Form Dtf-820 - Certificate Of Nonresidency Of New York State And/or Local Taxing Jurisdiction - 2001

ADVERTISEMENT

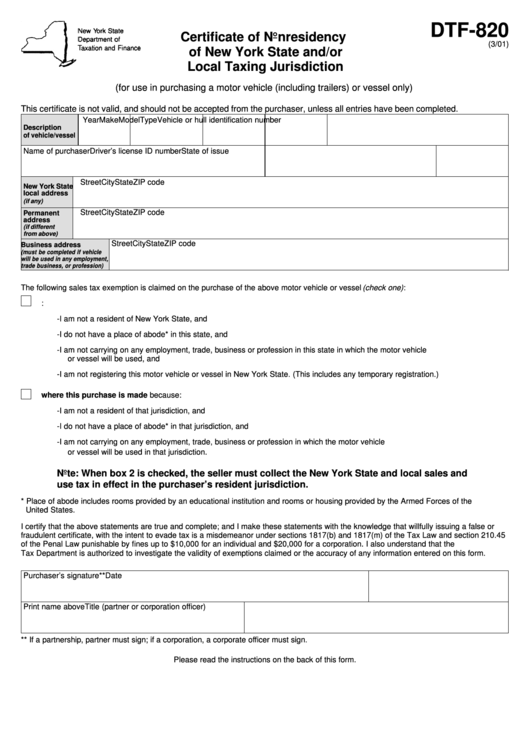

DTF-820

Certificate of Nonresidency

(3/01)

of New York State and/or

Local Taxing Jurisdiction

(for use in purchasing a motor vehicle (including trailers) or vessel only)

This certificate is not valid, and should not be accepted from the purchaser, unless all entries have been completed.

Year

Make

Model

Type

Vehicle or hull identification number

Description

of vehicle/vessel

Name of purchaser

Driver’s license ID number

State of issue

Street

City

State

ZIP code

New York State

local address

(if any)

Street

City

State

ZIP code

Permanent

address

(if different

from above)

Street

City

State

ZIP code

Business address

(must be completed if vehicle

will be used in any employment,

trade business, or profession)

The following sales tax exemption is claimed on the purchase of the above motor vehicle or vessel (check one) :

1.

This purchase is exempt from both the New York State and any local sales tax because:

- I am not a resident of New York State, and

- I do not have a place of abode* in this state, and

- I am not carrying on any employment, trade, business or profession in this state in which the motor vehicle

or vessel will be used, and

- I am not registering this motor vehicle or vessel in New York State. (This includes any temporary registration.)

2.

This purchase is exempt from the local sales tax imposed by the jurisdiction where this purchase is made because:

- I am not a resident of that jurisdiction, and

- I do not have a place of abode* in that jurisdiction, and

- I am not carrying on any employment, trade, business or profession in which the motor vehicle

or vessel will be used in that jurisdiction.

Note: When box 2 is checked, the seller must collect the New York State and local sales and

use tax in effect in the purchaser’s resident jurisdiction.

* Place of abode includes rooms provided by an educational institution and rooms or housing provided by the Armed Forces of the

United States.

I certify that the above statements are true and complete; and I make these statements with the knowledge that willfully issuing a false or

fraudulent certificate, with the intent to evade tax is a misdemeanor under sections 1817(b) and 1817(m) of the Tax Law and section 210.45

of the Penal Law punishable by fines up to $10,000 for an individual and $20,000 for a corporation. I also understand that the

Tax Department is authorized to investigate the validity of exemptions claimed or the accuracy of any information entered on this form.

Purchaser’s signature**

Date

Print name above

Title (partner or corporation officer)

** If a partnership, partner must sign; if a corporation, a corporate officer must sign.

Please read the instructions on the back of this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2