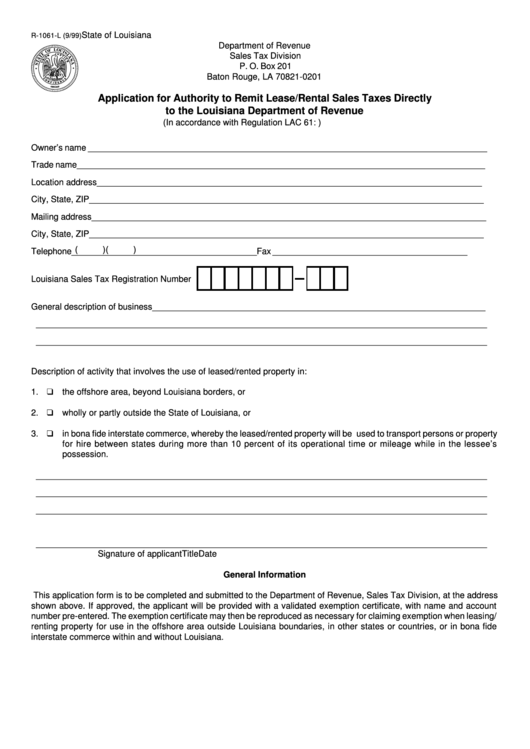

State of Louisiana

R-1061-L (9/99)

Department of Revenue

Sales Tax Division

P. O. Box 201

Baton Rouge, LA 70821-0201

Application for Authority to Remit Lease/Rental Sales Taxes Directly

to the Louisiana Department of Revenue

(In accordance with Regulation LAC 61:I.4303.B.2.d)

Owner’s name ____________________________________________________________________________________

Trade name ______________________________________________________________________________________

Location address _________________________________________________________________________________

City, State, ZIP ___________________________________________________________________________________

Mailing address ___________________________________________________________________________________

City, State, ZIP ___________________________________________________________________________________

(

)

(

)

Telephone _______________________________________

Fax _________________________________________

Louisiana Sales Tax Registration Number

General description of business ______________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

Description of activity that involves the use of leased/rented property in:

1.

the offshore area, beyond Louisiana borders, or

2.

wholly or partly outside the State of Louisiana, or

3.

in bona fide interstate commerce, whereby the leased/rented property will be used to transport persons or property

for hire between states during more than 10 percent of its operational time or mileage while in the lessee’s

possession.

_______________________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

Signature of applicant

Title

Date

General Information

This application form is to be completed and submitted to the Department of Revenue, Sales Tax Division, at the address

shown above. If approved, the applicant will be provided with a validated exemption certificate, with name and account

number pre-entered. The exemption certificate may then be reproduced as necessary for claiming exemption when leasing/

renting property for use in the offshore area outside Louisiana boundaries, in other states or countries, or in bona fide

interstate commerce within and without Louisiana.

1

1