Application For Extension of Time To File Alabama Income Tax Returns

General Instructions

charged a delinquent penalty. Other penalties such as

2004 to file your return. If you file a fiscal year, you will

fraud penalty (maximum 50%), non-payment penalty

be granted a 4-month extension from the regular due

Use Form 4868A to request a 4-month extension

(1% per month), estimate penalty (10% maximum), or

date of the return. Example: If your fiscal year ends

of time to file Forms 40, 40A, 40NR, 41, or 65. The

underestimation penalty (6% maximum), will be

June 30, 2004, your return is due October 15, 2004.

extension will be granted if you complete this form

charged, if applicable, even if you have an approved

You may request a 4-month extension until February

properly and file it on time. We will notify you only if

extension.

15, 2005 to file your return.

your request for an extension is denied.

Check box b if you have already been granted a 4-

Interest

If you need an additional 2-month extension, you

month extension and need an additional 2-month

must file another Form 4868A by the expiration date of

Interest is charged from the regular due date of the

extension to file your return. If a fiscal year return, you

the original extension. An additional 2-month extension

return until the tax is paid. It will be charged even if:

must give the information requested. (See above

will not be granted unless you have an approved 4-

• You have been granted an extension,

instruction.)

month extension.

or

Line 3

• You show reasonable cause for not paying the tax on

When To File

time.

If you anticipate owing additional tax when your

File Form 4868A by April 15, 2004. If you are filing

Alabama law provides that interest shall be collect-

return is filed, this amount may be paid with this appli-

a fiscal year Form 40, 40A, 40NR, 41, or 65, file Form

ed at the same rate as prescribed by the Internal

cation. Any tax due when your return is filed will be

4868A by the regular due date of the return. If you are

Revenue Service.

subject to interest as previously explained.

requesting a 2-month additional extension, file this

Composite Return

form by the expiration date of the original extension.

How To Claim Credit for

You may file your return any time before the 4-

Payment Made With This Form

If you plan to file a composite return for the non-

month period ends.

resident partners, and want to file an extension, use

If you file Form 40A, enter the amount paid on line

Form 4868A. This eliminates any penalty for late filing.

Where To File

6, column A, and write Form 4868A to the left of the

Payments can be made on Form 4868A or Form IT: E-

amount. Include this amount in the total to be entered

If you are not making a payment, mail this form to:

3.

on line 19.

Alabama Department of Revenue

If you file Form 40, 40NR, or 41, enter the amount

Specific Instructions

Individual and Corporate Tax Division

paid with this extension on line 25 of Form 40, line 24

P.O. Box 327461

Fill in the spaces for your name, address, social

of Form 40NR, or line 12c of Form 41.

Montgomery, AL 36132-7461

security number, and spouse’s social security number

If you and your spouse file separate Forms 4868A

If you are including a payment, mail this form and

if you are filing a joint return. If an extension of time is

for 2003, but file a joint income tax return for the year,

payment to:

requested to file Form 41 or 65, enter the FEIN of the

enter on the appropriate line of your Form 40, 40A, or

Alabama Department of Revenue

fiduciary or partnership return in the space provided.

40NR, the totals of the amounts paid on the separate

Individual and Corporate Tax Division

Forms 4868A. Also enter the social security numbers

Line 1

P.O. Box 327464

of both spouses in the spaces on your return.

Montgomery, AL 36132-7464

Indicate the type return for which you are re-

If you and your spouse file a joint Form 4868A for

Complete this form and mail the original. Keep two

questing an extension by checking the appropriate

2003, but file separate income tax returns for the year,

copies: one copy should be attached to your return

box.

you may claim the total payment (line 4) on your sepa-

when it is filed, and the other should be retained for

Line 2

rate return or on your spouse’s separate return, or you

your records.

Check box a if this is your first application. If you

may divide it in any agreed amounts. Be sure to enter

Penalties

will be filing a return for the calendar year 2003, you

the social security numbers of both spouses on the

If you have an approved extension, you will not be

will be granted a 4-month extension until August 15,

separate returns.

RESET

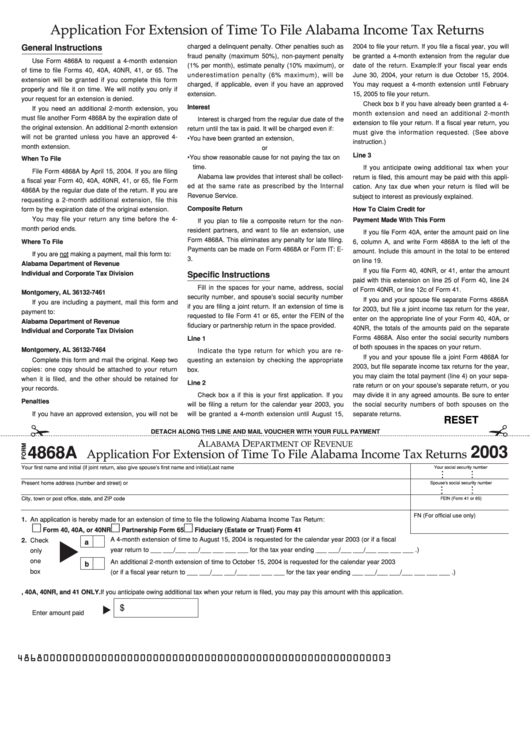

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT

A

D

R

LABAMA

EPARTMENT OF

EVENUE

2003

4868A

Application For Extension of Time To File Alabama Income Tax Returns

Your first name and initial (if joint return, also give spouse’s first name and initial)

Last name

Your social security number

Present home address (number and street) or P.O. Box

Spouse’s social security number

City, town or post office, state, and ZIP code

FEIN (Form 41 or 65)

FN

(For official use only)

1. An application is hereby made for an extension of time to file the following Alabama Income Tax Return:

Form 40, 40A, or 40NR

Partnership Form 65

Fiduciary (Estate or Trust) Form 41

A 4-month extension of time to August 15, 2004 is requested for the calendar year 2003 (or if a fiscal

2. Check

a

year return to ___ ___/___ ___/___ ___ ___ ___ for the tax year ending ___ ___/___ ___/___ ___ ___ ___ .)

only

one

An additional 2-month extension of time to October 15, 2004 is requested for the calendar year 2003

b

box

(or if a fiscal year return to ___ ___/___ ___/___ ___ ___ ___ for the tax year ending ___ ___/___ ___/___ ___ ___ ___ .)

3. APPLICABLE TO FORMS 40, 40A, 40NR, and 41 ONLY. If you anticipate owing additional tax when your return is filed, you may pay this amount with this application.

$

Enter amount paid here.

Full payment of the amount entered must be paid with this application. Partial payments will not be accepted.

4868000000000000000000000000000000000000000000000000000003

1

1