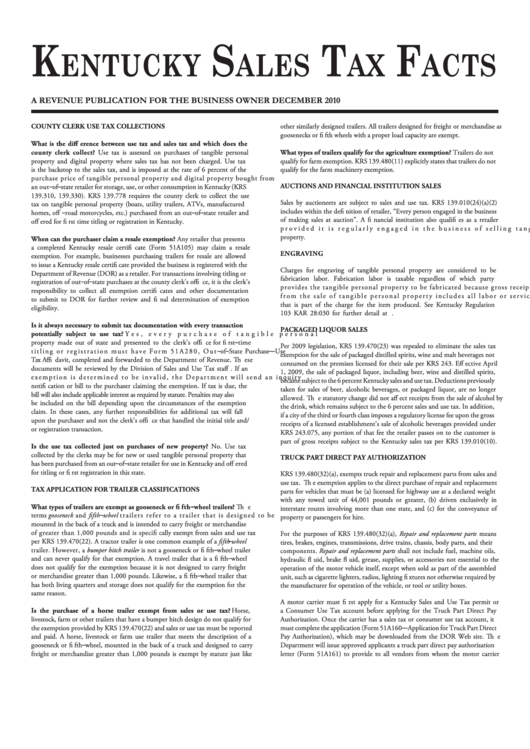

Kentucky Sales Tax Facts - 2010

ADVERTISEMENT

K

S

T

F

ENTUCKY

ALES

AX

ACTS

A REVENUE PUBLICATION FOR THE BUSINESS OWNER

DECEMBER 2010

COUNTY CLERK USE TAX COLLECTIONS

other similarly designed trailers. All trailers designed for freight or merchandise as

goosenecks or fi fth wheels with a proper load capacity are exempt.

What is the diff erence between use tax and sales tax and which does the

county clerk collect? Use tax is assessed on purchases of tangible personal

What types of trailers qualify for the agriculture exemption? Trailers do not

property and digital property where sales tax has not been charged. Use tax

qualify for farm exemption. KRS 139.480(11) explicitly states that trailers do not

is the backstop to the sales tax, and is imposed at the rate of 6 percent of the

qualify for the farm machinery exemption.

purchase price of tangible personal property and digital property bought from

AUCTIONS AND FINANCIAL INSTITUTION SALES

an out–of–state retailer for storage, use, or other consumption in Kentucky (KRS

139.310, 139.330). KRS 139.778 requires the county clerk to collect the use

Sales by auctioneers are subject to sales and use tax. KRS 139.010(24)(a)(2)

tax on tangible personal property (boats, utility trailers, ATVs, manufactured

includes within the defi nition of retailer, “Every person engaged in the business

homes, off –road motorcycles, etc.) purchased from an out–of–state retailer and

of making sales at auction”. A fi nancial institution also qualifi es as a retailer

off ered for fi rst time titling or registration in Kentucky.

provided it is regularly engaged in the business of selling tangible personal

property.

When can the purchaser claim a resale exemption? Any retailer that presents

a completed Kentucky resale certifi cate (Form 51A105) may claim a resale

ENGRAVING

exemption. For example, businesses purchasing trailers for resale are allowed

to issue a Kentucky resale certifi cate provided the business is registered with the

Charges for engraving of tangible personal property are considered to be

Department of Revenue (DOR) as a retailer. For transactions involving titling or

fabrication labor. Fabrication labor is taxable regardless of which party

registration of out–of–state purchases at the county clerk’s offi ce, it is the clerk’s

provides the tangible personal property to be fabricated because gross receipts

responsibility to collect all exemption certifi cates and other documentation

from the sale of tangible personal property includes all labor or services cost

to submit to DOR for further review and fi nal determination of exemption

that is part of the charge for the item produced. See Kentucky Regulation

eligibility.

