................

PAYROLL FACTOR

00

Total compensation of employees ...........................................................

00

_ _ _ . _ _ _ _

%

2

.

..........................................................................

2

Payroll factor (Divide column 2 by column 1 and multiply by 100)

SALES FACTOR

00

00

Gross receipts .........................................................................................

%

_ _ _ . _ _ _ _

3

............................................................................

3.

Sales factor (Divide column 2 by column 1 and multiply by 100)

%

_ _ _ . _ _ _ _

4

4.

TOTAL FACTORS (Add lines 1, 2 and 3) ..........................................................................................................................

4a. The entity submitted written notification of its election to apportion business income utilizing the

four-factor method for the tax year ending ______/______/______.

Date election was made ______/______/______ (see instructions).

5.

AVERAGE PERCENT (Divide the factor on line 4 by the number of factors computed above;

%

_ _ _ . _ _ _ _

5

enter on PTE-1, line 9). ....................................................................................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2