Instructions For Completing The Business & Occupation Activities Return

ADVERTISEMENT

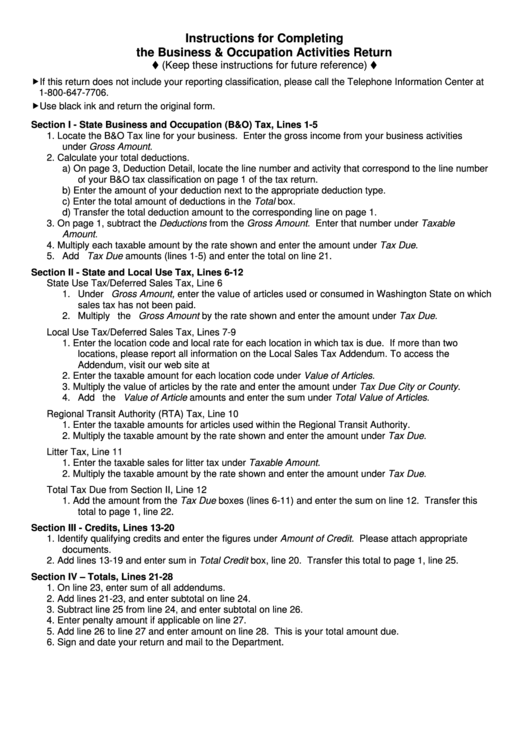

Instructions for Completing

the Business & Occupation Activities Return

!

!

(Keep these instructions for future reference)

!If this return does not include your reporting classification, please call the Telephone Information Center at

1-800-647-7706.

!Use black ink and return the original form.

Section I - State Business and Occupation (B&O) Tax, Lines 1-5

1. Locate the B&O Tax line for your business. Enter the gross income from your business activities

under Gross Amount.

2. Calculate your total deductions.

a) On page 3, Deduction Detail, locate the line number and activity that correspond to the line number

of your B&O tax classification on page 1 of the tax return.

b) Enter the amount of your deduction next to the appropriate deduction type.

c) Enter the total amount of deductions in the Total box.

d) Transfer the total deduction amount to the corresponding line on page 1.

3. On page 1, subtract the Deductions from the Gross Amount. Enter that number under Taxable

Amount.

4. Multiply each taxable amount by the rate shown and enter the amount under Tax Due.

5. Add Tax Due amounts (lines 1-5) and enter the total on line 21.

Section II - State and Local Use Tax, Lines 6-12

State Use Tax/Deferred Sales Tax, Line 6

1. Under Gross Amount, enter the value of articles used or consumed in Washington State on which

sales tax has not been paid.

2. Multiply the Gross Amount by the rate shown and enter the amount under Tax Due.

Local Use Tax/Deferred Sales Tax, Lines 7-9

1. Enter the location code and local rate for each location in which tax is due. If more than two

locations, please report all information on the Local Sales Tax Addendum. To access the

Addendum, visit our web site at

2. Enter the taxable amount for each location code under Value of Articles.

3. Multiply the value of articles by the rate and enter the amount under Tax Due City or County.

4. Add the Value of Article amounts and enter the sum under Total Value of Articles.

Regional Transit Authority (RTA) Tax, Line 10

1. Enter the taxable amounts for articles used within the Regional Transit Authority.

2. Multiply the taxable amount by the rate shown and enter the amount under Tax Due.

Litter Tax, Line 11

1. Enter the taxable sales for litter tax under Taxable Amount.

2. Multiply the taxable amount by the rate shown and enter the amount under Tax Due.

Total Tax Due from Section II, Line 12

1. Add the amount from the Tax Due boxes (lines 6-11) and enter the sum on line 12. Transfer this

total to page 1, line 22.

Section III - Credits, Lines 13-20

1. Identify qualifying credits and enter the figures under Amount of Credit. Please attach appropriate

documents.

2. Add lines 13-19 and enter sum in Total Credit box, line 20. Transfer this total to page 1, line 25.

Section IV – Totals, Lines 21-28

1. On line 23, enter sum of all addendums.

2. Add lines 21-23, and enter subtotal on line 24.

3. Subtract line 25 from line 24, and enter subtotal on line 26.

4. Enter penalty amount if applicable on line 27.

5. Add line 26 to line 27 and enter amount on line 28. This is your total amount due.

6. Sign and date your return and mail to the Department.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3