Instructions And Worksheet For Schedule K-59 - High Performance Incentive Program

ADVERTISEMENT

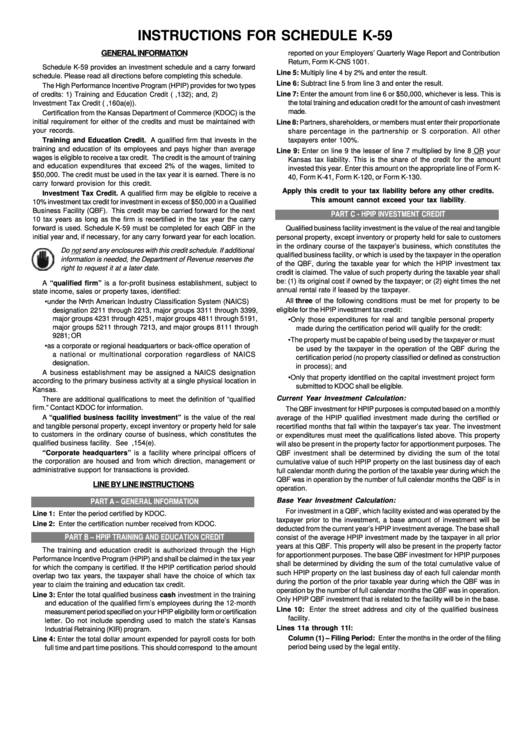

INSTRUCTIONS FOR SCHEDULE K-59

GENERAL INFORMATION

reported on your Employers’ Quarterly Wage Report and Contribution

Return, Form K-CNS 1001.

Schedule K-59 provides an investment schedule and a carry forward

Line 5: Multiply line 4 by 2% and enter the result.

schedule. Please read all directions before completing this schedule.

Line 6: Subtract line 5 from line 3 and enter the result.

The High Performance Incentive Program (HPIP) provides for two types

Line 7: Enter the amount from line 6 or $50,000, whichever is less. This is

of credits: 1) Training and Education Credit (K.S.A. 74-50,132); and, 2)

the total training and education credit for the amount of cash investment

Investment Tax Credit (K.S.A. 79-32,160a(e)).

made.

Certification from the Kansas Department of Commerce (KDOC) is the

initial requirement for either of the credits and must be maintained with

Line 8: Partners, shareholders, or members must enter their proportionate

your records.

share percentage in the partnership or S corporation. All other

Training and Education Credit. A qualified firm that invests in the

taxpayers enter 100%.

training and education of its employees and pays higher than average

Line 9: Enter on line 9 the lesser of line 7 multiplied by line 8 OR your

wages is eligible to receive a tax credit. The credit is the amount of training

Kansas tax liability. This is the share of the credit for the amount

and education expenditures that exceed 2% of the wages, limited to

invested this year. Enter this amount on the appropriate line of Form K-

$50,000. The credit must be used in the tax year it is earned. There is no

40, Form K-41, Form K-120, or Form K-130.

carry forward provision for this credit.

Apply this credit to your tax liability before any other credits.

Investment Tax Credit. A qualified firm may be eligible to receive a

This amount cannot exceed your tax liability.

10% investment tax credit for investment in excess of $50,000 in a Qualified

Business Facility (QBF). This credit may be carried forward for the next

PART C - HPIP INVESTMENT CREDIT

10 tax years as long as the firm is recertified in the tax year the carry

forward is used. Schedule K-59 must be completed for each QBF in the

Qualified business facility investment is the value of the real and tangible

initial year and, if necessary, for any carry forward year for each location.

personal property, except inventory or property held for sale to customers

in the ordinary course of the taxpayer’s business, which constitutes the

Do not send any enclosures with this credit schedule. If additional

qualified business facility, or which is used by the taxpayer in the operation

information is needed, the Department of Revenue reserves the

of the QBF, during the taxable year for which the HPIP investment tax

right to request it at a later date.

credit is claimed. The value of such property during the taxable year shall

be: (1) its original cost if owned by the taxpayer; or (2) eight times the net

A “qualified firm” is a for-profit business establishment, subject to

annual rental rate if leased by the taxpayer.

state income, sales or property taxes, identified:

All three of the following conditions must be met for property to be

• under the North American Industry Classification System (NAICS)

eligible for the HPIP investment tax credit:

designation 2211 through 2213, major groups 3311 through 3399,

major groups 4231 through 4251, major groups 4811 through 5191,

• Only those expenditures for real and tangible personal property

major groups 5211 through 7213, and major groups 8111 through

made during the certification period will qualify for the credit:

9281; OR

• The property must be capable of being used by the taxpayer or must

• as a corporate or regional headquarters or back-office operation of

be used by the taxpayer in the operation of the QBF during the

a national or multinational corporation regardless of NAICS

certification period (no property classified or defined as construction

designation.

in process); and

A business establishment may be assigned a NAICS designation

• Only that property identified on the capital investment project form

according to the primary business activity at a single physical location in

submitted to KDOC shall be eligible.

Kansas.

Current Year Investment Calculation:

There are additional qualifications to meet the definition of “qualified

firm.” Contact KDOC for information.

The QBF investment for HPIP purposes is computed based on a monthly

A “qualified business facility investment” is the value of the real

average of the HPIP qualified investment made during the certified or

and tangible personal property, except inventory or property held for sale

recertified months that fall within the taxpayer’s tax year. The investment

to customers in the ordinary course of business, which constitutes the

or expenditures must meet the qualifications listed above. This property

qualified business facility. See K.S.A. 79-32,154(e).

will also be present in the property factor for apportionment purposes. The

“Corporate headquarters” is a facility where principal officers of

QBF investment shall be determined by dividing the sum of the total

the corporation are housed and from which direction, management or

cumulative value of such HPIP property on the last business day of each

administrative support for transactions is provided.

full calendar month during the portion of the taxable year during which the

QBF was in operation by the number of full calendar months the QBF is in

LINE BY LINE INSTRUCTIONS

operation.

Base Year Investment Calculation:

PART A – GENERAL INFORMATION

For investment in a QBF, which facility existed and was operated by the

Line 1: Enter the period certified by KDOC.

taxpayer prior to the investment, a base amount of investment will be

Line 2: Enter the certification number received from KDOC.

deducted from the current year’s HPIP investment average. The base shall

PART B – HPIP TRAINING AND EDUCATION CREDIT

consist of the average HPIP investment made by the taxpayer in all prior

years at this QBF. This property will also be present in the property factor

The training and education credit is authorized through the High

for apportionment purposes. The base QBF investment for HPIP purposes

Performance Incentive Program (HPIP) and shall be claimed in the tax year

shall be determined by dividing the sum of the total cumulative value of

for which the company is certified. If the HPIP certification period should

such HPIP property on the last business day of each full calendar month

overlap two tax years, the taxpayer shall have the choice of which tax

during the portion of the prior taxable year during which the QBF was in

year to claim the training and education tax credit.

operation by the number of full calendar months the QBF was in operation.

Line 3: Enter the total qualified business cash investment in the training

Only HPIP QBF investment that is related to the facility will be in the base.

and education of the qualified firm’s employees during the 12-month

Line 10: Enter the street address and city of the qualified business

measurement period specified on your HPIP eligibility form or certification

facility.

letter. Do not include spending used to match the state’s Kansas

Lines 11a through 11l:

Industrial Retraining (KIR) program.

Column (1) – Filing Period: Enter the months in the order of the filing

Line 4: Enter the total dollar amount expended for payroll costs for both

period being used by the legal entity.

full time and part time positions. This should correspond to the amount

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3