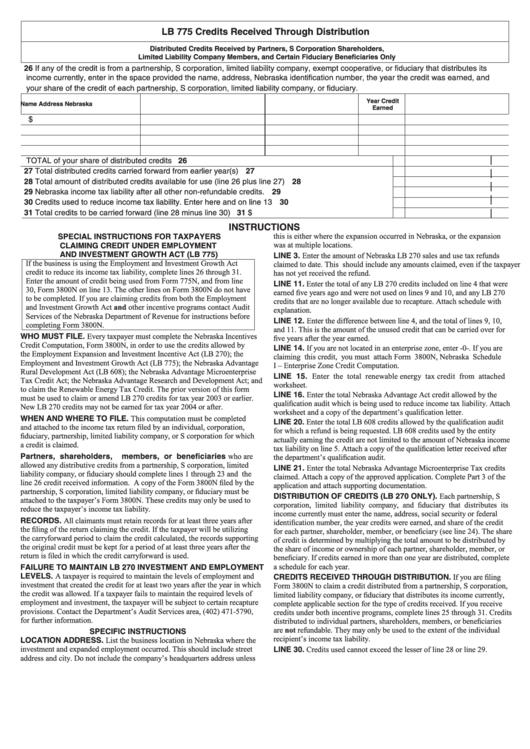

LB 775 Credits Received Through Distribution

Distributed Credits Received by Partners, S Corporation Shareholders,

Limited Liability Company Members, and Certain Fiduciary Beneficiaries Only

26 If any of the credit is from a partnership, S corporation, limited liability company, exempt cooperative, or fiduciary that distributes its

income currently, enter in the space provided the name, address, Nebraska identification number, the year the credit was earned, and

your share of the credit of each partnership, S corporation, limited liability company, or fiduciary.

Year Credit

Name

Address

Nebraska I.D. Number

Share of Credit

Earned

$

TOTAL of your share of distributed credits................................................................................................... 26

27 Total distributed credits carried forward from earlier year(s)........................................................................ 27

28 Total amount of distributed credits available for use (line 26 plus line 27)................................................... 28

29 Nebraska income tax liability after all other non-refundable credits............................................................. 29

30 Credits used to reduce income tax liability. Enter here and on line 13 ........................................................ 30

31 Total credits to be carried forward (line 28 minus line 30) ........................................................................... 31 $

INSTRUCTIONS

this is either where the expansion occurred in Nebraska, or the expansion

SPECIAL INSTRUCTIONS FOR TAXPAYERS

was at multiple locations.

CLAIMING CREDIT UNDER EMPLOYMENT

AND INVESTMENT GROWTH ACT (LB 775)

LINE 3. Enter the amount of Nebraska LB 270 sales and use tax refunds

If the business is using the Employment and Investment Growth Act

claimed to date. This should include any amounts claimed, even if the taxpayer

credit to reduce its income tax liability, complete lines 26 through 31.

has not yet received the refund.

Enter the amount of credit being used from Form 775N, and from line

LINE 11. Enter the total of any LB 270 credits included on line 4 that were

30, Form 3800N on line 13. The other lines on Form 3800N do not have

earned five years ago and were not used on lines 9 and 10, and any LB 270

to be completed. If you are claiming credits from both the Employment

credits that are no longer available due to recapture. Attach schedule with

and Investment Growth Act and other incentive programs contact Audit

explanation.

Services of the Nebraska Department of Revenue for instructions before

LINE 12. Enter the difference between line 4, and the total of lines 9, 10,

completing Form 3800N.

and 11. This is the amount of the unused credit that can be carried over for

WHO MUST FILE. Every taxpayer must complete the Nebraska Incentives

five years after the year earned.

Credit Computation, Form 3800N, in order to use the credits allowed by

LINE 14. If you are not located in an enterprise zone, enter -0-. If you are

the Employment Expansion and Investment Incentive Act (LB 270); the

claiming this credit, you must attach Form 3800N, Nebraska Schedule

Employment and Investment Growth Act (LB 775); the Nebraska Advantage

I – Enterprise Zone Credit Computation.

Rural Development Act (LB 608); the Nebraska Advantage Microenterprise

LINE 15. Enter the total renewable energy tax credit from attached

Tax Credit Act; the Nebraska Advantage Research and Development Act; and

worksheet.

to claim the Renewable Energy Tax Credit. The prior version of this form

LINE 16. Enter the total Nebraska Advantage Act credit allowed by the

must be used to claim or amend LB 270 credits for tax year 2003 or earlier.

qualification audit which is being used to reduce income tax liability. Attach

New LB 270 credits may not be earned for tax year 2004 or after.

worksheet and a copy of the department’s qualification letter.

WHEN AND WHERE TO FILE. This computation must be completed

LINE 20. Enter the total LB 608 credits allowed by the qualification audit

and attached to the income tax return filed by an individual, corporation,

for which a refund is being requested. LB 608 credits used by the entity

fiduciary, partnership, limited liability company, or S corporation for which

actually earning the credit are not limited to the amount of Nebraska income

a credit is claimed.

tax liability on line 5. Attach a copy of the qualification letter received after

members, or beneficiaries who are

Partners, shareholders,

the department’s qualification audit.

allowed any distributive credits from a partnership, S corporation, limited

LINE 21. Enter the total Nebraska Advantage Microenterprise Tax credits

liability company, or fiduciary should complete lines 1 through 23 and the

claimed. Attach a copy of the approved application. Complete Part 3 of the

line 26 credit received information. A copy of the Form 3800N filed by the

application and attach supporting documentation.

partnership, S corporation, limited liability company, or fiduciary must be

DISTRIBUTION OF CREDITS (LB 270 ONLY). Each partnership, S

attached to the taxpayer’s Form 3800N. These credits may only be used to

corporation, limited liability company, and fiduciary that distributes its

reduce the taxpayer’s income tax liability.

income currently must enter the name, address, social security or federal

RECORDS. All claimants must retain records for at least three years after

identification number, the year credits were earned, and share of the credit

the filing of the return claiming the credit. If the taxpayer will be utilizing

for each partner, shareholder, member, or beneficiary (see line 24). The share

the carryforward period to claim the credit calculated, the records supporting

of credit is determined by multiplying the total amount to be distributed by

the original credit must be kept for a period of at least three years after the

the share of income or ownership of each partner, shareholder, member, or

return is filed in which the credit carryforward is used.

beneficiary. If credits earned in more than one year are distributed, complete

a schedule for each year.

FAILURETO MAINTAIN LB 270 INVESTMENT AND EMPLOYMENT

LEVELS. A taxpayer is required to maintain the levels of employment and

CREDITS RECEIVED THROUGH DISTRIBUTION. If you are filing

investment that created the credit for at least two years after the year in which

Form 3800N to claim a credit distributed from a partnership, S corporation,

the credit was allowed. If a taxpayer fails to maintain the required levels of

limited liability company, or fiduciary that distributes its income currently,

employment and investment, the taxpayer will be subject to certain recapture

complete applicable section for the type of credits received. If you receive

provisions. Contact the Department’s Audit Services area, (402) 471-5790,

credits under both incentive programs, complete lines 25 through 31. Credits

for further information.

distributed to individual partners, shareholders, members, or beneficiaries

are not refundable. They may only be used to the extent of the individual

SPECIFIC INSTRUCTIONS

recipient’s income tax liability.

LOCATION ADDRESS. List the business location in Nebraska where the

investment and expanded employment occurred. This should include street

LINE 30. Credits used cannot exceed the lesser of line 28 or line 29.

address and city. Do not include the company’s headquarters address unless

1

1