Form Eft-100s - Electronic Funds Transfer Authorization Agreement For Streamlined Sales Tax

ADVERTISEMENT

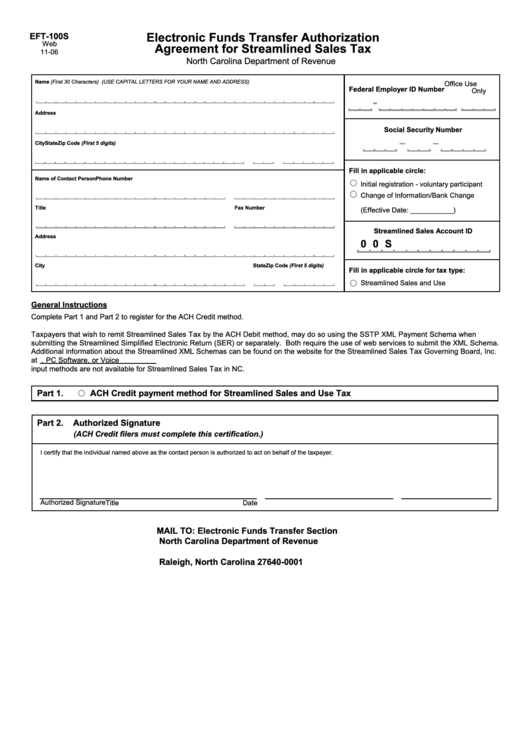

Electronic Funds Transfer Authorization

EFT-100S

Web

Agreement for Streamlined Sales Tax

11-06

North Carolina Department of Revenue

Name

(First 30 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Office Use

Federal Employer ID Number

Only

Address

Social Security Number

City

State

Zip Code (First 5 digits)

Fill in applicable circle:

Name of Contact Person

Phone Number

Initial registration - voluntary participant

Change of Information/Bank Change

Title

Fax Number

(Effective Date: ___________ )

Streamlined Sales Account ID

Address

0 0 S

City

State

Zip Code (First 5 digits)

Fill in applicable circle for tax type:

Streamlined Sales and Use

General Instructions

Complete Part 1 and Part 2 to register for the ACH Credit method.

Taxpayers that wish to remit Streamlined Sales Tax by the ACH Debit method, may do so using the SSTP XML Payment Schema when

submitting the Streamlined Simplified Electronic Return (SER) or separately. Both require the use of web services to submit the XML Schema.

Additional information about the Streamlined XML Schemas can be found on the website for the Streamlined Sales Tax Governing Board, Inc.

at by clicking on the SST Technology link. ACH Debit payments thru Touchtone, PC Software, or Voice

input methods are not available for Streamlined Sales Tax in NC.

Part 1.

ACH Credit payment method for Streamlined Sales and Use Tax

Part 2.

Authorized Signature

(ACH Credit filers must complete this certification.)

I certify that the individual named above as the contact person is authorized to act on behalf of the taxpayer.

Authorized Signature

Title

Date

MAIL TO: Electronic Funds Transfer Section

North Carolina Department of Revenue

P.O. Box 25000

Raleigh, North Carolina 27640-0001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2