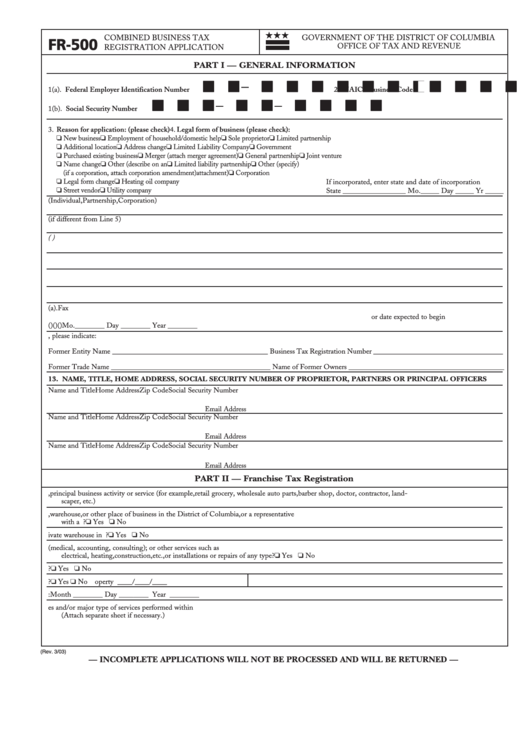

Form Fr-500 - Combined Business Tax Registration Application

ADVERTISEMENT

COMBINED BUSINESS TAX

GOVERNMENT OF THE DISTRICT OF COLUMBIA

FR-500

OFFICE OF TAX AND REVENUE

REGISTRATION APPLICATION

PART I — GENERAL INFORMATION

–

1(a). Federal Employer Identification Number

2. NAICS Business Code

–

–

1(b). Social Security Number

3. Reason for application: (please check)

4. Legal form of business (please check):

New business

Employment of household/domestic help

Sole proprietor

Limited partnership

Additional location

Address change

Limited Liability Company

Government

Purchased existing business

Merger (attach merger agreement)

General partnership

Joint venture

Name change

Other (describe on an

Limited liability partnership

Other (specify)

(if a corporation, attach corporation amendment)

attachment)

Corporation

Legal form change

Heating oil company

If incorporated, enter state and date of incorporation

Street vendor

Utility company

State _________________ Mo. _____ Day _____ Yr _____

5. Business Name (Individual, Partnership, Corporation)

6. Trade Name (if different from Line 5)

7. Business Address (P.O. Box is not acceptable unless located in a Rural Area)

8. Mailing Address

9. Local Business Phone No.

10. Main Office Phone No.

10(a). Fax No.

11. Date present business began in D.C.

or date expected to begin

(

)

(

)

(

)

Mo. ________ Day ________ Year ________

12. If previously registered with the District of Columbia, please indicate:

Former Entity Name __________________________________________ Business Tax Registration Number ___________________________________

Former Trade Name ___________________________________________ Name of Former Owners __________________________________________

13. NAME, TITLE, HOME ADDRESS, SOCIAL SECURITY NUMBER OF PROPRIETOR, PARTNERS OR PRINCIPAL OFFICERS

Name and Title

Home Address

Zip Code

Social Security Number

Email Address

Name and Title

Home Address

Zip Code

Social Security Number

Email Address

Name and Title

Home Address

Zip Code

Social Security Number

Email Address

PART II — Franchise Tax Registration

14. Indicate your profession, principal business activity or service (for example, retail grocery, wholesale auto parts, barber shop, doctor, contractor, land-

scaper, etc.)

15. Do you or will you have an office, warehouse, or other place of business in the District of Columbia, or a representative

with a D.C. location?

Yes

No

16. Do you or will you have merchandise stored in a public or private warehouse in D.C.?

Yes

No

17. Do you or will you perform in D.C. personal services (medical, accounting, consulting); or other services such as

electrical, heating, construction, etc., or installations or repairs of any type?

Yes

No

18. Do you or will you generate any business related income from D.C. sources?

Yes

No

19. Do you or will you have rental property in D.C.?

Yes

No 20. Date converted or expected to be converted to rental property ____/____/____

21. Date on which your taxable year ends:

Month ________ Day ________ Year ________

22. Describe fully ALL your current or expected business activities and/or major type of services performed within D.C.

(Attach separate sheet if necessary.)

(Rev. 3/03)

— INCOMPLETE APPLICATIONS WILL NOT BE PROCESSED AND WILL BE RETURNED —

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4