103 KAR 28:030 for further detail at

Is it always necessary to submit tax documentation with every transaction

PACKAGED LIQUOR SALES

potentially subject to use tax? Yes, every purchase of tangible personal

property made out of state and presented to the clerk’s offi ce for fi rst–time

Per 2009 legislation, KRS 139.470(23) was repealed to eliminate the sales tax

titling or registration must have Form 51A280, Out–of–State Purchase—Use

exemption for the sale of packaged distilled spirits, wine and malt beverages not

Tax Affi davit, completed and forwarded to the Department of Revenue. Th ese

consumed on the premises licensed for their sale per KRS 243. Eff ective April

documents will be reviewed by the Division of Sales and Use Tax staff . If an

1, 2009, the sale of packaged liquor, including beer, wine and distilled spirits,

exemption is determined to be invalid, the Department will send an inquiry

became subject to the 6 percent Kentucky sales and use tax. Deductions previously

notifi cation or bill to the purchaser claiming the exemption. If tax is due, the

taken for sales of beer, alcoholic beverages, or packaged liquor, are no longer

bill will also include applicable interest as required by statute. Penalties may also

allowed. Th e statutory change did not aff ect receipts from the sale of alcohol by

be included on the bill depending upon the circumstances of the exemption

the drink, which remains subject to the 6 percent sales and use tax. In addition,

claim. In these cases, any further responsibilities for additional tax will fall

if a city of the third or fourth class imposes a regulatory license fee upon the gross

upon the purchaser and not the clerk’s offi ce that handled the initial title and/

receipts of a licensed establishment’s sale of alcoholic beverages provided under

or registration transaction.

KRS 243.075, any portion of that fee the retailer passes on to the customer is

part of gross receipts subject to the Kentucky sales tax per KRS 139.010(10).

Is the use tax collected just on purchases of new property? No. Use tax

collected by the clerks may be for new or used tangible personal property that

TRUCK PART DIRECT PAY AUTHORIZATION

has been purchased from an out–of–state retailer for use in Kentucky and off ered

for titling or fi rst registration in this state.

KRS 139.480(32)(a), exempts truck repair and replacement parts from sales and

use tax. Th e exemption applies to the direct purchase of repair and replacement

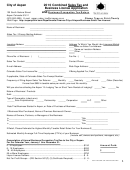

TAX APPLICATION FOR TRAILER CLASSIFICATIONS

parts for vehicles that must be (a) licensed for highway use at a declared weight

with any towed unit of 44,001 pounds or greater, (b) driven exclusively in

What types of trailers are exempt as gooseneck or fi fth–wheel trailers? Th e

interstate routes involving more than one state, and (c) for the conveyance of

terms gooseneck and fi fth–wheel trailers refer to a trailer that is designed to be

property or passengers for hire.

mounted in the back of a truck and is intended to carry freight or merchandise

of greater than 1,000 pounds and is specifi cally exempt from sales and use tax

For the purposes of KRS 139.480(32)(a), Repair and replacement parts means

per KRS 139.470(22). A tractor trailer is one common example of a fi fth–wheel

tires, brakes, engines, transmissions, drive trains, chassis, body parts, and their

trailer. However, a bumper hitch trailer is not a gooseneck or fi fth–wheel trailer

components. Repair and replacement parts shall not include fuel, machine oils,

and can never qualify for that exemption. A travel trailer that is a fi fth–wheel

hydraulic fl uid, brake fl uid, grease, supplies, or accessories not essential to the

does not qualify for the exemption because it is not designed to carry freight

operation of the motor vehicle itself, except when sold as part of the assembled

or merchandise greater than 1,000 pounds. Likewise, a fi fth–wheel trailer that

unit, such as cigarette lighters, radios, lighting fi xtures not otherwise required by

has both living quarters and storage does not qualify for the exemption for the

the manufacturer for operation of the vehicle, or tool or utility boxes.

same reason.

A motor carrier must fi rst apply for a Kentucky Sales and Use Tax permit or

Is the purchase of a horse trailer exempt from sales or use tax? Horse,

a Consumer Use Tax account before applying for the Truck Part Direct Pay

livestock, farm or other trailers that have a bumper hitch design do not qualify for

Authorization. Once the carrier has a sales tax or consumer use tax account, it

the exemption provided by KRS 139.470(22) and sales or use tax must be reported

must complete the application (Form 51A160—Application for Truck Part Direct

and paid. A horse, livestock or farm use trailer that meets the description of a

Pay Authorization), which may be downloaded from the DOR Web site. Th e

gooseneck or fi fth–wheel, mounted in the back of a truck and designed to carry

Department will issue approved applicants a truck part direct pay authorization

freight or merchandise greater than 1,000 pounds is exempt by statute just like

letter (Form 51A161) to provide to all vendors from whom the motor carrier

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2