Form Dr-157a - Assignment Of Time Deposit

ADVERTISEMENT

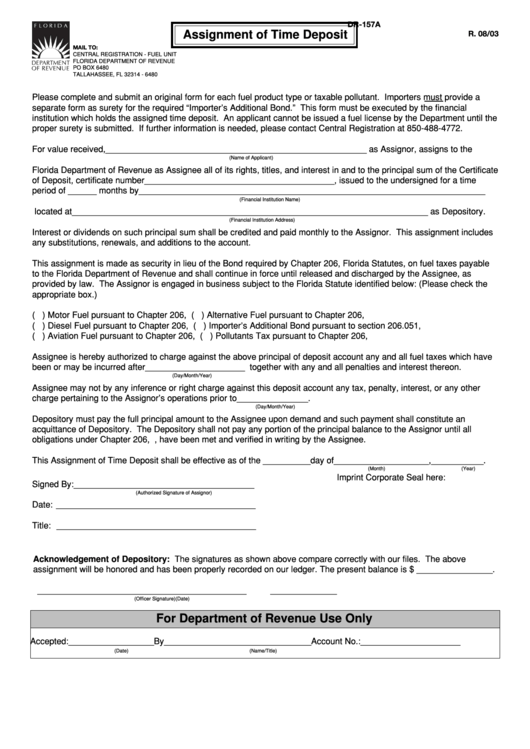

DR-157A

Assignment of Time Deposit

R. 08/03

MAIL TO:

CENTRAL REGISTRATION - FUEL UNIT

FLORIDA DEPARTMENT OF REVENUE

PO BOX 6480

TALLAHASSEE, FL 32314 - 6480

Please complete and submit an original form for each fuel product type or taxable pollutant. Importers must provide a

separate form as surety for the required “Importer’s Additional Bond.” This form must be executed by the financial

institution which holds the assigned time deposit. An applicant cannot be issued a fuel license by the Department until the

proper surety is submitted. If further information is needed, please contact Central Registration at 850-488-4772.

For value received, _______________________________________________________ as Assignor, assigns to the

(Name of Applicant)

Florida Department of Revenue as Assignee all of its rights, titles, and interest in and to the principal sum of the Certificate

of Deposit, certificate number ________________________________________ , issued to the undersigned for a time

period of ______ months by _________________________________________________________________________

(Financial Institution Name)

located at ___________________________________________________________________________ as Depository.

(Financial Institution Address)

Interest or dividends on such principal sum shall be credited and paid monthly to the Assignor. This assignment includes

any substitutions, renewals, and additions to the account.

This assignment is made as security in lieu of the Bond required by Chapter 206, Florida Statutes, on fuel taxes payable

to the Florida Department of Revenue and shall continue in force until released and discharged by the Assignee, as

provided by law. The Assignor is engaged in business subject to the Florida Statute identified below: (Please check the

appropriate box.)

( ) Motor Fuel pursuant to Chapter 206, F.S.

( ) Alternative Fuel pursuant to Chapter 206, F.S.

( ) Diesel Fuel pursuant to Chapter 206, F.S.

( ) Importer’s Additional Bond pursuant to section 206.051, F.S.

( ) Aviation Fuel pursuant to Chapter 206, F.S.

( ) Pollutants Tax pursuant to Chapter 206, F.S.

Assignee is hereby authorized to charge against the above principal of deposit account any and all fuel taxes which have

been or may be incurred after _____________________ together with any and all penalties and interest thereon.

(Day/Month/Year)

Assignee may not by any inference or right charge against this deposit account any tax, penalty, interest, or any other

charge pertaining to the Assignor’s operations prior to _______________ .

(Day/Month/Year)

Depository must pay the full principal amount to the Assignee upon demand and such payment shall constitute an

acquittance of Depository. The Depository shall not pay any portion of the principal balance to the Assignor until all

obligations under Chapter 206, F.S., have been met and verified in writing by the Assignee.

This Assignment of Time Deposit shall be effective as of the __________ day of ____________________, ___________ .

(Month)

(Year)

Imprint Corporate Seal here:

Signed By: ______________________________________

(Authorized Signature of Assignor)

Date: __________________________________________

Title: __________________________________________

Acknowledgement of Depository: The signatures as shown above compare correctly with our files. The above

assignment will be honored and has been properly recorded on our ledger. The present balance is $ ________________ .

____________________________________________

______________

(Officer Signature)

(Date)

For Department of Revenue Use Only

Accepted: __________________ By _______________________________ Account No.: _____________________

(Date)

(Name/Title)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1