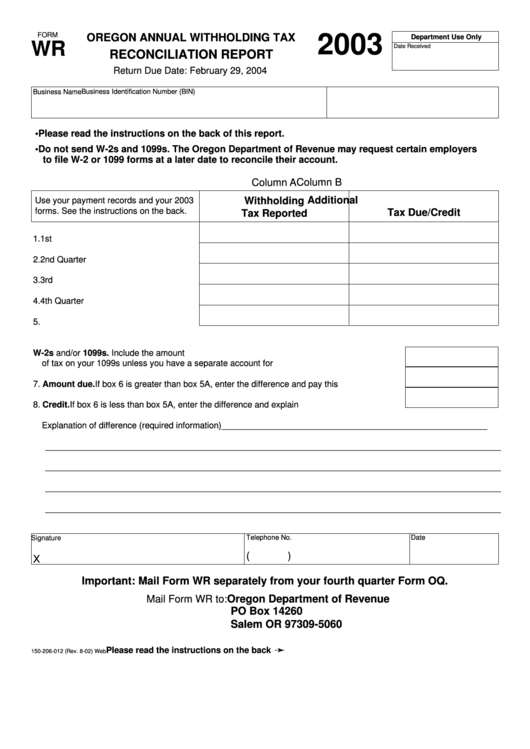

Form Wr - Oregon Annual Withholding Tax Reconciliation Report - 2003

ADVERTISEMENT

FORM

OREGON ANNUAL WITHHOLDING TAX

2003

Department Use Only

WR

Date Received

RECONCILIATION REPORT

Return Due Date: February 29, 2004

Business Identification Number (BIN)

Business Name

• Please read the instructions on the back of this report.

• Do not send W-2s and 1099s. The Oregon Department of Revenue may request certain employers

to file W-2 or 1099 forms at a later date to reconcile their account.

Column B

Column A

Additional

Withholding

Use your payment records and your 2003

forms. See the instructions on the back.

Tax Due/Credit

Tax Reported

1. 1st Quarter .......................................... 1

2. 2nd Quarter ......................................... 2

3. 3rd Quarter .......................................... 3

4. 4th Quarter .......................................... 4

5. TOTAL ................................................. 5

6. Total Oregon Tax shown on W-2s and/or 1099s. Include the amount

of tax on your 1099s unless you have a separate account for these ....................................... 6

7. Amount due. If box 6 is greater than box 5A, enter the difference and pay this amount ........ 7

8. Credit. If box 6 is less than box 5A, enter the difference and explain below ........................... 8

Explanation of difference (required information) ________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

Date

Signature

Telephone No.

(

)

X

Important: Mail Form WR separately from your fourth quarter Form OQ.

Mail Form WR to: Oregon Department of Revenue

PO Box 14260

Salem OR 97309-5060

Please read the instructions on the back

150-206-012 (Rev. 8-02) Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1