Form 33 - Idaho Estate And Transfer Tax Return

ADVERTISEMENT

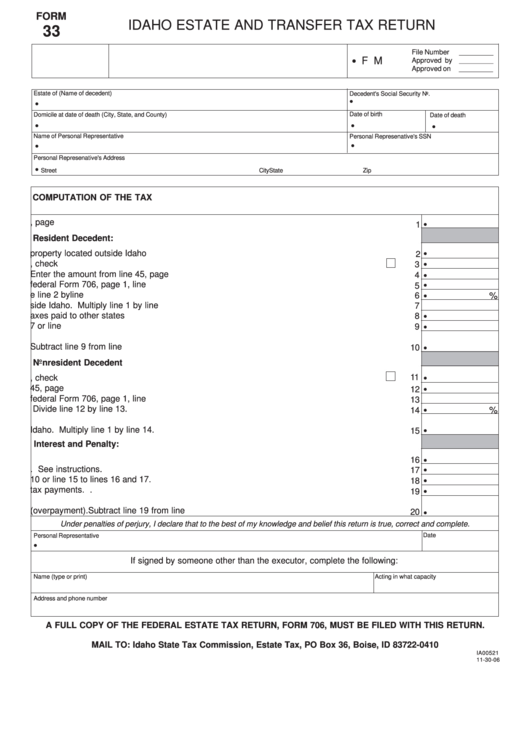

FORM

IDAHO ESTATE AND TRANSFER TAX RETURN

33

File Number

__________

•

F M

Approved by

__________

Approved on

__________

Estate of (Name of decedent)

Decedent's Social Security No.

•

•

Date of birth

Domicile at date of death (City, State, and County)

Date of death

•

•

•

Name of Personal Representative

Personal Represenative's SSN

•

•

Personal Represenative's Address

•

Street

City

State

Zip

COMPUTATION OF THE TAX

1.

Total state death tax credit from federal Form 706, page 1 ....................................................

•

1

Resident Decedent:

2.

Gross value of property located outside Idaho .......................................................................

•

2

3.

Name of Idaho county where property is located. If more than one county, check box

...

•

3

4.

Gross value of property located in Idaho. Enter the amount from line 45, page 2. ...............

4

•

5.

Total gross estate from federal Form 706, page 1, line 1 ........................................................

•

5

6.

Percent of estate located outside Idaho. Divide line 2 by line 5. ............................................

6

%

•

7.

Portion of credit for property located outside Idaho. Multiply line 1 by line 6. .......................

7

8.

Credit for estate taxes paid to other states .............................................................................

8

•

9.

Lesser of line 7 or line 8 ..........................................................................................................

9

•

10.

Idaho Estate Tax. Subtract line 9 from line 1. ........................................................................

10

•

Nonresident Decedent

11

11.

Name of Idaho county where property is located. If more than one county, check box

...

•

12.

Gross value of property located in Idaho. Enter the amount from line 45, page 2. ...............

•

12

13.

Total gross estate from federal Form 706, page 1, line 1 ........................................................

13

14.

Percent of estate located in Idaho. Divide line 12 by line 13. ................................................

•

%

14

15.

Estate Tax payable to Idaho. Multiply line 1 by line 14. .........................................................

•

15

Interest and Penalty:

16.

Interest for late payment. See instructions. ...........................................................................

16

•

17.

Late filing penalty. See instructions. ......................................................................................

•

17

18.

Total due. Add line 10 or line 15 to lines 16 and 17. .............................................................

•

18

19.

Total of estimated tax payments. ............................................................................................

•

19

20.

Balance due (overpayment). Subtract line 19 from line 18. ...................................................

20

•

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct and complete.

Date

Personal Representative

•

If signed by someone other than the executor, complete the following:

Name (type or print)

Acting in what capacity

Address and phone number

A FULL COPY OF THE FEDERAL ESTATE TAX RETURN, FORM 706, MUST BE FILED WITH THIS RETURN.

MAIL TO: Idaho State Tax Commission, Estate Tax, PO Box 36, Boise, ID 83722-0410

IA00521

11-30-06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3